These are my hypotheticals for today’s crude oil session. Basically the levels that I will be looking at where it has a higher probabilistic chance the market will start reacting. Then I come up with ways I think the market will react around those levels. During the session I then wait for the market to hit those levels and either confirm or reject my hypothesis. I hope that makes sense. If not, please get in touch with me. I am not selling you anything. I just love to talk to people that are on the same path as me. So don’t be shy and reach out. If any of the terminology isn’t common to you that’s because I made them up. I’m pleased to share them with you though. Again, don’t be shy. Get in touch.

Observations of the market

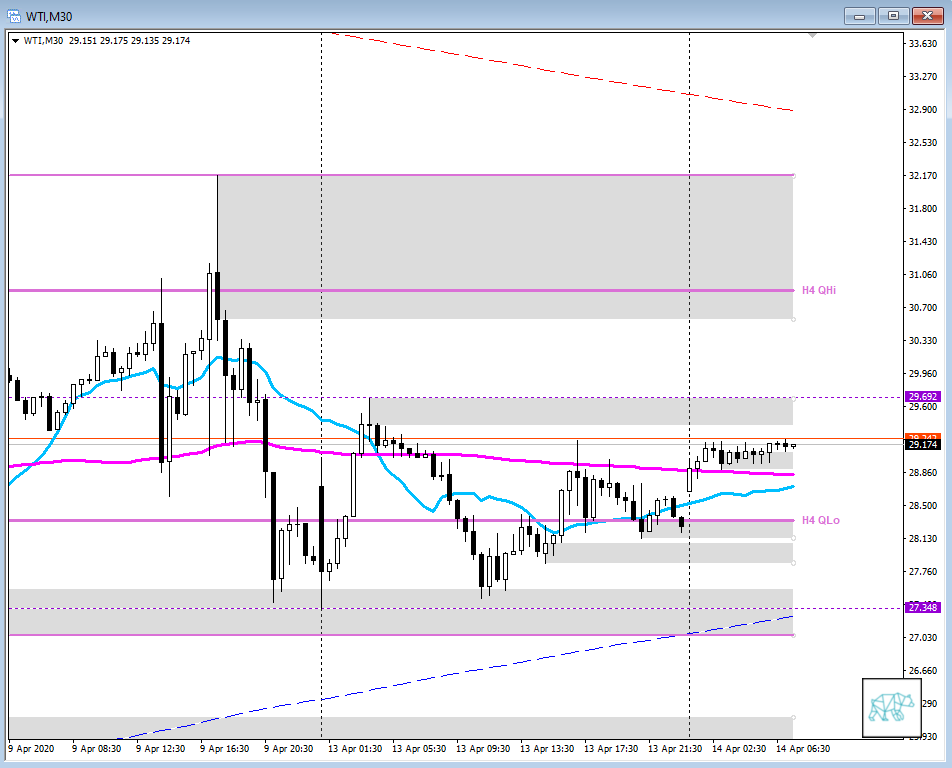

- W: Overextension to the downside but no HL made yet so we could see more downside on the medium to long term

- D: D TT with price consolidating above VWAP bu7t below LKC. I fwe can hold above 32.10 I would be bullish to 36.50. If not we can see a drop to 25.65, with an extended price target of 20.55.

- H4: H4 was in D TT and has broken out from VWAP trying to pull the market bullish but is running into the 200MA. Still looking very bullish for the short to medium term since we clearly stayed above the 50MA indicating some momentum behind the move. Furthermore VWAP is flat but price is trading around it indicating a consolidation in process.

- M30: Clearly showing a range where price has rejected support twice but no rejection of Resistance yet indicating possibility for more upside. Smaller trader price action just below UKC in line with more consolidation before a potential market move. Due to Easter holidays the EIA report will come out tomorrow instead of today so let’s wait and see if the market wants to make a move today.

Hypotheticals

(In order of what I think has a higher probability)

Hypo1:

M30 Range BO Attempt

Entry LONG if we can hold above 29.25, target 29.60

Hypo2:

M30 Range BO F — Range overextension

Entry Short around 29.40, target 29.10, 28.90, extended target 28.70

Hypo3:

Range 28.90 — 29.30