No weekly trading plan this week because of personal life getting in the way. Rebuilding my PC and re-situating my office but thought I can do a daily trading plan because I’ll be having more time today.

So these are my hypotheticals for today’s Gold session. Basically the levels that I will be looking at where it has a higher probabilistic chance the market will start reacting. Then I come up with ways I think the market will react around those levels. During the session I then wait for the market to hit those levels and either confirm or reject my hypothesis. I hope that makes sense. If not, get in touch with me. I am not selling you anything. I just love to talk to people that are on the same path as me. So don’t be shy and reach out.

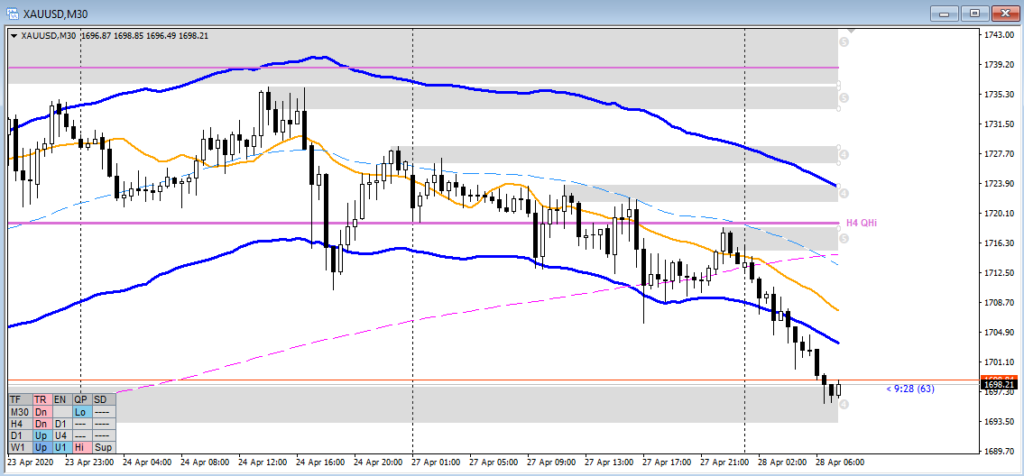

Observations of the market

- M: Price within Quarterly and monthly QHi and Supply ZOI after having created 2 long-wicked doji candles in the previous 2 months. There are still 3 days left in the current month.

- W: Price within W QHi. There was an evening star two weeks ago but we kept going up last week. This week we are retracing last week’s candle body by, now, already more than 50%. Still above the weekly conterminous line at 1655.

- D: Double top with consequent push down nearing D ZOI. In the middle of Daily Q points swing. Moved away from the trade location of Daily conterminous line 1716.

- H4: H4 range mid Q point

- M30: Move down to 1697 area, possible short term swing low

- Market Profile: Price below yesterday’s low, session low, and VAL. Market imbalanced.

Hypothetical

Hypo1: M30 Swing Low to Down Trend Continuation at VWAP (possibly near yesterday’s low)

Entry Short below 1705. Targets 1694, 1684, 1681

Hypo2: Range 1696 — 1705

Hypo3: H4 Swing Reversal (perhaps tomorrow or later)

Entry Long above 1685. Targets 1695, 1705, 1715