30 Jun Analyzing your Trading Stats

#tradingforex #forex #tradingjournal #daytrading #tradinglifestyle #daytraderlife #trackyourstats #tradingstats

So you’ve been trading for a while. How do you know what to look for? How do you know what you are doing right and wrong? Which setup works best? What time of day works best? How long do I let winners and losers run? How much is my expectancy? What is my risk to reward ratio? In other words: how much money am I putting on the line to make how much? Just by looking at these stats you will get real insight into your strengths and weaknesses. Do not overlook this. Do not be one of those people that just trade and trade and trade but never review and wonder where they went wrong. You need to know what to improve upon.

Why now?

It is the last day of June. Both assets that I currently trade (GBPNZD and Gold XAUUSD) are balancing today (at least at the time I wrote this) so decided not to trade. This and trying to preserve my winnings for the month. If you are working for a prop firm it is important to keep winnings at the end of the month. No winnings? No payout. There are no normal salaries given at a prop firm. So I decided to have a look at my current stats. Compare them to my previous stats. Perhaps I can get a better understanding of my own trading. As well as find points that I should work to improve. Spoiler alert. I will!

Thank you for following my progress

First off. For those of you that have been following my journey I’d like to give a big thank you! I know I haven’t been blogging much. Although almost everyday I upload trading plans and a Daily Report Card. I sincerely hope my journey somehow adds to your own. Furthermore, you should know by now that I’m quite serious about this. I try not to half-ass this although I still make many mistakes. Which is perfectly fine. Try. Fail. Review. Try again and repeat till infinity! What works now, might not work later. So it’s this process that will keep you in the running. If continuous learning excites you?! You’ve found the right path in trading.

Quick shoutout to Dee

Most of you that follow me know that I am being mentored by Deeyana Angelo from Market Stalkers. I am a Gold member and have been so since the beginning of May. I am in the process of writing an article on my mentoring. However, I want to put it in a format that you can learn from. Stay tuned. It will come. If there are any questions you’d like answered please let me know by either contacting me directly or posting in the comment section below. For now, I’ll leave you with this: I can honestly say that it was the single best decision I ever made regarding my trading.

Are we gonna get to the analyzing stats part?

Yes yes here we go. I use Edgewonk for my trade journaling but the principles apply to whatever it is you’re using. Spreadsheets or whatever. So where to start? First, let’s get some terminology out of the way so that we actually have an understanding of what we are talking about. For now we’ll be focussing on the following:

- Average RRR planned

- This metric measures the distance between the entry and your stop (potential risk) and compares it to the distance between the entry and the target order (potential reward). The ratio of those two numbers, potential risk and potential reward, is called the Reward:Risk Ratio and it’s an important metric. Ideally, you should have a higher profit than risk. I will even go so far as to say that this is a MUST. When you aim for 2:1R you only need to be right like 36% of the time. Put your ego aside and play the statistics.

- Average R‑multiple

- The R‑Multiple is similar to the RRR planned but the R‑Multiple measures the final outcome of your trade. The ‘R’ stands for Risk. For example, a trade where the original stop loss got hit has an R‑Multiple of ‑1. A trade where you closed the trade halfway to your stop loss has an R‑Multiple of ‑0.5. A winning trade where the target was twice the size of the stop loss has an R‑Multiple of +2.

- Profit factor

- The Profit Factor compares the average losing and winning trade and builds a ratio. For example, if your winning trade is on average $100 and your average loser is $50, your Profit Factor is 2 ($100 / $50).

- Avg Winner / Loser performance

- This is the average return figure for winning and losing trades in percentage

For more information on what Edgewonk can track for you please visit https://edgewonk.com/

Edgewonk is a local trading journal software that I highly recommend.

