10 Oct Writing a trading plan — part 4

Writing a trading plan

Part 4

One of the best sources out there for learning anything about trading is definitely without a doubt; Investopedia. So many highly professional contributors and knowledge to be found there. That is also where I found this article on ‘Building the Perfect Master Plan’ by Matt Blackman.

So thanks to Matt and thanks Investopedia.

Part of a series

This is the fourth part of ‘writing a trading plan’. Not sure how many parts it will have because that all depends on how much work each part will take to write. I will continue this series until I have a working trading plan that I can be consistent with. I will mention all mistakes and things that did go well to the best of my ability and in all honesty. Thanks for taking the time to read it.

Writing a trading plan. Part 1.

Treating trading like a business.

Writing a trading plan — part 2

Writing a trading plan — part 3

DISCLAIMER

Here it goes…

Summary so far

In the first part of writing a trading plan I talked about things like skill assessment. You first have to learn some basics before you have a better understanding on how to make a plan. Then I took a look at ‘mental preparation’ and made a mantra for myself. A mantra I will say before I start my trading session. Afterwards, I established the amount of risk I am willing to take. This was primarily based on my balance chart, take a deeper look into my balance chart here. At the end of the first part I wrote about my personal goals regarding trading.

In the second part I wrote about doing your homework. The things that, in my case, crude oil has correlations too. News to read. Financial instruments to watch in order to prepare myself for a trading session. Then I concluded that because I trade the very small time frames I don’t have to take them into consideration that much.

In the third part I wrote out my thoughts on ‘trade preparation’ and defined my exit rules. The exit rules come before the entry rules because they are more important. Most people tend to neglect these thinking the entry rules are more important. I defined my trade preparation as doing the technical analysis on the charts that I am trading at. On top of this the mental preparation that goes into starting your trading session.

In this fourth part I will continue following the trading plan outlined by Matt in his article on Investopedia. The remainder of the items are:

- Set Entry rules

- Keep Excellent records (next article)

- Perform a Post-Mortem (next article)

So let’s get started with working on the next item which is ‘Setting entry rules’.

Set Entry Rules

In order to set entry rules I think we need to first understand that there are different strategies for different occasions. I’d like to observe first and then see what distinctions and ultimately strategies we can make regarding ‘entry’ rules. Here are some factors to take into consideration:

- Time frame

- Time period (what time in the day/week/month/year)

- What pattern are we trading? Are we waiting for a break out or are we trading the ‘internals’ of the pattern.

- What is our strategy?

Because I trade on a small time frame and take only ‘quick’ positions in the market I am a scalper. Don’t know what that is? GOOGLE!

Time frames

I have discussed earlier what timeframes I use but I’ll share it here again. At any give time I have on my screens open the following charts:

- The daily chart (analysis)

- The 4 hourly chart (analysis)

- The hourly chart (analysis)

- The 30 minute chart (analysis)

- The 15 minute chart (entry and exit)

- And the 5 minute chart (entry and exit)

EDIT: After reading up a bit on using multiple time frames on Babypips.com I decided to follow its advice and only use 3 time frames. The article makes a few suggestions and since I am having more ‘luck’ with taking small profits I decided to go with the smallest setup. The 1‑minute, 5‑minute, and 15-minute. I will write another article on my experiences using these charts.

Read my article here on choosing the time frames.

