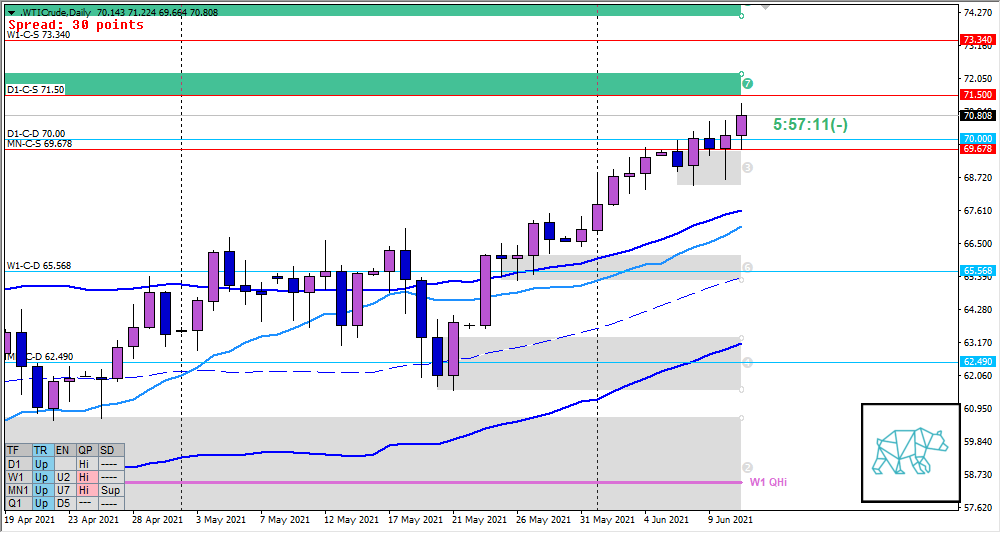

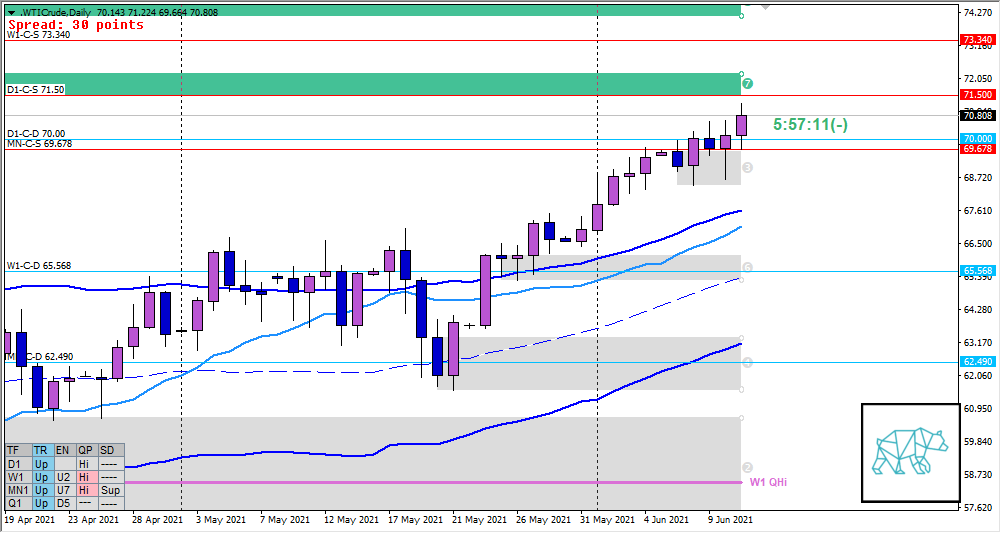

12 Jun WTI Crude 2021 Week 24 Trading Plan

#Fintwit #Orderflow #daytrading #daytrade #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #oil #crude #WTI #USoil

This is my weekly outlook on WTI Crude Oil. The levels that I will be looking at with a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and order flow. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

Monthly — Slightly Bullish

- Price formed a MN RBR through Bull Engulf giving MN-C‑D 62.490 with one test and continuation higher arriving at MN-C‑S 69.678

- Price trading within MN QHi

Weekly — Slightly Bullish

- W1 Bull Engulf giving W1-C‑D 65.568 at W1 VWAP in UT TC above MN demand

- Price trading within W1 QHi below W1-C‑S 73.340

Daily — Slightly Bullish

- D1 demand created through Bull Engulf at MN C‑sup with consequent RBR testing said demand 3 times arriving at D1-C‑S 71.50 with slight reaction

- No D1 Q point activated

Sentiment summary — Slightly Bullish

- MN shows a strong move higher although having arrived at a strong supply from October 2018 some reaction could be expected

- W1 is showing a continued move higher as well although nearing W1-C‑S 73.340. If price takes out W1 Supply End 76.899 price would take out the high of October 2018

- Price arrived at a strong D1 supply with only little reaction so far which could mean a continuation until proven otherwise

Additional notes

- N.A.

ZOIs for Possible Shorts

- W1-C‑S 73.340

- D1-C‑S 71.50

- MN-C‑S 69.678

ZOIs for Possible Long

- D1-C‑D 70.000

- W1-C‑D 65.568

- MN-C‑D 62.490

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- Total of 13 trades by the end of the month

- Weekly Goal

- Min. 3 times working out at home + mandatory cardio

- Risk Management

- Without forcing a trade: aim to take 1 trade a day, if possible 2.

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments