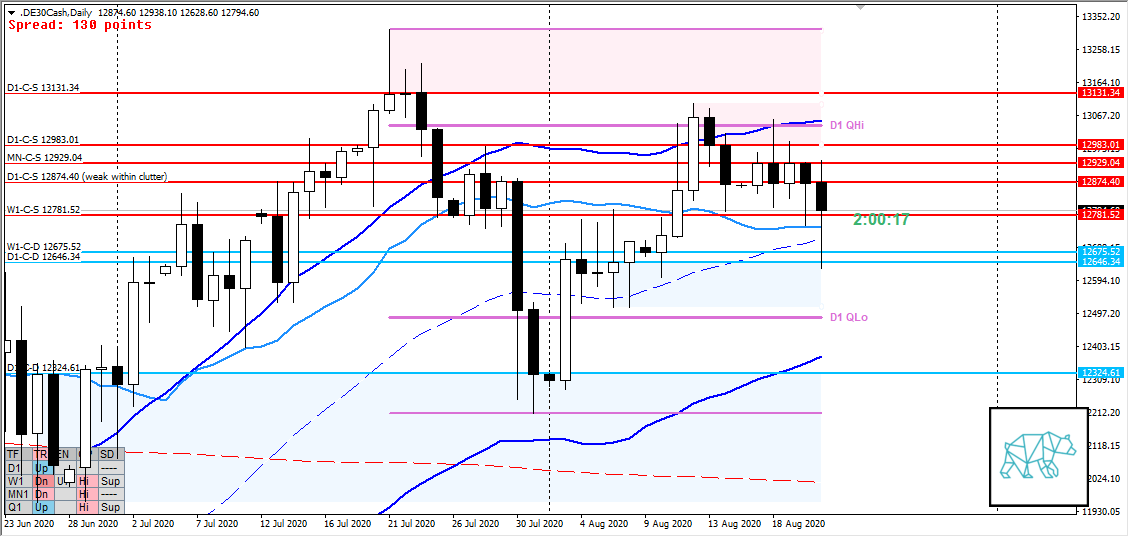

23 Aug DE30 DAX Week 35 Trading Plan

#daytrade #daytrading #forex #FX #INDEX #INDICES #DAX #DE30 #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #tradingforex #daytrading

This is my weekly outlook on DE30 otherwise known as DAX. Basically the levels that I will be looking at where it has a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and market profile. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me.

Monthly — Slightly Bullish

- 3rd month testing MN-C‑S 12929.04

- Last month closed as doji (slightly below MN QHi) with longer selling wick testing overhead supply

- Developing month trading above last month’s body within range

- Trading within Q1 QHi, developing month within MN QHi but no close until slight over a week from now

Weekly — Neutral

- Phase 3

- W1-C‑S 12781.52 created within MN QHi no follow-through on move away possible Phase 3 creating demand through inside bar at W1-C‑D 12675.52

- Some consolidation at 2nd test of overhead supply

Daily — Neutral

- Test of D1-C‑S 13131.34 an consequent new supply formed at D1-C‑S 12983.01 at D1 QHi closing below QHi through inside bar

- Consolidation below supply (testing QHi) with Friday breaking down from consolidation giving D1-C‑S 12874.40 (weak within clutter) and testing underlying demand at D1-C‑D 12646.34 closing with longer buying wick

- Possible Phase 3

- Price currently mid swing

H4 — Neutral to Slightly Bearish

- Phase 3

- A lot of contradicting price action with slight break down from balancing range

- Long buying wick into H4 QLo combined with W1 and D1 demand and consequent bounce creating inside bar (H4-C‑D 12779.02) and slight follow-through

Market Profile — Neutral

- Bracketing profiles

Sentiment summary — Neutral to slightly bearish

- Last month’s candle closed as a doji which could turn into an evening star (also a possible RBR). Possible Phase 3 on W1 and D1 are indicating a possible confirmation of a MN Evening star forming however there is still more than a week left. D1 is in a range so until the range is broken, range highs and lows might be best suited as trade locations if profile confirms on the day.

ZOIs for Possible Shorts

- D1-C‑S 13131.34

- D1-C‑S 12983.01

- MN-C‑S 12929.04

- D1-C‑S 12874.40 (weak within clutter)

- W1-C‑S 12781.52

ZOIs for Possible Long

- H4-C‑D 12779.02

- W1-C‑D 12675.52

- D1-C‑D 12646.34

- D1-C‑D 12324.61

Focus Points for trading development

- Weekly Goal

- Formulate hypos in order of likelihood and track with actual development on the day

- Incorporate profile day type

- Trading Rules

- If Open outside of value consider the placement in relation to ADR/ASR

- FX within value > DAX

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- 2 consecutive days of lack of sleep = NO TRADING