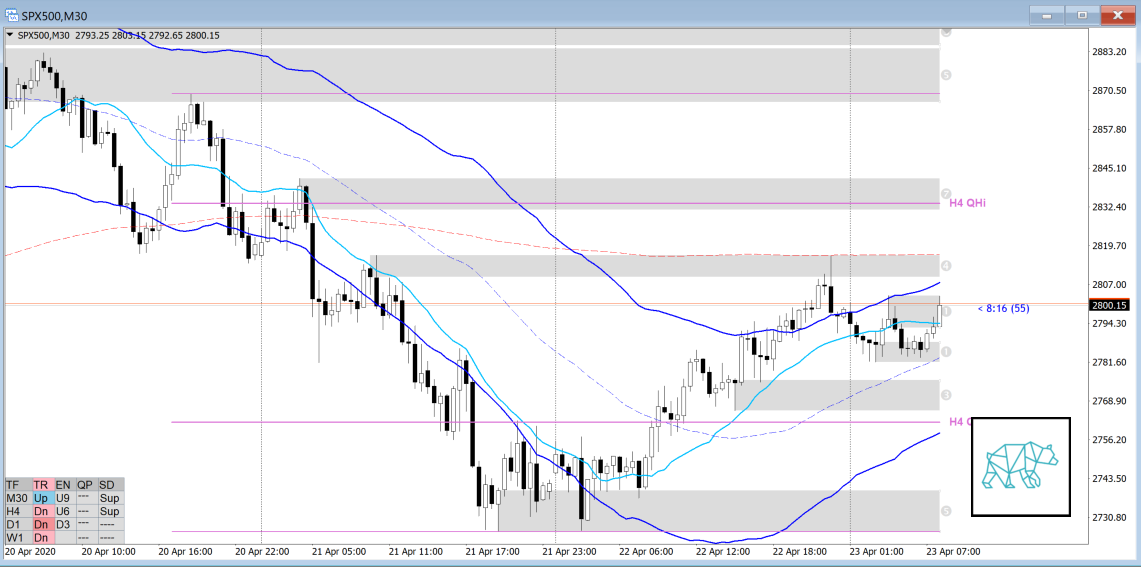

23 Apr Trading Plan 04232020 SPX500

These are my hypotheticals for today’s SPX500 session. Basically the levels that I will be looking at where it has a higher probabilistic chance the market will start reacting. Then I come up with ways I think the market will react around those levels. During the session I then wait for the market to hit those levels and either confirm or reject my hypothesis. I hope that makes sense. If not, please get in touch with me. I am not selling you anything. I just love to talk to people that are on the same path as me. So don’t be shy and reach out.

Observations of the market

- M: Q point not active. In the process of retracing more than 50% of last month’s candle’s body but still a week left in the candle.

- W: In the middle of the Q point range. Not optimal trading location. Pullback to VWAP after already testing it last week. This week we closed near last week’s candle high and have tested VWAP again.

- D: Q points greyed out. Price rejected 50MA once and then made a HL just below.

- H4: In the middle of Q points range. Not optimal trading location. Price is consolidating below VWAP but no finisher yet.

- M30: Retest of previous Supply ZOI (4) during yesterday’s session.

- Market Profile: Currently above PVAH and range. Still within day’s range.

Hypothetical

Hypo1: H4 Swing Reversal below H4 QHi, Yesterday high’s rejection.

Entry Short around 2806. Targets 2798, 2785, extended target 2771

Hypo2: VA acceptance

Entry short around 2778. Targets 2772, 2766, extended target 2757

Hypo3: Range 2781 — 2816

T3chAddict

Posted at 15:59h, 23 AprilEvening star before London open and consequent drop to rev. range high. Hypo2 possibly in play. Let’s see when IB is over we can accept into PVA to go short.

T3chAddict

Posted at 17:20h, 23 AprilNear Bullish Engulfing after hitting yesterday range high. Not too convincingly. Trading around DPOC. Possible Hypo3 in play.