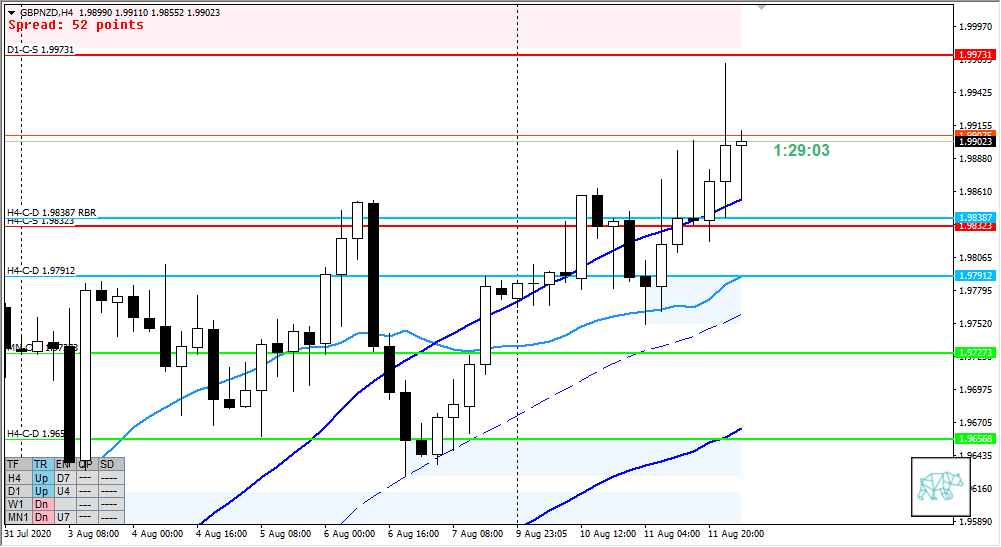

12 Aug Premarket Prep GBPNZD 08122020

#premarketprep #tradingforex #forex #FX #daytrading #tradinglifestyle #daytraderlife #GBPNZD

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias.

Non-conjecture observations of the market

- Yesterday closed higher breaking the phase 3 range albeit not strongly

- D1 first touch of D1-C‑S 1.99731 (being very close to round number of 2) today proved reactive

- New demand H4-C‑D 1.97912 formed through H4 Bull Engulf followed by messy price action to say the least indicating possible phase 1 or 3 still, H4-C‑D 1.98387 RBR was formed in the move up

- Market Profile

- ADR exhausted 90+%, 1268 out of 1326

- M30 QHi lining up with ADR 0.5

- Price currently trading above value and range, will reassess at open

- ASR

- 1093

Compared against Weekly Trading Plan

- Mid MN, W1, and D1 swing

- W1 trading above previous week’s body touching VWAP

- H4, D1 trend is up, W1 is down

Sentiment — Slightly Bullish to neutral

- Sentiment is due to price being above value

- However an open above value could still warrant (due to overhead supply, ADR exhaustion and possible Phase 3 on medium time frames)

- Exhausted move into supply, failed auction, reversal

- Value acceptance

- Return to value with price action confirmation long

Additional notes

- An open above value could warrant

- Exhausted move into supply, failed auction, reversal

- Value acceptance

- Return to value with price action confirmation long

ZOIs for Possible Shorts

- D1-C‑S 1.99731

ZOIs for Possible Long

- H4-C‑D 1.98387 RBR

- H4-C‑D 1.97912

Mindful Trading

- Slept okay

Focus Points for trading development

- Weekly Goal

- Align with market narrative

- Taking a trade is not a priority

- Risk Management

- 3 trades 1% risk

- 2 consecutive days of lack of sleep = NO TRADING

No Comments