These are my hypotheticals for today’s SPX500 session. Basically the levels that I will be looking at where it has a higher probabilistic chance the market will start reacting. Then I come up with ways I think the market will react around those levels. During the session I then wait for the market to hit those levels and either confirm or reject my hypothesis. I hope that makes sense. If not, please get in touch with me. I am not selling you anything. I just love to talk to people that are on the same path as me. So don’t be shy and reach out.

Observations of the market

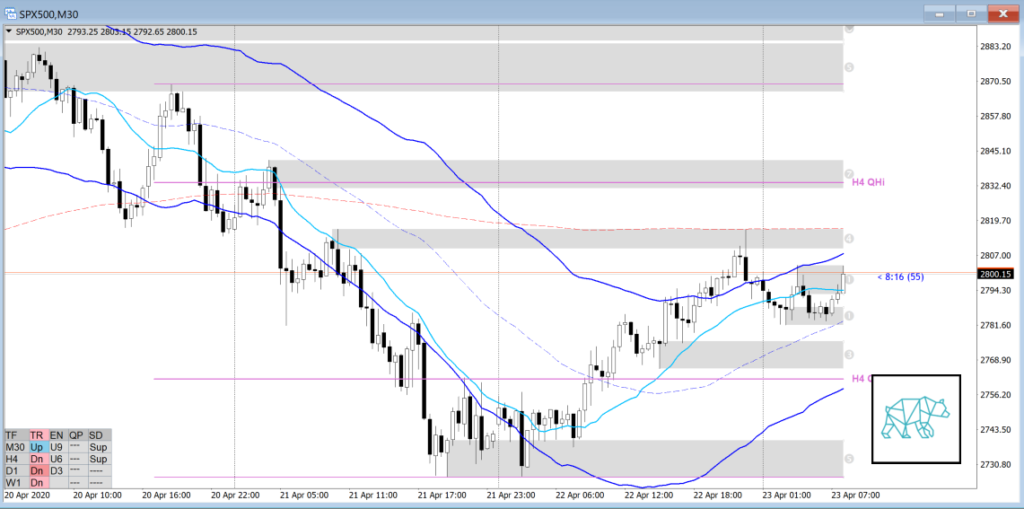

- M: Q point not active. In the process of retracing more than 50% of last month’s candle’s body but still a week left in the candle.

- W: In the middle of the Q point range. Not optimal trading location. Pullback to VWAP after already testing it last week. This week we closed near last week’s candle high and have tested VWAP again.

- D: Q points greyed out. Price rejected 50MA once and then made a HL just below.

- H4: In the middle of Q points range. Not optimal trading location. Price is consolidating below VWAP but no finisher yet.

- M30: Retest of previous Supply ZOI (4) during yesterday’s session.

- Market Profile: Currently above PVAH and range. Still within day’s range.

Hypothetical

Hypo1: H4 Swing Reversal below H4 QHi, Yesterday high’s rejection.

Entry Short around 2806. Targets 2798, 2785, extended target 2771

Hypo2: VA acceptance

Entry short around 2778. Targets 2772, 2766, extended target 2757

Hypo3: Range 2781 — 2816