Let’s get to some of my own stats

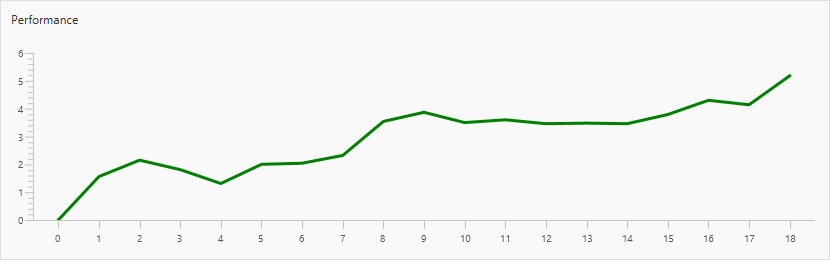

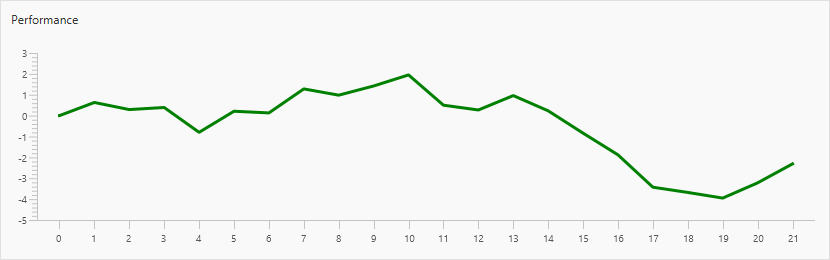

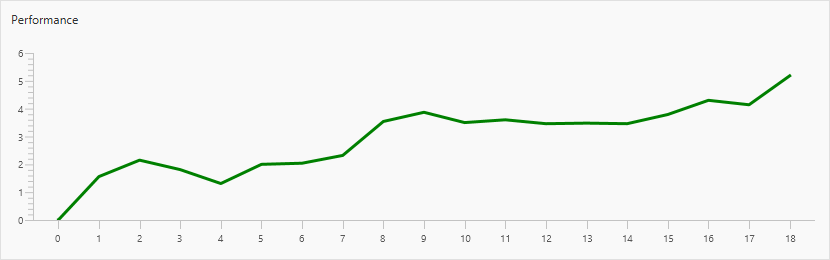

In all openness these are my current stats trading a new account that I started 2nd week of June (June 8th) till now June 30th. So it’s fair to say that this does not represent the complete reality of my trading. I will need upwards of 50, preferably 200+ trades to have a more realistic data set to calculate stats. However, I will compare this to my stats from the month before. As we go along (yes I’m taking you with me on my journey) I will update you on my development. Here they are for now:

| Metrics | June (6/8–6/30 | May (5/4–6/3) |

| Total trades | 18 | 21 |

| Winners | 8 | 9 |

| Losers | 3 | 11 |

| Winrate (%) | 72.73 | 45 |

| Average RRR planned | 2.02 | 1.64 |

| Average R‑multiple | 0.37 | -0.09 |

| Profit factor | 5.46 | 0.73 |

| Avg. Winner Performance % of account | 0.66 | 0.69 |

| Avg. Loser Performance % of account | -0.4 | -0.77 |

| Avg. Holding Time (minutes) Winners | 146.75 | 102.33 |

| Avg. Holding Time (minutes) Losers | 53.67 | 74.75 |

| Up for the month in % | 5.29 | -2.32 |

Things to consider

If you have been following my Daily Report Cards you might have noticed that my current weekly goal is to get sizing right! I am still learning how to do this manually. Needless to say that I am messing this up from time to time. This is also why I have 18 total trades but only 8 winners and 3 losers. For the genius mathematicians amongst us 🙂 that means there are 7 trades ‘missing’. This is due to me sizing wrong and then adding to or getting rid of some of my position. I consider these as 1 trade. In total I made 5 of these mistakes. This is just an indication on how I progressed as opposed to the month before.

Speaking of the month before. This is also not quite the fair comparison. The month prior my account was too smal to constantly trade in a way every asset would represent 1% risk of my account. In order to have ‘cleaner’ stats it is imperative to risk a fixed amount. Because my account was too small I was unable to always risk 1%. So I started a new account in June. This will be my benchmark for the months to come. The beginning of a larger sample size to measure the expectancy of my edge.

To sum things up

Sure, I can boast about my high win rate combined with a high profit factor. But I’m not going to do that since it is somewhat irrelevant. 1. I don’t have enough trades as pointed out before. 2. It is the first month that I ‘somewhat’ got sizing right. 3. AGAIN, I NEED MORE TRADES! So… My average winner is 0.66% of my account where my average loser is ‑0.40%. Ideally my average winners would be closer to 2% but we do not live in a perfect world. See what I did there. I blamed THE WORLD! It’s the world’s fault I am not driving a Lambo! DAMN YOU WORLD! OK…. Getting tired and thus annoying 🙂 Now that I got that out of my system.

I know that when I keep focusing on good setups plus getting better at holding and letting exit rules play out, I will increase my average winners. When compared to the previous month I can say that I have been more picky about my trades. Trading less for more. One facotr for that is that I have increased my hold time on winners. This aside, my main point for improvement is still sizing. I will continue to aim to get this right so that my 2R targets are actually a 2% increase of my account. So that overall I can get closer to that average 2R win. Obviously trades don’t always pan out and you are left with less than 2R. Only way to find out is to keep continuing this trajectory that I am on and build on the sample size. This will give me a more accurate estimate of how well defined my edge really is.

If you have made it all the way through… Here is a FREE LAMBO!!!

Sorry no Lambo. Nonetheless, I greatly appreciate your interest in my journey. I’m sure it is not an easy read. If you have any comments or suggestions feel free to let me know. Even though I do like writing I don’t consider myself to be much of a writer. I rather talk or play online games 🙂 Reach out to me. Let’s hang. Talk. Perhaps some Call of Duty Modern Warfare or some Sim Racing? Let’s team up. Contact me for my Discord channel details.