21 Aug Premarket Prep GBPNZD 08212020

#premarketprep #tradingforex #forex #FX #daytrading #tradinglifestyle #daytraderlife #GBPNZD

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias.

Weekly goal

- Formulate hypos in order of likelihood and track with actual development on the day

Non-conjecture observations of the market

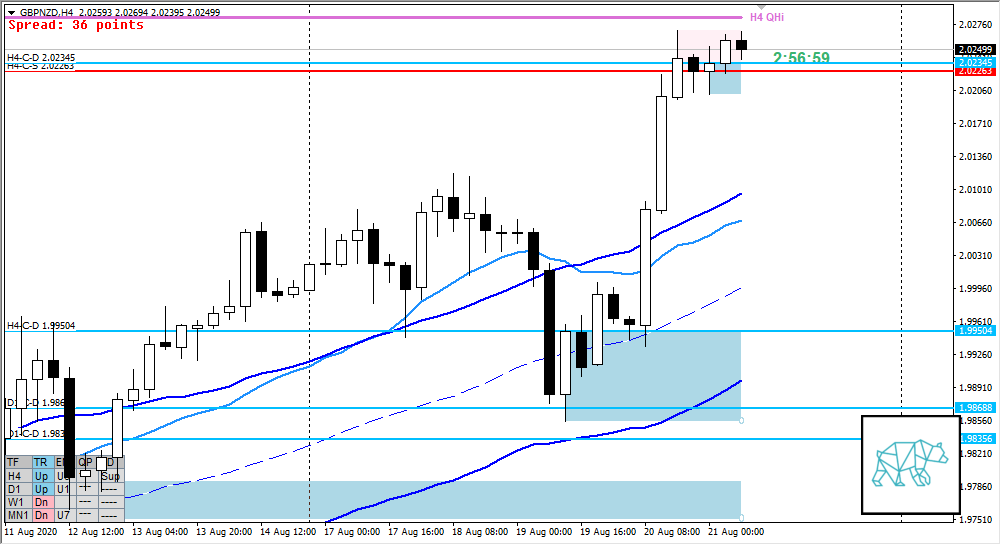

- D1 huge bull engulf reaching for but hasn’t arrived there (yet) D1-C‑S 2.03784

- Lots of sellers got stuck the day prior

- Some Phase 1 creating H4-C‑D 1.99504 transitions into phase 2 reaching for D1 QHi might get reactive. Small supply formed here through consolidation with H4-C‑S 2.02263

- Could just be a speed bump or start of phase 3

- New H4-C‑D 2.02345 formed during AS (weaker due to being within the clutter)

- Market Profile

- ADR 1597

- ASR 1135

- LN open

- Above value outside range

- D1-C‑S 2.03784 @ ADR Exhaustion inside D1/H4 QHi

- H4-C‑S 2.02263 just below H4 Qhi above value outside range

Compared against Weekly Trading Plan

- Just below D1 QHi

- Mid MN, W1 swing

- W1 high above preceding week’s candle

- H4, D1 trend is up, W1 is down

Sentiment — Slightly Bearish

- Sentiment

- Price above value however also outside range, yesterday 2 sessions unidirectional, plus today being a Friday there might be getting ready for some selling off profit-taking.

- H4 QHi right at 1xASR and ADR 0.5 at 1x ADR with price above value outside range might be conducive to a mean reversion trade

- Clarity (1–5, 5 being best)

- 4

- Hypo 1

- H4 QHi right at 1xASR and ADR 0.5 at 1x ADR with price 110 pips above value outside range might be conducive to a mean reversion trade, Friday potential sell off, 2 sessions yesterday unidirectional with no significant retracement, sustained auction down

- Cons: lower time frame demand ZOIs, D1-C‑S 2.03784 coinciding with ADR exhaustion would have been safer

- Hypo 2

- Value Acceptance

- Cons: still some way to go might see a return to value and reversal but then H4 demand would have been taken out so that would be positive.

Additional notes

- N.A.

ZOIs for Possible Shorts

- D1-C‑S 2.03784

- H4-C‑S 2.02263

ZOIs for Possible Long

- H4-C‑D 1.99504

- H4-C‑D 2.02345 (weak)

Mindful Trading

- Slept okay

Focus Points for trading development

- Weekly Goal

- Formulate hypos in order of likelihood and track with actual development on the day

- Incorporate profile day type

- Trading Rules

- If Open outside of value consider the placement in relation to ADR

- Don’t take into consideration medium time frame c‑lines past 24 hours

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- 2 consecutive days of lack of sleep = NO TRADING

No Comments