19 Aug Premarket Prep GBPNZD 08192020

#premarketprep #tradingforex #forex #FX #daytrading #tradinglifestyle #daytraderlife #GBPNZD

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias.

Weekly goal

- Formulate hypos in order of likelihood and track with actual development on the day

Non-conjecture observations of the market

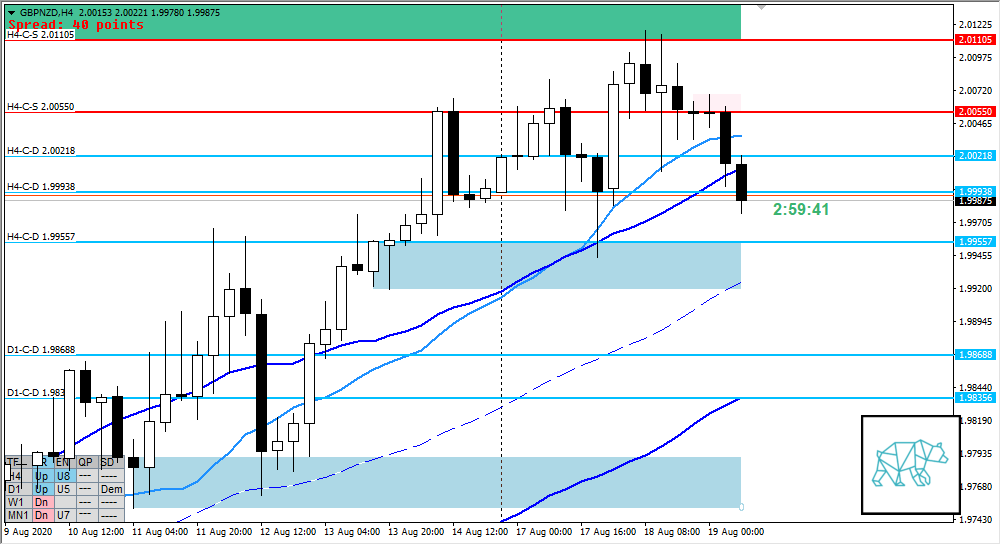

- D1 closed as bull engulf D1-C‑D 2.00218 but with longer selling wick

- H4 bear engulf below previous supply giving H4-C‑S 2.00773 followed by DBD with longer wicks followed by consolidation indicating possible Phase 3 in play

- AS closing with a break from H4 consolidation down creating new supply at H4-C‑S 2.00550

- Price is trading below VWAP and D1 demand

- Market Profile

- After 2 days of bracketing yesterday’s value is slightly higher but still overlapping indicating more balancing

- LN open below value outside range at ADR 0.5

- ADR 1264

- ASR 921

- H4-C‑S 2.00773 within value at PPOC

- D1-C‑D 2.00218 just 30 pips below VAL

- H4-C‑S 2.01105 at VAH and ADR 0.5 is just above, within M30 QLo

- H4-C‑D 1.99938 at ADR 0-.5, M30 QLo and yesterday session low

Compared against Weekly Trading Plan

- Mid MN, W1, and D1 swing

- W1 closed above VWAP, current candle within last week’s body, retraced D1 Bull Engulf

- H4, D1 trend is up, W1 is down

Sentiment — Slightly Bearish

- Sentiment

- Price below value outside range, fair imbalance, might see slight continuation but due to D1 C‑dem this might be short-lived although it is along the lines of H4 Phase 3. A mean reversion is a more safer play.

- Clarity (1–5, 5 being best)

- 3

- Hypo 1

- LN open below value outside range

- Possible mean reversion ADR 0.5 at H4 c‑dem, M30 QLo and yesterday session low, IB range wider than usual less likelihood of momentum plays, possible fake play down with failed auction

- LN open below value outside range

- Hypo 2

- Due to H4 phase 3 might see a continuation downwards further enhanced through an ADR exhaustion with no reversal signs.

Additional notes

- N.A.

ZOIs for Possible Shorts

- H4-C‑S 2.01105

- H4-C‑S 2.00550

ZOIs for Possible Long

- D1-C‑D 2.00218

- H4-C‑D 1.99938

- H4-C‑D 1.99557

Mindful Trading

- Slept light

Focus Points for trading development

- Weekly Goal

- Formulate hypos in order of likelihood and track with actual development on the day

- Incorporate profile day type

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- 2 consecutive days of lack of sleep = NO TRADING

No Comments