19 Apr Weekly Trading Plan Crude Oil, Gold (XAU USD) and S&P 500 (SPX500) 04192020

This is my weekly outlook on crude oil, gold and the S&P 500. Basically the levels that I will be looking at where it has a higher probabilistic chance the market will start reacting. Then I come up with ways I think the market might react around those levels. During the session I then wait for the market to hit those levels and either confirm or reject my hypothesis. I hope that makes sense. If not, please get in touch with me. I am not selling you anything. I just love to talk to people that are on the same path as me. So don’t be shy and reach out.

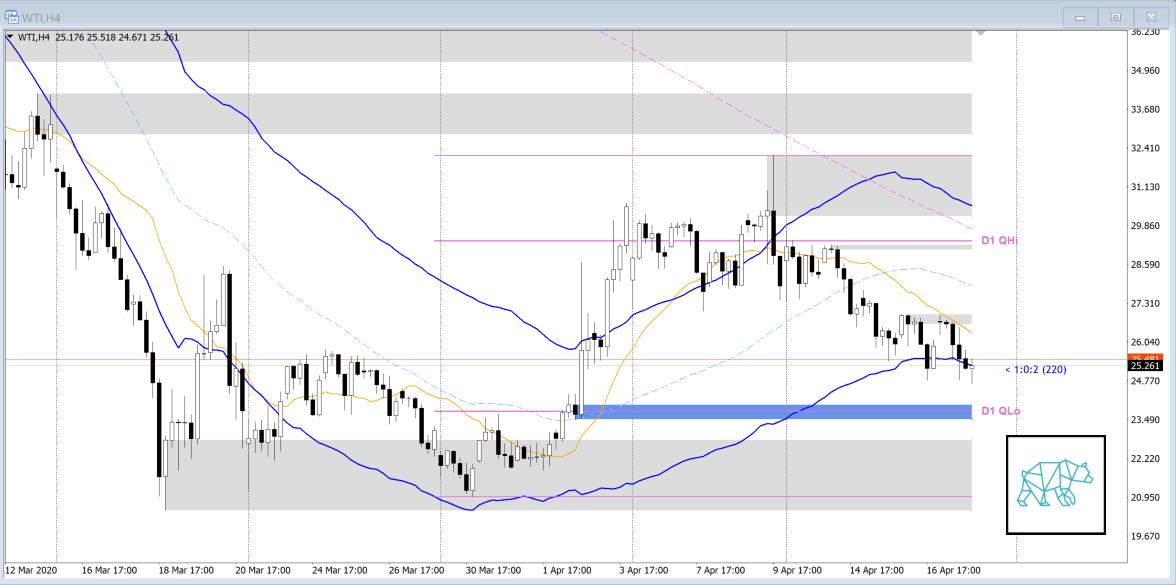

Observations of the market — Crude Oil

- M: Still almost 2 weeks before the candle closes. Price is trading in the bottom half of the candle but unclear if we’ll see more downside. Will have to wait for the close of the candle. No Q points.

- W: Consolidation in process. Too early to say if it’s a pennant or flag. Continuation down possible. Still 200+ ticks room on the downside before hitting Weekly Demand ZOI at 23.20. No Q points.

- D: Failed to make a convincing bullish move and the last 6 trading days have all been closing down. Furthermore price is entering Daily Demand ZOI around 25.40. Q points active and QLo at 23.70.

- H4: Price failure to hold above VWAP. H4 Q points same as Daily. Stronger H4 Demand ZOI (8) right at QLo 23.70.

