This is my weekly outlook on the Forex pair USDCAD. Basically the levels that I will be looking at where it has a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and market profile. I hope that makes sense. If not, please get in touch with me. I am not selling you anything. I just love to talk to people that are on the same path as me. So don’t be shy and reach out.

Monthly — Bearish

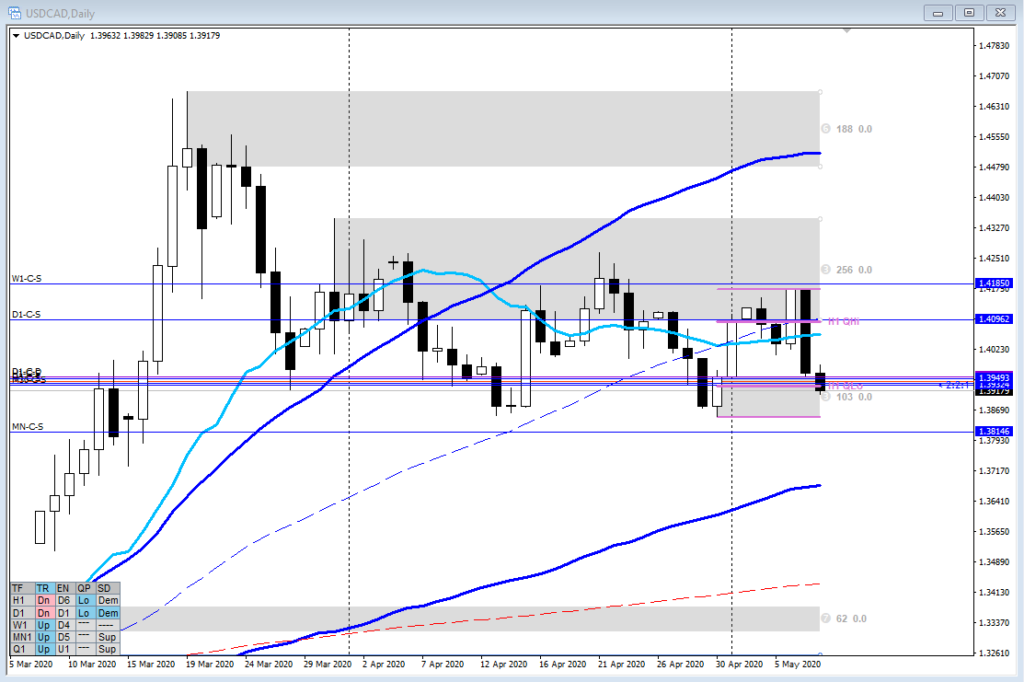

- Clean rally to Monthly Supply ZOI 1.38146–1.46872, followed by inside bar (after rejection of Q1/Y1 QHi) just below upper KC in a ranging market that close below MN QHi

- Price has not left MN Supply ZOI still above conterminous line 1.38146

- Potential for normal formation or RBD

Weekly — Bearish

- Clear rejection of Q1/Y1 QHi within W1 Supply ZOI with multiple retests of W1 Conterminous Supply line 1.41850 indicating phase 3 distribution

- Price above upper KC in ranging market

- Last week tested W1 C supply with convincing move down to upper KC

Daily — Slightly Bearish

- Last Thursday Bearish Engulfing rejecting W1 C Supply now testing D1 Conterminous demand 1.39534

- D1 Demand ZOI 1.38501–1.39534 from April 30th having taken out Demand from April 14th prior

H4 — Bearish

- Move away from D1/H4 QHi to QLo

- Higher volatility ranging market

- Bearish engulfing at D1/H4 QLo with consequent testing of H4 Conterminous Supply line at 1.39378

- No H4 Demand ZOI formed yet

Market Profile — Bearish

- Last week Monday- Thursday profile bracketing with Friday having moved away indicating a possible pickup in momentum

Sentiment summary

- Trend indicating Q1, MN1, W1 up, D1 down, H4 up

- Larger time frame price action indicating a possible swing reversal so unless proven otherwise my sentiment is bearish and will look for lower time frame setups in this direction

- Price within D1/H4 QLo so there is a chance for a swing reversal if price action can confirm a close outside of QLo

ZOIs for Possible Shorts

- H4 Conterminous Supply line at 1.39378

- H1 Conterminous Supply line at 1.39493

- M30 Conterminous Supply line at 1.39324

ZOIs for Possible Long

- D1/H4 QLo after confirmation of D1 or H4 bullish price action triggering a possible swing reversal in line with larger time frame trend being up

Focus Points for trading development

- Exit rules

- Option 1: hold trade until noon (London time)

- Option 2: Target hit (SL or x2 TP)

- NO OPTION 3

- Entry rules

- No staring at M5 chart

- Trade needs to have a target that has the chance of hitting min. X2 R/R

- I will post trades including:

- Trade location

- Price action entry condition

- What were TPOs doing at the time

- With screenshot

- Learn how to use the Session Range Exhaustion

- Keep own approach of KC, VWAP as odd enhancers instead of hard trade locations