Monitor setup

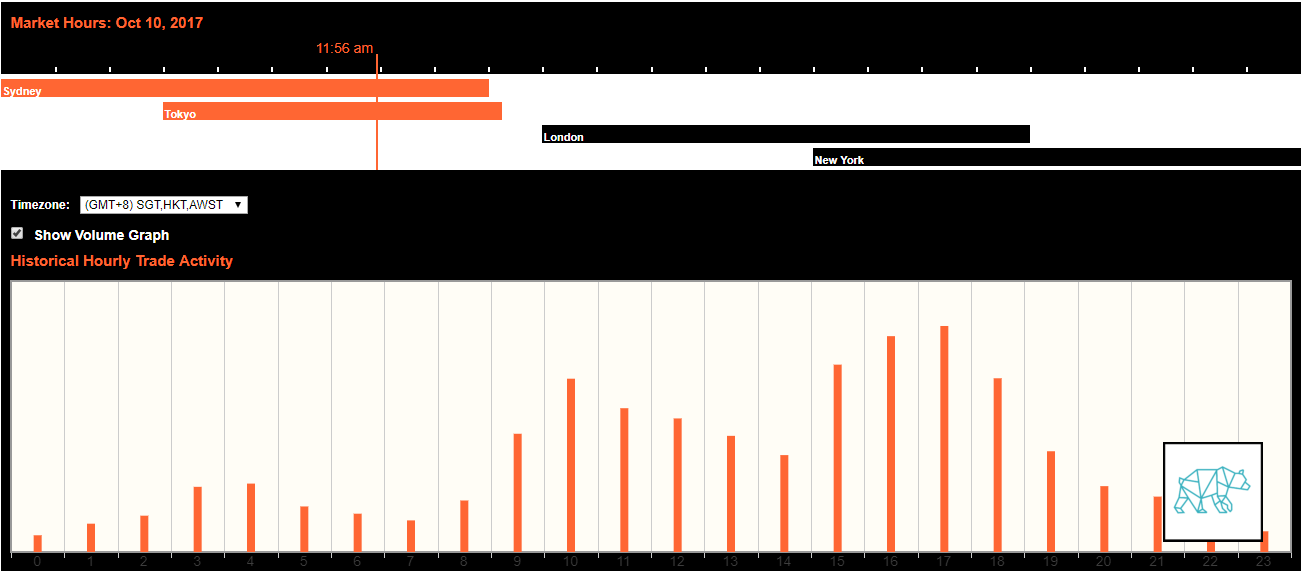

On my main trading setup I have 3 monitors. In the middle I have my 24 inch monitor that shows me the higher time frames (ie. daily, 4H, 1H, and 30m). On the right I have my 23 inch monitor that shows me the 5 and 15 minute chart. These two monitors are connected to my laptop that sits on the left of my setup. By using a laptop I don’t have to worry about power outages that rarely happen where I am but can happen. On the laptop screen I take notes in Trello on my positions and watch the trading hours timeline of the main exchanges around the world (ie. Sydney, Tokyo, London, and New York). On the far right I have a tablet that I use for redundancy to open and close positions or for checking news and social media.

Time periods

Obviously the market doesn’t behave the same all of the time. It behaves differently on several occasions that we then can formulate a different kind of strategy for. In my example I will have a look at the WTI crude oil futures contracts. I already wrote an article about it here but in this article I’ll relate these events to potential strategies. Of course since I am a beginner I will then need to try out these strategies. Here are some things I think I should keep in mind when trading WTI crude oil:

- News reports coming out

- American Petroleum Institute API comes out with their report usually on Tuesdays unless there’s an holiday on the preceding Monday at 16:30 E.T.. For me this means 4:30 in the morning on Wednesdays.

- The Energy Information Administration (EIA) comes out with their report on Wednesdays 10:30 E.T. unless there’s a holiday on the preceding Monday. For me that is 22:30 on Wednesday evening.

- Opening and closing times of the main exchanges around the world

- In combination with the most volume traded that can be an indicator for more volatility. Remember, volatility is good.

Opening hours

Let’s talk about opening hours. If you want to see how this graph looks like for you please go here. In the graph we can see that based on where I am in Asia the exchange in Sydney opens at 5 o’clock in the morning. Tokyo then opens at 8 and they both close around the same time. Sydney closes 14:00 and Tokyo at 14:15 in the afternoon. Then there’s a gap until London opens at 15:00 (even though futures contracts can still be traded). London is open until 00:00. New York opens at 20:00 and closes at 5:00 in the morning when it’s time for Sydney to reopen. That completes the cycle for the day.

High activity

Now what is probably even more interesting is the amount of volume traded throughout the day. As we can see in the graph underneath the trading hours. There we find the the historical hourly trade activity. Now, I would strongly suggest you compare this to your own findings actively trading in the market. The graph suggests that at the opening of London there’s a peak in activity the first hour. The hour before it the activity starts to increase already. Then activity subsides only to pick up stronger at the opening of New York. Which makes sense because now both London and New York are open and heavily trading. The highest activity is between 21:00 and 23:00. Then at 00:00 London closes and activity retreats back.

What about the strategy?

We can conclude that there are different ways of trading different time periods. Here I will discuss the way I see on how these are divided.

- Low volatility

- In these time periods the market hardly moves

- More likely to stay in range

- Can ignore ‘pressure points”

- Look for the channel that prices are ranging between and try and hit the extremes of this range to take positions in opposite direction

- Medium volatility

- Accommodates bigger moves

- Moves can result in breakouts from ‘pressure points’

- Wait for breakout and trade only in that direction. If you do choose to bet on the opposite direction wait for a definite confirmation first. Usually prices don’t return and they just keep following the initial wave. Try and identify the range at the bottom or top of the wave to see which way it breaks out. This way we can either catch the reversal or the continuation of the wave.

- High volatility

- Can behave very erratic but accommodates big moves

- Try and catch the wave upon breakout from pressure point

Get your surf on

OK, I already mentioned to ‘catch the wave’ but what exactly means that for me? I believe we trade based on certain assumptions we make about the market. Based on these assumptions we either stand on the buy or sell side of the market. I use a long, medium and short term moving average (ie. the 200, 50 and 20 MA). Because of the lagging effect of these moving averages I don’t believe that these have much of a ‘predictive power’. What they do ‘do’ is smoothen out the direction of the ‘waves’ of price action. This way we get a general indication on what way prices are going. However, like I said. We won’t be able to make predictions off of these. I do think we can get a bias based on these moving averages that will give us an initial position in the market. Buy or sell. Then we wait for the market to give us a confirmation and we trade ‘only’ in that direction.

In the detailed plan I call the different scenarios of trading I will give examples on what kind trades I make. Since this is already getting to be pretty long I will dedicate a whole article on just that.

Thank you

Let me know what you think of this so far or just ridicule me. All good. This is taking longer than I thought, which is a good thing. If it was done so easily everyone would do it right. Till next time my friend. See you then.

No Comments