Hypotheticals

Hypo1:

Short: BD with D TC VWAP possibly prompting a 2nd leg down

Potential targets: 23.90, 22.80, 21.95, 20.60

Hypo2:

Long: Swing Reversal @ Daily QLo Within Daily QLo, look for confirmation on lower time frames

Potential targets: 24.80, 25.95, 26.65

Hypo3:

Long: Swing Reversal @ Within Daily QLo, look for confirmation on lower time frames

Potential targets: 23.80, 24.80, 25.95, 26.65

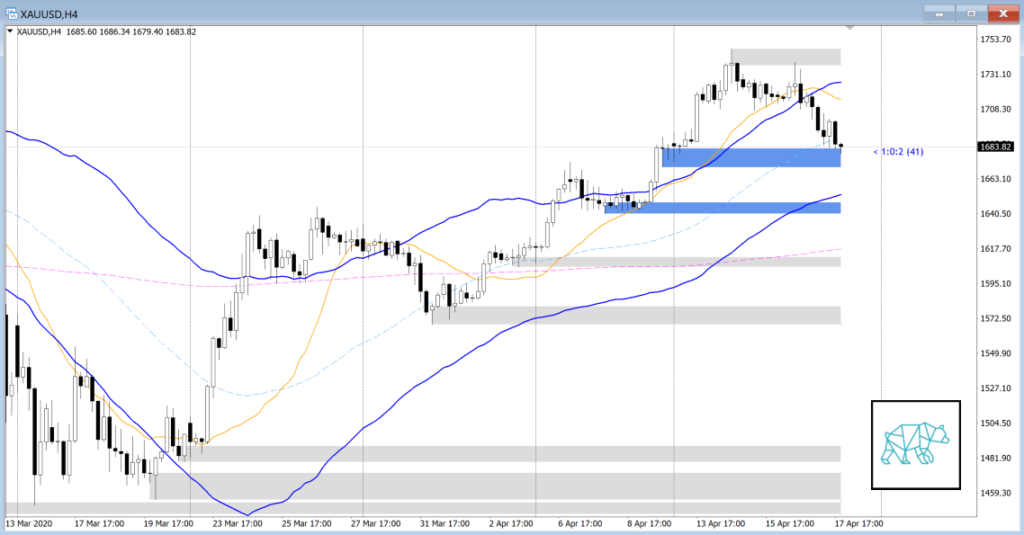

Observations of the market — Gold (XAU USD)

- M: Price within Quarterly and monthly QHi and Supply ZOI

- W: Long-wicked doji candle indicating a possible evening star in the making

- D: Consolidation below strong Supply ZOI with consequent BD

- H4: Retest of H4 Supply ZOI with an Evening star, price moved down to Demand ZOI and formed a bearish engulfing just above it.

Hypotheticals

Hypo1:

Short: PB to 1700 area

Potential targets: 1680, 1670, 1655

Hypo2:

Long: Swing Reversal @ H4 QLo

Potential targets: 1665, 1680, 1695

Hypo3:

Short: D TC VWAP

Potential targets: 1680, 1670, 1655, 1640, 1625

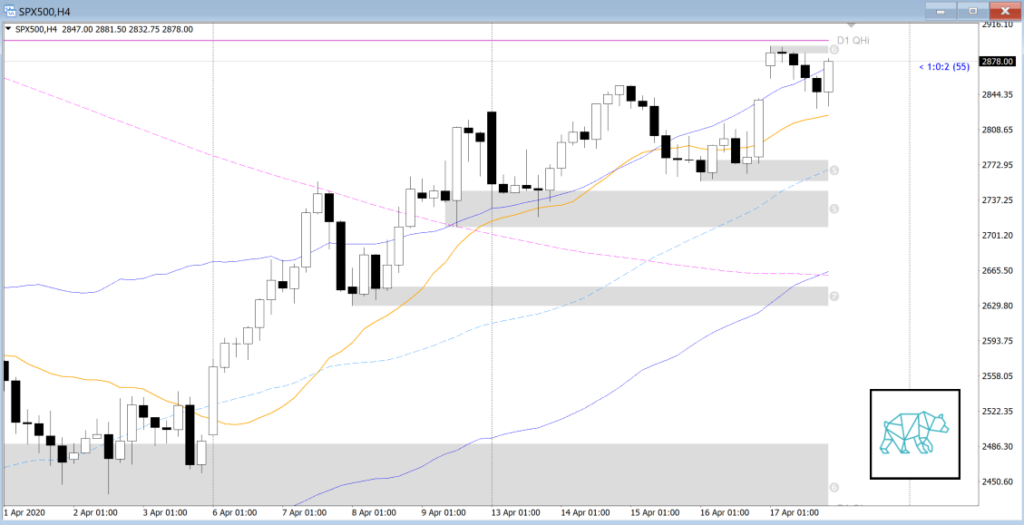

Observations of the market — SPX500 (S&P 500)

- M: Almost full retracement of last month’s candle body however still almost 2 weeks left.

