#premarketprep #tradingforex #forex #FX #daytrading #tradinglifestyle #daytraderlife #GBPNZD

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias.

Non-conjecture observations of the market

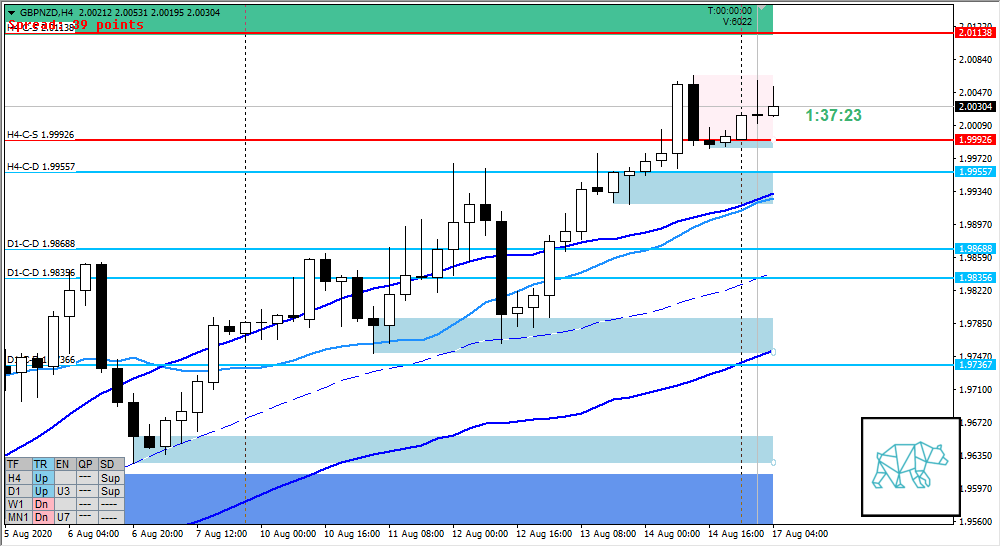

- D1 supply formed same c‑line as H4-C‑S 1.99926 and price is still trading within

- H4 doji formed after (consolidation and move up) but no confirmation on direction yet now shares demand c‑line with H4-C‑S 1.99926

- Market Profile

- ADR 1316

- ASR 1013

- Max 21 long

- Max 30 short

- Price currently trading within value

Compared against Weekly Trading Plan

- Mid MN, W1, and D1 swing

- W1 closed above VWAP, current candle within last week’s body

- H4, D1 trend is up, W1 is down

Sentiment — Neutral

- Price is currently within value and showing lots of lower time frame SD ZOIs on either side and ADR 0.5 and exhaustion laying further outside of value

- Best to stay out unless there is a confluence around the levels of ADR

Additional notes

- N.A.

ZOIs for Possible Shorts

- H4-C‑S 2.01138

- H4-C‑S 1.99926

ZOIs for Possible Long

- H4-C‑D 1.99926

- H4-C‑D 1.99557

Mindful Trading

- Slept very light. Took a nap.

Focus Points for trading development

- Weekly Goal

- Align with market narrative

- Taking a trade is not a priority

- Risk Management

- 3 trades 1% risk

- 2 consecutive days of lack of sleep = NO TRADING