#premarketprep #tradingforex #forex #FX #daytrading #tradinglifestyle #daytraderlife #GBPNZD

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias.

Non-conjecture observations of the market

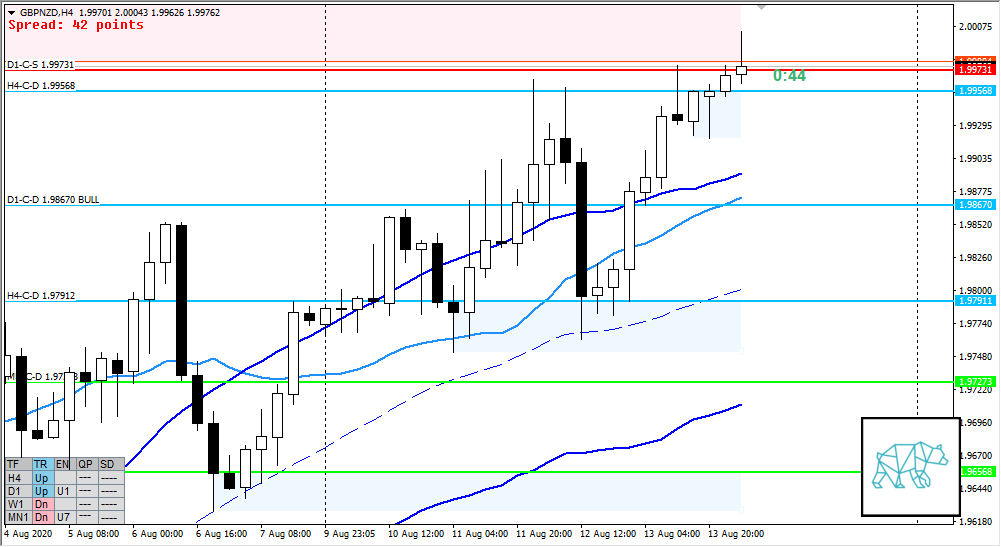

- D1-C‑D 1.98670 Bull Engulf formed closing below overhead supply D1-C‑S 1.99731 (testing 2nd time) taking out previous D1 supply

- H4 RBR through Bull Engulf followed by another forming demand at H4-C‑D 1.99568 just below D1 C‑Sup

- Market Profile

- ADR 1391

- LN ASR 1093

- Price currently above value within range

- ADR exhaustion @ 2.009, ADR 0.5 @ 2.002

Compared against Weekly Trading Plan

- Mid MN, W1, and D1 swing

- W1 trading above previous week’s body and VWAP

- H4, D1 trend is up, W1 is down

Sentiment — Bullish

- Even though H4 is showing an unclean arrival at D1-C‑S 1.99731 there are 2 consecutive RBR, an open above value and within range might prove suitable for a continuation to the upwards move especially with H4-C‑D 1.99568 right at VAH

Additional notes

- Value Acceptance would negate the bullish sentiment

ZOIs for Possible Shorts

- D1-C‑S 1.99731

ZOIs for Possible Long

- H4-C‑D 1.99568

- D1-C‑D 1.98670 BULL

- H4-C‑D 1.97912

Mindful Trading

- Slept okay

Focus Points for trading development

- Weekly Goal

- Align with market narrative

- Taking a trade is not a priority

- Risk Management

- 3 trades 1% risk

- 2 consecutive days of lack of sleep = NO TRADING