11 Aug GBPNZD Week 33 Trading Plan

#daytrade #daytrading #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #GBPNZD

This is my weekly outlook on the Forex pair GBPNZD. Basically the levels that I will be looking at where it has a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and market profile. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

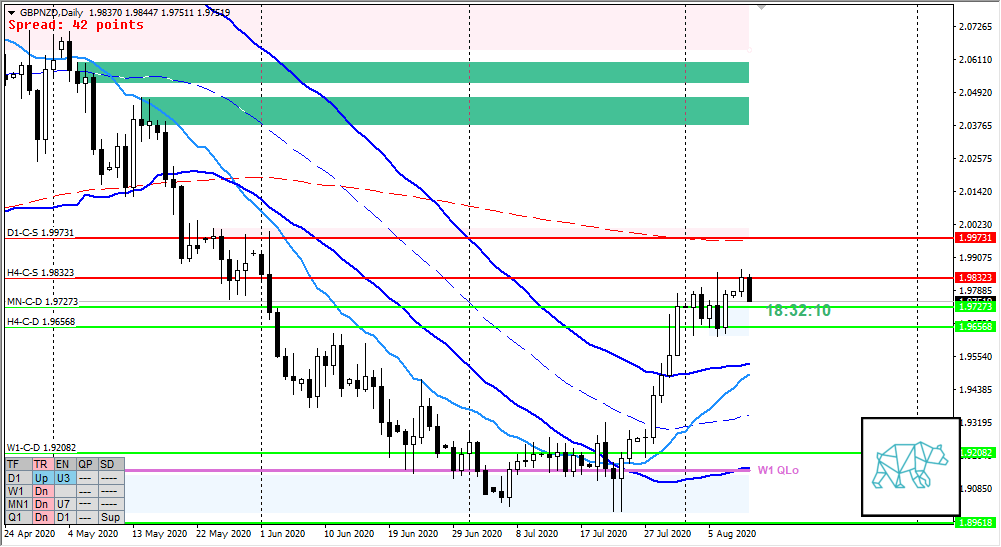

Monthly — Slightly Bullish

- Last month closed as an inside bar retracing ¾ of the preceding month creating MN-C‑D 1.97273

- Currently price is trading above aforementioned C‑Dem

- 2.5 weeks left in the month

Weekly — Slightly Bullish

- W1-C‑D 1.92082 was formed through some Phase 1 ending with Bull Engulf and clear push away

- Price running into congestion at W1 VWAP coinciding with D1-C‑S 1.99731

- Last week retraced slightly but closed above preceding rally

- Current week has started with a slightly HH now trading within last week’s body

Daily — Neutral

- Phase 3

- Bull Engulf coinciding with MN-C‑D 1.97273 (and previous D1 bear engulf) creating D1 demand but no follow-through on the move

- Price trading sideways with slight HH

H4 — Slightly Bearish

- H4 bull Engulf formed demand at H4-C‑D 1.96568

- Phase 3 to slightly move higher with no follow-through creating inside bar and DBD creating H4-C‑S 1.98323

- Price running into some congestion with H4 VWAP, but overall trend is rolling over into possible range

Market Profile — Slightly Bearish

- Swings within bracketing more pronounced

- Price currently trading below value and range

- ADR 1291

- ASR 1037

Sentiment summary — Neutral to Slightly Bearish

- Due to swings within bracketing being more pronounced there is a pickup in volatility in line with a potential move after medium time frame phase 3

- For now range is still in effect

- Due to being in the middle of medium and larger timeframe Q points (and Ranging market) I am more inclined to trade off newly formed SD ZOIs in conjunction with value edges and ADR (0.5 or Exhaustion)

ZOIs for Possible Shorts

- D1-C‑S 1.99731

- H4-C‑S 1.98323

ZOIs for Possible Long

- MN-C‑D 1.97273

- W1-C‑D 1.92082

- H4-C‑D 1.96568

Focus Points for trading development

- Weekly Goal

- Align with market narrative

- Risk Management

- 3 trades 1% risk

- 2 consecutive days of lack of sleep = NO TRADING

No Comments