16 Aug GBPNZD Week 34 Trading Plan

#daytrade #daytrading #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #GBPNZD

This is my weekly outlook on the Forex pair GBPNZD. Basically the levels that I will be looking at where it has a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and market profile. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

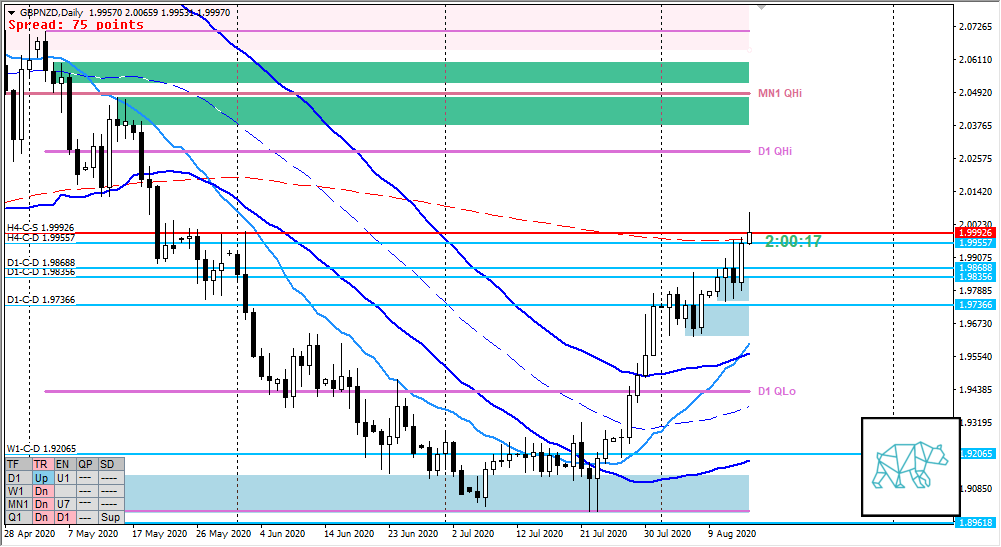

Monthly — Slightly Bullish

- Large inside bar last month after reacting with MN-C‑D 1.89618 and QLo

- Currently trading above last month’s body indicating possible transition to phase 2 however still two weeks left in the month

- Price mid Q1/MN swing

Weekly — Slightly Bullish

- W1 consolidation with bull engulf finisher above Mn-C‑D 1.89618 giving W1-C‑D 1.92065

- Clean move away currently trading at W1 VWAP but no break above (yet)

- Phase 2 still in effect

- No supply formed yet

- Price mid W1 swing

Daily — Slightly Bullish

- Strong move followed with a pullback which initially looked like a possible Phase 3, but ended with a bull engulf creating new demand at D1-C‑D 1.97366

- The phase 1 / 3 range was then broken through a messy break higher that created demand at D1-C‑D 1.98356. This was then followed by what looked like more Phase 1 / 3 resulting in a weak bear engulf followed by immediate bull engulf (creating demand at D1-C‑D 1.98688) testing Supply at 1.99730. On Friday this supply was taken out with a test above the round number of 2 with close higher

- Possible phase 2 in effect again although quite messy still

- Price mid D1 swing

H4 — Slightly Bearish

- Multiple RBR forming new demand at H4-C‑D 1.99557 after which price reached new highs testing the round number of 2 towards overhead supply at H4-C‑S 2.01138

- Followed by a big retracement creating supply at H4-C‑S 1.99926 and currently consolidating

- Price mid H4 swing but QHi at 2.028

Market Profile — Slightly Bullish

- Even though medium time frame price action showed a possible phase 3, the profiles show 2 day bracketing followed by move higher after returning to value and rotating through finding buyers in line with higher time frame phase 2.

Sentiment summary — Slightly Bullish to Neutral

- D1 Phase 2 in effect but due to messiness could very well turn into phase 3

- H4 supply is just around the round number of 2 so unless that gets taken out a phase 3 becomes more likely

- Large time frames prevail where weekly has shown quite the momentum behind the move without much retracement although this could be upon us.

- Price has not reached a medium or large time frame swing high which could enhance the bullish sentiment for the moment unless proven otherwise by a phase 3

- In order to have phase 3 ushered in we need more bracketing on the profile and a possible open below value. Until then the higher time frames still look bullish.

ZOIs for Possible Shorts

- H4-C‑S 2.01138

- H4-C‑S 1.99926

ZOIs for Possible Long

- H4-C‑D 1.99557

- D1-C‑D 1.98688

- D1-C‑D 1.97366

- W1-C‑D 1.92065

- MN-C‑D 1.89618

Focus Points for trading development

- Weekly Goal

- Align with market narrative

- Risk Management

- 3 trades 1% risk

- 2 consecutive days of lack of sleep = NO TRADING