- W: Q Points active (retraced swing high low over 50%). Moved over VWAP. Not within Q Point.

- D: Consolidation below 50MA and consequent gap up but closed as a doji

- H4: Stronger Supply ZOI (7) at 2936–2986

Hypotheticals

Hypo1:

Short: Swing Reversal H4 Supply ZOI

Potential targets: 2905, 2855, 2830

T3chAddict

Posted at 13:32h, 20 AprilWTI

1:30 (local time) M30 Consolidating just above H4/D1 QLo after big rejection of this level

T3chAddict

Posted at 16:21h, 20 AprilWTI: Bullish engulfing above H4 QLo during AS but no move yet. IB just finished. Market not moving yet. Price within Developing Value Area (DVA)

Gold: Price within H4 Demand ZOI but no push back. Price within DVA.

SPX500: Slight drop and immediate retracement more than 50%. Price within DVA. Lack of clarity at the moment

T3chAddict

Posted at 17:18h, 20 AprilWTI

MP showing possible double distribution in the making just above H4 Demand ZOI @ H4/D1 QLo, waiting for price action to confirm a Swing Reversal setup to go long.

T3chAddict

Posted at 18:16h, 20 AprilWTI

Thought confirmation was there in the form of a Three Inside Up and went long, got filled @ 23.689. Stop below H4 Demand ZOI @22.958, TP @ 24.800

T3chAddict

Posted at 19:30h, 20 AprilStopped out

T3chAddict

Posted at 12:29h, 21 AprilGOLD

Hypo1 got in play during 0420 US session. Looking for a potential retest of the same 1700 level + price action confirmation for a short.

T3chAddict

Posted at 16:32h, 21 AprilEvening star went short @ 1693.74, SL1697.15, TP 1689.67

T3chAddict

Posted at 16:00h, 21 AprilWTI

WIthin H4/D1 QLo, looking for a swing reversal

Opened outside VA and outside Range, possible imbalance to continue DT and no chance for a Swing reversal

Will look for IB holding and price action confirming the swing reversal (long)

T3chAddict

Posted at 16:25h, 21 AprilLooking for IB extension to the downside. Broke H4 QLo. Looking for PB to Developing VALto go short

T3chAddict

Posted at 16:03h, 21 AprilGold

Testing 1700 area, looking for rejection

Opened above VA and Range, possible exhaustion and reverse

Will look for price action confirming the rejection + PB to enter short

T3chAddict

Posted at 17:05h, 21 AprilPosted under the wrong post:

Posted at 16:32h, 21 April REPLY

Evening star went short @ 1693.74, SL1697.15, TP 1689.67

T3chAddict

Posted at 17:08h, 21 AprilTook Profit 1X @ 1692.48

I am still trying to get comfortable taking trades in combination with market profile and I understand I have to aim for AT LEAST 2X. I will monitor the trade to see if it would have reached my target.

T3chAddict

Posted at 17:24h, 21 AprilHoly shit: It would have hit my target at 1689.67 with ease. It obliverated it and dropped beyond Previous POC to 7X @ 1671

T3chAddict

Posted at 16:05h, 21 AprilSPX500

Testing H4 50MA

Opened below VA and Range, possible imbalance continuation

Looking for IB to extend to the downside and PB to go short

T3chAddict

Posted at 16:16h, 21 AprilPrice potentially rejecting H4 QLO, looking for PA to confirm long after retesting 2800, however still trading within today’s IB