22 Apr Trading Plan Crude Oil 04222020

These are my hypotheticals for today’s crude oil session. Basically the levels that I will be looking at where it has a higher probabilistic chance the market will start reacting. Then I come up with ways I think the market will react around those levels. During the session I then wait for the market to hit those levels and either confirm or reject my hypothesis. I hope that makes sense. If not, please get in touch with me. I am not selling you anything. I just love to talk to people that are on the same path as me. So don’t be shy and reach out.

Observations of the market

Click here for my recent weekly trading plan

- M: Big drop. Still have more than a week to go to close off the candle to give insight.

- W: Still 3 days left in the candle before close. We made a fast second-leg move we have made previously indicating a potential exhaustion. Although the markets can go against you longer than you can stay solvent so only trade based on your trading rules.

- D: Showing a nice imbalance but extended away from VWAP very fast indicating a possible return. No Demand ZOI has been created yet so will need to wait for confirmation of that first before even considering a longer-term long position.

- H4: Big Demand ZOI 8.10 — 14.10. Last leg of the move has a more than 50% retracement so there is more buying going on.

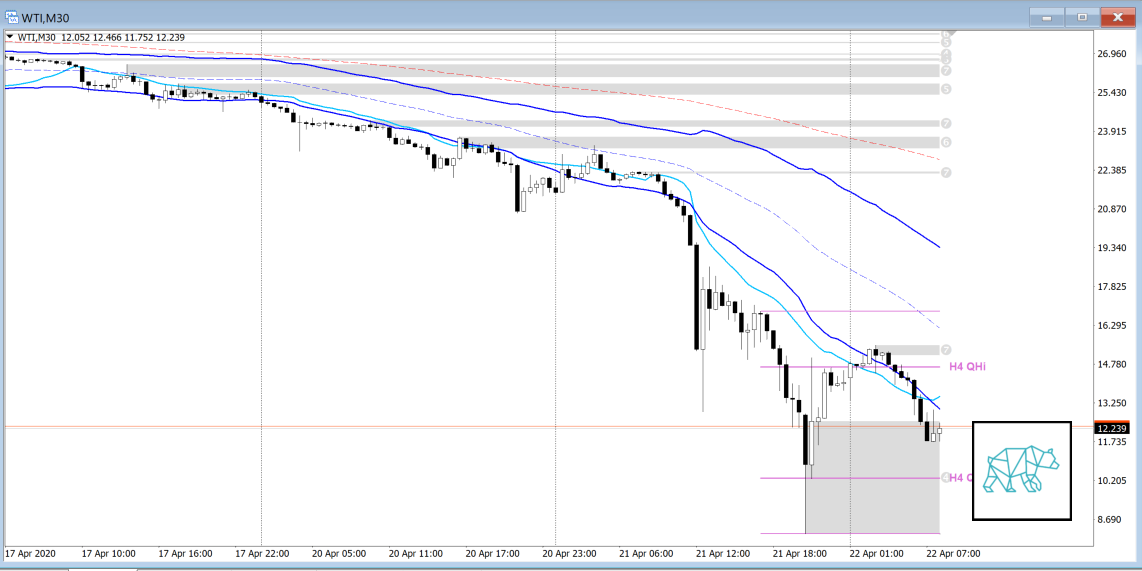

- M30: Price rejected VWAP and KC imbalance still very much in play.

- MP: Previous profile was a trend day. During the Asian session we rejected yesterday’s VAL and consequently the range as well confirming the imbalance for the moment in the market.

Hypotheticals

Hypo1:

Price Opens below PVAL and Range and we continue the extension downwards.

Entry short @ retest previous day range around 12.899, targets 12.05, 11.65, 11.05, extended targets 10.30, 8.05

Hypo2: H4 Swing Reversal, within Demand ZOI / H4 QLo. Find support above prev. Day low

Entry long around 9.05, targets 10.70, extended target 12.90

Hypo3: H4 Swing Reversal, above Demand ZOI / H4 QLo.

Entry long around 10.80, target 12.90

T3chAddict

Posted at 16:30h, 22 April!MESSAGE FROM MY BROKER!

Due to increased volatility and uncertainty in the Oil markets, [INSERT BROKER] will be increasing margin requirements for all Oil products as of Thursday 23rd April 2020 at 10:00 AM GMT.

More importantly, WTI Crude Oil has been set to Close Only, which means you will not be able to open any new positions on WTI and only have the ability to close existing trades. Note, you can still open new trades on Brent UK Crude Oil.