20 Aug Premarket Prep GBPNZD 08202020

#premarketprep #tradingforex #forex #FX #daytrading #tradinglifestyle #daytraderlife #GBPNZD

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias.

Weekly goal

- Formulate hypos in order of likelihood and track with actual development on the day

Non-conjecture observations of the market

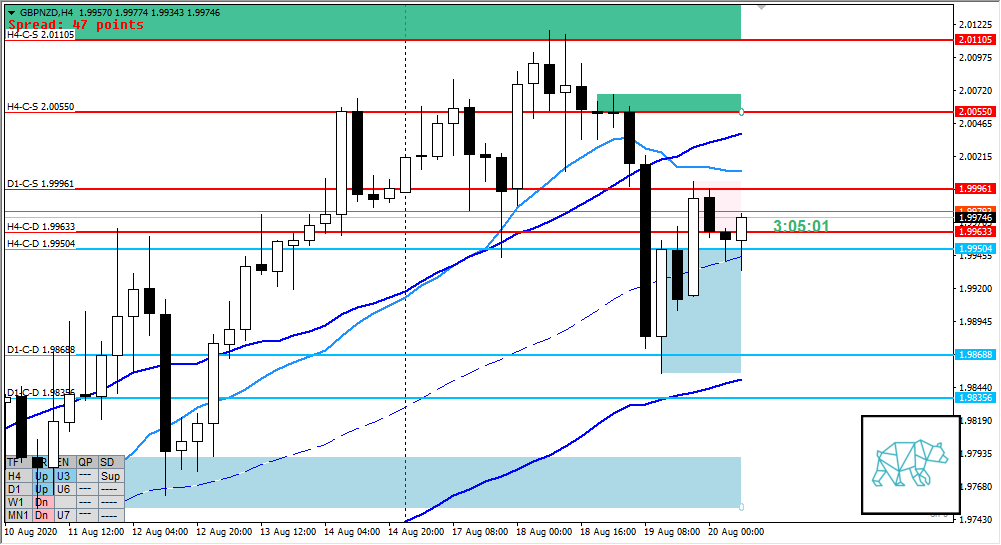

- D1 closed as a bear engulf (with long buying wick touching D1-C‑D 1.98688 below) giving new supply at D1-C‑S 1.99961 ducking below the round number of 2

- No close below 200MA

- AS, LN down NY retraced (activating H4 Q points) through H4 RBR giving demand H4-C‑D 1.99504

- H4 Inside bar testing D1-C‑S 1.99961 giving H4-C‑D 1.99633 (within clutter)

- Market Profile

- Yesterday opened below value inside range establishing value below the bracketing range

- ADR 1321

- ASR 992

- LN open within value

- H4-C‑S 2.00550 at ADR 0.5 near ADR exhaustion within H4 QHi (above value)

- D1-C‑D 1.98688 at ADR exhaustion and near H4 QLo (within value)

- H4-C‑D 1.99504 right below VAH

Compared against Weekly Trading Plan

- Mid MN, W1, and D1 swing

- W1 closed above VWAP, current candle within last week’s body, Bear Engulf with long buying wick formed

- H4, D1 trend is up, W1 is down

Sentiment — Neutral

- Sentiment

- LN open within value, larger time frame still looking bullish even though D1 formed a bear engulf there were a lot of buyers to absorb the selling

- Clarity (1–5, 5 being best)

- 2

- Hypo 1

- Price being within value I am not looking to trade. Although having said that there might be the following hypos I might want to get involved with

- Hypo 2

- LN open right at H4-C‑D 1.99504 below VAH may prove to be reactive but due to lower time frame supply ZOIs and Medium time frame c‑sup lines the profit target would be less than desirable

- I will monitor how the day plays out but not looking to force anything instead try and see what there is to learn.

- LN open right at H4-C‑D 1.99504 below VAH may prove to be reactive but due to lower time frame supply ZOIs and Medium time frame c‑sup lines the profit target would be less than desirable

Additional notes

- N.A.

ZOIs for Possible Shorts

- H4-C‑S 2.01105

- H4-C‑S 2.00550

- D1-C‑S 1.99961

ZOIs for Possible Long

- H4-C‑D 1.99633 (within clutter)

- H4-C‑D 1.99504

Mindful Trading

- Slept light again

Focus Points for trading development

- Weekly Goal

- Formulate hypos in order of likelihood and track with actual development on the day

- Incorporate profile day type

- Trading Rules

- If Open outside of value consider the placement in relation to ADR

- Don’t take into consideration medium time frame c‑lines past 24 hours

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- 2 consecutive days of lack of sleep = NO TRADING

No Comments