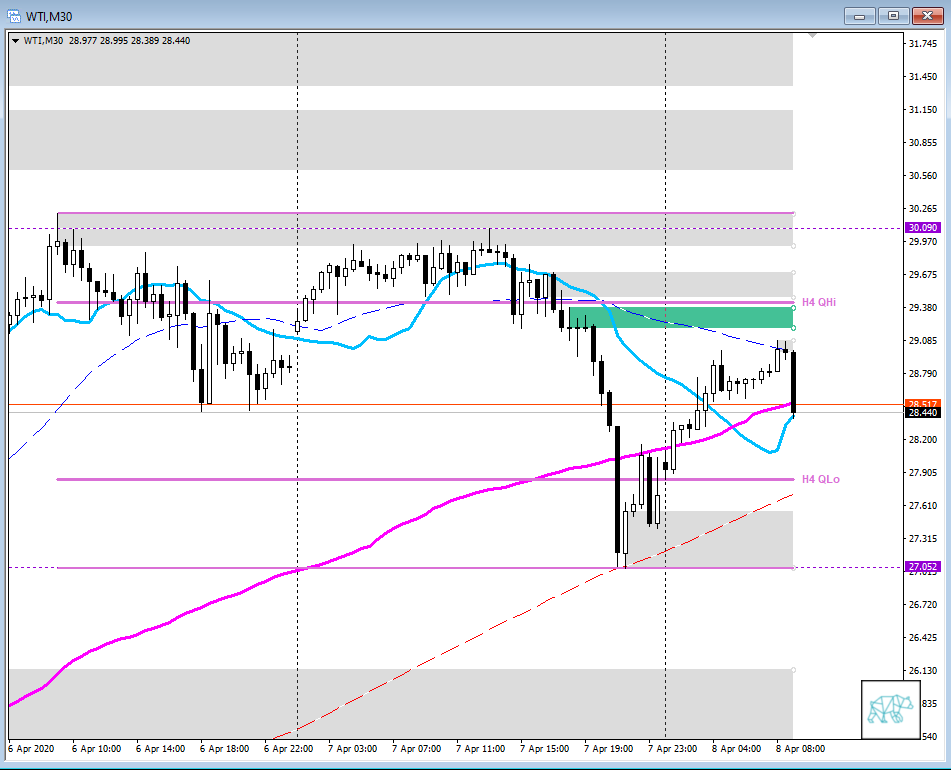

08 Apr Trading Plan Crude Oil 04082020

These are my hypotheticals for today’s crude oil session. Basically the levels that I will be looking at where it has a higher probabilistic chance the market will start reacting. Then I come up with ways I think the market will react around those levels. During the session I then wait for the market to hit those levels and either confirm or reject my hypothesis. I hope that makes sense. If not, please get in touch with me. I am not selling you anything. I just love to talk to people that are on the same path as me. So don’t be shy and reach out.

(In order of what I think has a higher probability)

Hypotheticals

- Short — M30 50MA rejection

- Price hits M30 50MA and Prev. EU session low

- Entry short around 28.80

- Targets

- 28.60

- 28.50

- Extended target 28.30

- Range bound 28.30 — 29.08

- Long — M30 H4 VWAP cross over

- Price finds support above H4 Demand ZOI nd price action confirms a M30 H$ VWAP cross over

- Entry long around 28.50

- Targets

- 28.80

- 29.05

- Extended target 29.30

- Short — M30 50MA Break Out Failure

- Price tries and break out and hits stronger (8) M30 Supply ZOI just below H4 QHi and we reverse

- Entry short around 29.10

- Targets

- 28.70

- 28.60

- Extended target 28.30

EDIT: Hypo1 played out during the Asian Session

Observations of the market

- Daily is showing a cross over VWAP and is consolidating just above VWAP hinting for a bullish sentiment on the longer term.

- Previously H4 broke over VWAP and we are trying to initiate an uptrend. Yesterday we pulled back to VWAP but broke through a little bit and then bounced back. It is because of this that I think we might see more downside.

- M30 is showing big drop down to 200MA and bounced back over H4 VWAP however M30 VWAP crossed down over H4 VWAP and with price showing divergence with the M30 VWAP indicating it might be overextended

- Price moved towards M30 50MA and might run into some sellers

Let me know what you think and get in touch.

No Comments