31 Aug Analyzing your Trading Stats Month 3

#tradingforex #forex #tradingjournal #daytrading #tradinglifestyle #daytraderlife #trackyourstats #tradingstats #noFURUhere #brutallyhonest

So you’ve been trading for a while. How do you know what to look for? How do you know what you are doing right and wrong? Which setup works best? What time of day works best? How long do I let winners and losers run? How much is my expectancy? What is my risk to reward ratio? In other words: how much money am I putting on the line to make how much? Just by looking at these stats you will get real insight into your strengths and weaknesses. Do not overlook this. Do not be one of those people that just trade and trade and trade but never review and wonder where they went wrong. You need to know what to improve upon.

Thank you for following my progress

First off. For those of you that have been following my journey I’d like to give a big thank you! I know I haven’t been blogging much. Although almost everyday I upload trading plans and a Daily Report Card. I sincerely hope my journey somehow adds to your own. Furthermore, you should know by now that I’m quite serious about this. I try not to half-ass this although I still make many mistakes. Which is perfectly fine. Try. Fail. Review. Try again and repeat till infinity! What works now, might not work later. So it’s this process that will keep you in the running. If continuous learning excites you?! You’ve found the right path in trading.

Still in Drawdown

Another month has passed so another review is upon us. Well.. Me. Long story short. I am in the process of actively experimenting with all that I have learned. Trying to make sense of it all. Untangling that spaghetti that is currently taking occupancy of where my brain used to be. In my pursuit of doing this I have started incorporating hypos (hypotheticals) into my premarket preps (which you can find here). So even though I can’t be trading every day due to limitations of only trading the London session and being limited in now 2 tradable assets. Dee suggested me to keep track of how often I am right on the direction of the session. So that I have yet another metric to gauge my progress with than just the trades I do. I thought this was not enough and started incorporating hypos again. I used to do this before and I love the exercise. I keep track of how I think a session will play out based on likeliness of the event and then track which hypo actually did and to what extent. Then also if there was a trading opportunity and if I actually traded it. Hypo 1 is always the one I deem more likely than 2 and so forth. Then I grade the hypo in percentages to the degree I feel the hypo played out based on the observations I made. I’ve only started doing this halfway into August after I had taken the second week off. The first week I didn’t do well. Talking to Dee I realized I might have been burning out a bit. So I took a week off and came back fresh.

DRC Tracking Stats

So here you can find the stats that I tracked. The picture is too big for me to post so I have provided you with a download option underneath. Let me know what you think of this.

In the DRC stats sheet you can see that I have been right on the direction on most days. Not just that. I have outlined the Hypos in order of likelihood and graded them by how much they played out (if any). As you can see in the sheet most of them were Hypo 1 and played out 100%. Another conclusion I can draw is that there were no opportunities under the rules of my process plan. Be it that they were simply subpar setups or that I had not learned a particular setup. I now added that setup to my arsenal and if and when the next time a similar opportunity arises I will take it.

Another factor I tracked was the clarity I had when coming up with the hypos. I want to track to see if there is any valuable information to be gathered by understanding when certain market conditions are more conducive to the clarity of my understanding of the market narrative. This way I hope to better figure out what those conditions are and hopefully work on the ones that I am not good at. Or perhaps I will just discard from trading them at all.

Let’s get to some stats

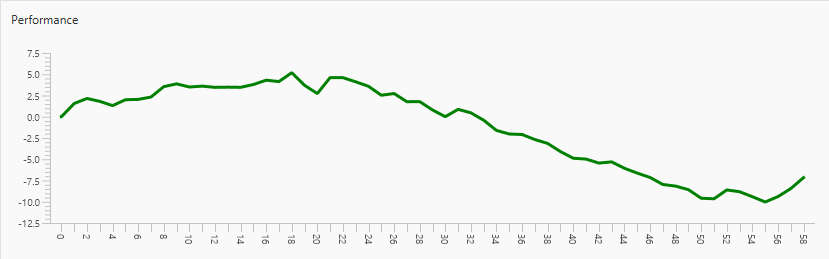

My equity curve for last month, July 2020

Here’s my current equity curve:

I went from being 5.27% to be doing down slightly more than 10% to now 7.04%. I also want to point out being down 1% when you have 10k is different than when you are down 1% of 9K. What a math wizard I am 🙂 Point is that when I am down it takes me slightly longer to get back up then it was on the way down. I got my work cut out but all part of being a trader.

Here is a summary of all my trades from June till end of August together:

Here you can see I didn’t do well the first week. Then took a week off because I was probably indeed having a light burn out. Then the rest of the month I had only 3 days where I actually took a trade. The last week in particular I was extra careful to not take any risky trades to preserve the gains I had made. September is upon us so hopefully the markets will be more conducive to providing us day traders with better opportunities.

What went wrong?

The ‘juicy’ stuff now. As mentioned earlier I was kinda burning out. Several factors where at play and in no particular order:

- Coming off a bad month

- Work

- I run a business and have to find time outside of work to focus on trading. Long story short I don’t have much down time. I spend too much time in front of the screens. With trading (as with most actually) More is not better. Quality over quantity.

- FIX: It is important to spend time away from the screens. If there is anything you pick up from this it is this. Spend time away from the screens. Go spend it with loved ones. Be social (IRL not in-game!) 🙂 and please hit the gym! It is crucial to rational thinking.

- Ego

- Coming off a month where I did most things right to doing most things wrong kinda hit my ego. But I’m over that now, so will focus on the things I can control. My process.

- FIX: it doesn’t matter what others do or think. I am not competing with anyone but myself. To be the best trader I can be.

Is it all just bad?!

Lastly, I’d like to focus on the things I DID do well. Learning from my mistakes is obviously the main goal here. However, it is best to not just focus on the things I did wrong. I also did a lot well (if I do say so myself). In the end, there is no point in lying or trying to conceal certain elements. In trading all of your skeletons will find their way out of the closet 🙂 So here it goes:

- I am good at following trading rules (when I am functioning well). Ha 🙂 that’s a big caveat there. But honestly, I have already outlined quite a few times all the things that went wrong last month. But I’d like to emphasize the fact that before that and now afterwards I do follow rules to a tee. I have very little emotions during a trade because I have clear cut rules to tell me what to do no matter what prints.

- I haven’t used the ‘let’s hope/pray for this to work method’ once since starting the mentorship program.

- Due to my ego getting a big hit last month I had to regroup with all two of my brain cells and make hard decisions. Which I did. All decisions I make are to benefit my trading process. Some of them might be wrong but that’s okay and for me to find out in the future. In the end, due to the process of eternal reviewing, I will make adjustments that are needed as I go. I am not afraid to be brutally honest with myself and with you, my valued reader, and take my issues head on.

- I am always trying to get better. I have put into place a structured guideline to catch myself getting into trouble again. This doesn’t mean I won’t get into trouble but at least I have a chance of catching it early on.

Monthly Goals

- Continue tracking hypos

- Focus on my own progress and less on others.

- Feeling okay with NOT trading

If you have made it all the way through… Here is a FREE LAMBO!!!

Sorry no Lambo. Nonetheless, I greatly appreciate your interest in my journey. I’m sure it is not an easy read as I tend to get long-winded. If you have any comments or suggestions feel free to let me know. Even though I do like writing I don’t consider myself to be much of a writer. I rather talk or play online games 🙂 Reach out to me. Let’s hang. Talk. Even though I haven’t played in a while I am sure I can still kick your A** in Call of Duty Modern Warfare or some Sim Racing or Sim Flying perhaps? 🙂 Let’s team up. Contact me for my Discord channel details.

No Comments