These are my hypotheticals for today’s EU session of Gold. Basically the levels that I will be looking at where it has a higher probabilistic chance the market will start reacting. Then I come up with ways I think the market will react around those levels. During the session I then wait for the market to hit those levels and either confirm or reject my hypothesis. I hope that makes sense. If not, please get in touch with me. I am not selling you anything. I just love to talk to people that are on the same path as me. So don’t be shy and reach out.

Observations of the market

- M: Price within Quarterly and monthly QHi and Supply ZOI. Nearing high of October 2012 @ 1795 which is not at a too strong Supply ZOI (3).

- W: Within W QHi. 1st rejection of W Supply ZOI last week but now have retraced more than 50% up and are looking to possibly reject again.

- D: Push into D QHi. D Supply ZOI (7) @ 1750 area. Need lower time frames to confirm a possible Swing Reversal otherwise stay long-biased.

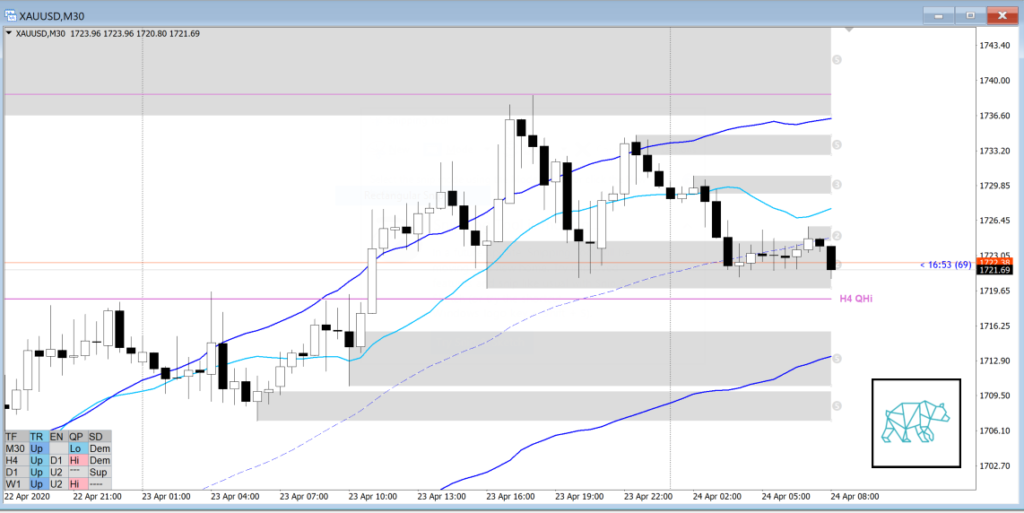

- H4: Price consolidating within H4 QHi with bearish engulfing.

- M30: Consolidation within M30 demand ZOI @ 1721–1724.

- Market Profile: Price trading within PVA, market is balanced.

Hypothetical

Hypo1: Price push below PVA + confirmation of PVAL as resistance to go short

Entry short below 1719. Targets 1710, 1707, 1700, extended target 1683

Hypo2: Range 1719 — 1738

Hypo3: M30 Swing Reversal

Entry Long around 1724. Targets 1729, 1732, extended target 1736