#daytrade #daytrading #forex #FX #INDEX #INDICES #DAX #DE30 #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #tradingforex #daytrading

This is my premarket prep for today’s European session for DE30 DAX. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias.

Non-conjecture observations of the market

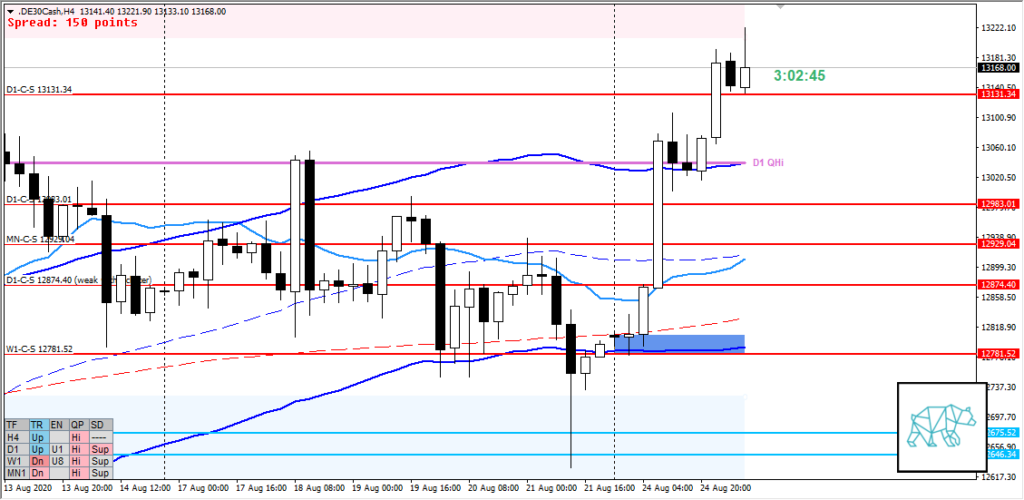

- D1 bull engulf arriving at D1-C‑S 13131.34 within D1 QHi

- Market Profile

- LN open

- LN open above value, outside range

- Could mean a possible continuation since we are dealing with equities

- LN open above value, outside range

- ADR 19133

- ASR 18437

- D1-C‑S 13131.34 within QHi below ADR 0.5 (0.5xASR) at lower time frame supply

- LN open

Compared against Weekly Trading Plan

- Trading within W1 supply phase 3 range

- Within W1 QHi

Sentiment — Bearish

- Sentiment

- Price trading within QHi after an extensive UT nearing supply created at all-time high combined with current larger time frame supply created and price action hinting to a phase 3 would suggest a bearish sentiment. Equities being what they are going short proves more challenging. Furthermore, an open outside value and range might prove as momentum for a possible continuation.

- IB

- A closed as bull Engulf, B retraced almost entirely

- Sentiment: due to the nature of equities I am interested to see how price develops given the current conditions with yesterday having a big up-day, today opening above value outside range at ADR 0.5 I am leaning towards a mean reversion. C has already extended IB down but can’t call it a sustained auction just yet. Will monitor closely.

- Clarity (1–5, 5 being best)

- 3

- Hypo 1 — SHORT

- LN open above value, outside range

- D1-C‑S 13131.34 within QHi below ADR 0.5 (0.5xASR) at lower time frame supply, no retracement to yesterday’s move yet, mean reversion

- LN open above value, outside range

- Hypo 2 — SHORT

- LN open above value, outside range

- Value acceptance

- LN open above value, outside range

- Hypo 3 — LONG

- LN open above value, outside range

- Bounce off VAH (coinciding with M30 VWAP in UT, plus above VWAP and KC)

- LN open above value, outside range

Additional notes

- N.A.

ZOIs for Possible Shorts

- D1-C‑S 13131.34

ZOIs for Possible Long

- H1-C‑D 13041.72

Mindful Trading

- Slept okay, still sick

Focus Points for trading development

- Weekly Goal

- Formulate hypos in order of likelihood and track with actual development on the day

- Incorporate profile day type

- Trading Rules

- If Open outside of value consider the placement in relation to ADR

- Don’t take into consideration medium time frame c‑lines past 24 hours

- FX within value > DAX

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- 2 consecutive days of lack of sleep = NO TRADING