18 Jul WTI Crude Week 30 Trading Plan

#daytrade #daytrading #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #GBPNZD #tradingforex #WTI #BLACKGOLD #CRUDEOIL #CRUDE #CRUDEOILISSLIPPERY #daytrading

This is my weekly outlook on WTI crude oil. Basically the levels that I will be looking at where it has a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and market profile. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

Monthly — Slightly Bullish

- MN trading back inside KC and above last month’s range

Weekly — Slightly Bullish

- W1 crossed over VWAP trying to re-enter KC however still consolidating within supply

- Slow W1 RBR or ladder could be in progress

- W1 supply with W1-C‑S 37.770

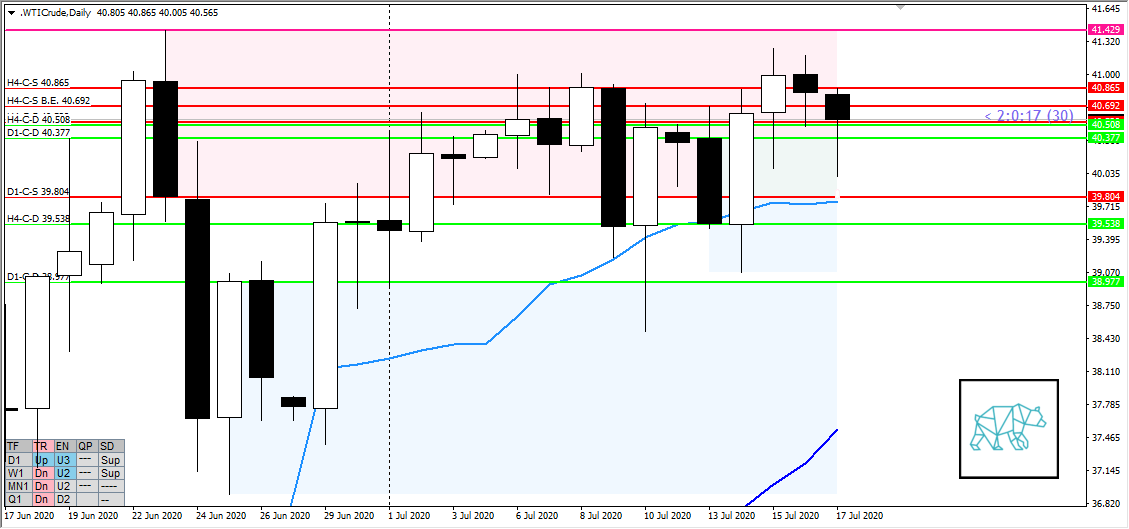

Daily — Neutral

- Daily extended tight range trading below 41.429

- D1 Bull Engulf (@ VWAP) creating new demand with D1-C‑D 40.377 and price currently consolidating above it

- D1 Price trading above UKC and VWAP (although VWAP got touched a few times) however still within D1 supply D1-C‑S 39.804

H4 — Slightly Bullish

- Phase 1/3 going on

- H4 Bear Engulf within pre-existing supply H4-C‑S 40.865, creating new conterminous: H4-C‑S B.E. 40.692 but no clean break just further meandering

- New H4 supply created below H4-C‑S 40.538 with immediate demand created below through H4 bull engulf H4-C‑D 40.508

Market Profile — Slightly Bearish

- After 2 bracketing days we opened below range

Sentiment summary — Neutral

- Due to consolidations on different time frames there is no stronger bias in sentiment and would need a break from this range we are in now. Still lots of opportunities intraday though due to new medium term SD ZOIs. Longer term bullish sentiment would be enhanced in case of a breakout from 41.429.

ZOIs for Possible Shorts

- D1-C‑S 39.804

- H4-C‑S 40.865

- H4-C‑S B.E. 40.692

- H4-C‑S 40.538

ZOIs for Possible Long

- H4-C‑D 40.508

- D1-C‑D 40.377

- H4-C‑D 39.538

- D1-C‑D 38.977

Focus Points for trading development

- Weekly Goal

- Correct position sizing

- Have correct SL placement

- Due to summer time I will focus on trading off newly formed SD ZOIs for intraday plays. Keeping in mind that due to lack of liquidity 2nd chance entries can give better R/R using the M30/M15 rule.

- Risk Management

- Only take 2 trades a day but only have 1 active trade on between the assets

- Only trade off M30 candles

- Trading Priority

- FX pair outside value

- FX pair inside > Gold

- 2+R profit during LN consider trading PNYC

- After 4 losing trades reduce TP to 1.5R but after 1R can consider taking profits

- 2 consecutive days of lack of sleep = NO TRADING

No Comments