15 Apr Trading Plan Crude Oil 04152020

These are my hypotheticals for today’s crude oil session. Basically the levels that I will be looking at where it has a higher probabilistic chance the market will start reacting. Then I come up with ways I think the market will react around those levels. During the session I then wait for the market to hit those levels and either confirm or reject my hypothesis. I hope that makes sense. If not, please get in touch with me. I am not selling you anything. I just love to talk to people that are on the same path as me. So don’t be shy and reach out.

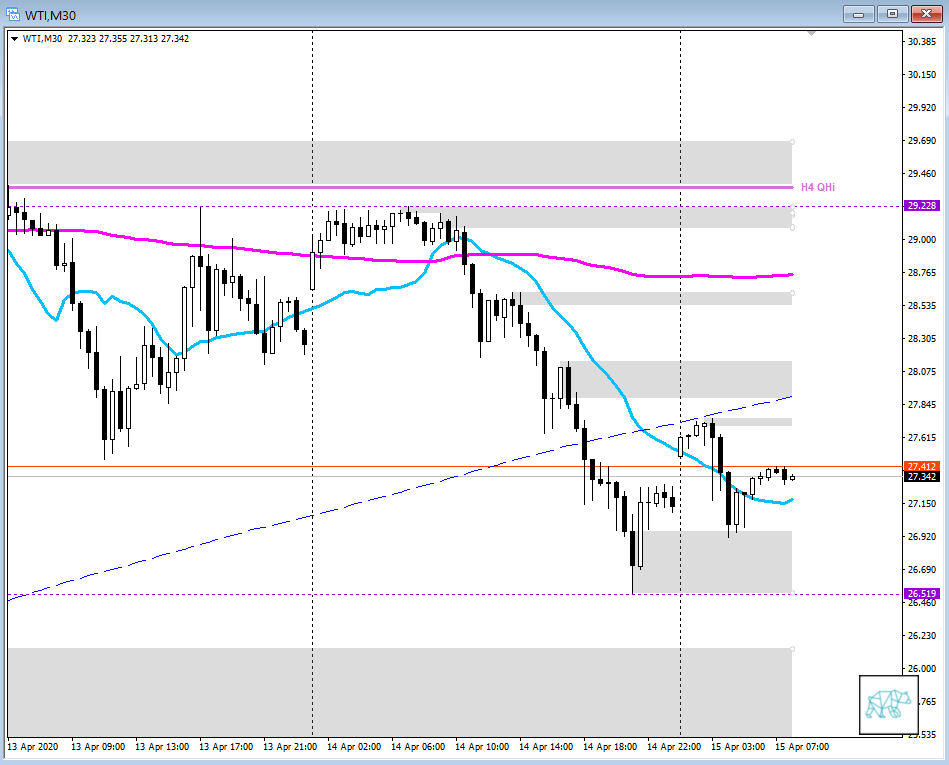

Observations of the market

- W: Overextension to the downside but no HL made yet so we could see more downside on the medium to long term

- D: D TT with price consolidating above VWAP but below LKC. If we can hold above 32.10 I would be bullish to 36.50. If not we can see a drop to 25.65, with an extended price target of 20.55.

- H4: Broke H4 Demand ZOI 27.05 but found more demand at 26.50.

- M30: Bullish engulfing created M30 Demand ZOI with consequent lack of momentum pushing back (late in the session). Today price revisited this Demand ZOI during the Asian session.

- EIA report coming out today

Hypotheticals

(Lack of clarity)

Hypo1:

M30 Swing Reversal @ M30 Supply ZOI

Entry Short around 27.50, targets 27.20, extended targets 26.90, 26.70, 26.50

Hypo2:

Range 27.10 — 27.40

Hypo3:

M30 Demand ZOI holding

Entry Long around 27.15, targets 27.40, 27.70, extended target 27.90

No Comments