06 Sep Understanding the big reversals

The Big Reversals

Now that you know the basics and have played around with drawing trend lines on charts we can start looking at charts from a bird’s eye view. If you haven’t mastered the basics yet, I suggest you go read this article Bootstrap Trading. If you haven’t played around with the drawing tool I suggest you go read this article on The Honest Secrets to Trading Connecting the Dots.

DISCLAIMER

Like you, probably, I am learning how to trade. I don’t claim to know anything. What I do claim is that I will be a successful trader. I am confident that I will be one because I am putting in the time and effort. If I can’t become one, it’s because the game is rigged and I was never able to be good at it anyway. And basically the bottomline is… It’s never my fault 🙂

BECAUSE THE GAME IS RIGGED!

Obviously, I don’t believe this.

This series of posts are my personal approaches to understand markets and trading and in the end my path to success. So if you can be honest about your situation as I can be about mine, we can do this together and get cracking. If ‘they’ can do it… We can.

After all, you can’t be a good trader if you are not completely and brutally honest with yourself.

This series is called ‘The Honest Secrets to Trading’. I call it this because Yes, it is a ‘clickbait’ thing. Partly. How else can I get your attention amid all these other guys. But I also call it this because I will show you in all honesty what my approach to learning this craft is. Because I am looking for these secrets as well. Just like you. I am putting in the time. Are you?

Last note. Generally, you will find a common theme through my articles and that is GOOGLE for yourself. Don’t know a term that I’m talking about? GOOGLE it. I’m not here to tell you all there is about trading. I am here to tell you how I learn and how you can start learning by yourself. I hope you can appreciate that.

Here it goes…

Bird’s eye view

When you start drawing trend lines (don’t know what trend lines are? Google it) on charts you start noticing that price action ‘flows’ in a certain way. Then it changes directions and flows in another way. When you take a bird’s eye view though you see that these individual flows are a part of something bigger.

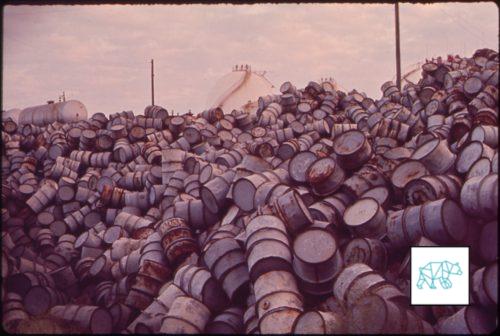

Let’s look at the daily time frame on WTI crude oil looking back a year. What do you see? Have you noticed that the top side of the price is following a diagonal trend line? Every time it touches the trend line it goes back down and touches another trendline that is in line with previous lows of the price action. Isn’t that interesting?

The Big Reversals

Now, what I would find even more interesting is to know what made prices go down or up after it hit these trend lines. By the way, the upper trend line is called the resistance and the lower the support. They are called these because they resist prices from going further up and there’s enough support underneath to prevent prices from going further down. That’s a freebie from me because you could have just Googled it.

Light a candle

So how do I suggest you approach to analyze these ‘big reversals’? After having established for yourself where these ‘big reversals’ are, you can know take a closer look at them. Zoom in on each one of them and play around with the different time frames to see if you can recognize a certain pattern. I use candlesticks because they give me a lot of information in just a small form factor. Obviously you need to know the basics about how to use candlesticks before u can start interpreting them on charts. Google! Or have a look here: http://www.investopedia.com/walkthrough/forex/beginner/level3/candlestick.aspx

Don’t judge, merely observe

When taking a closer look at these ‘big reversals’ please keep in mind that you are here to learn. You are here to listen. You are merely observing what prices are doing at these turning points. Don’t try to understand just yet. Just fill up that beautiful brain of yours with information collected at these points. What would be a good way to start measuring? How would you approach trying to understand what’s going on at this ‘Big Reversal’ point?

Thank you

Thank you for taking the time to read this article. If you have any questions or suggesting please feel free to let me know.

No Comments