22 Sep Trading Day Summary 20210922

Summary: Execute your plan and let risk parameters take over

#DAX #DE30 #XAUUSD #fintwit #orderflow #daytrading #dailyreportcard #tradinglifestyle #daytraderlife #tradingforex

A small summary of how I did during the session. Things I did well. Things I need to keep working on. Trade Reviews are part of my post-mortem.

My weekly goals:

- Trading rules

- Use SL scaling in case the profit target for the setup doesn’t provide 2R for example for FA or VAA setups

- No early exits, either hit SL or 2R target

Good Pre-market routines

Good Session PECS

Good Trade selection

Good Trade sizing or SL placement

Good Trade Execution & Mgmt.

Good Risk Adjusted Returns

Yes Clarity — in tune with price

Muppet Meter (1 being best — 5 being worst): 1

Notes

Gold

- Price extended below in C hitting H4 demand before forming an inside bar to a slight RBR testing IB low before continuing down.

- A late-sustained auction entry could’ve been played here but I don’t like to trade right into H4 demand as well asn the large LTF demand at VAH not providing with good 2R profit target. ALthough with trend being down the expectation is that both of these will get taken out at some point.

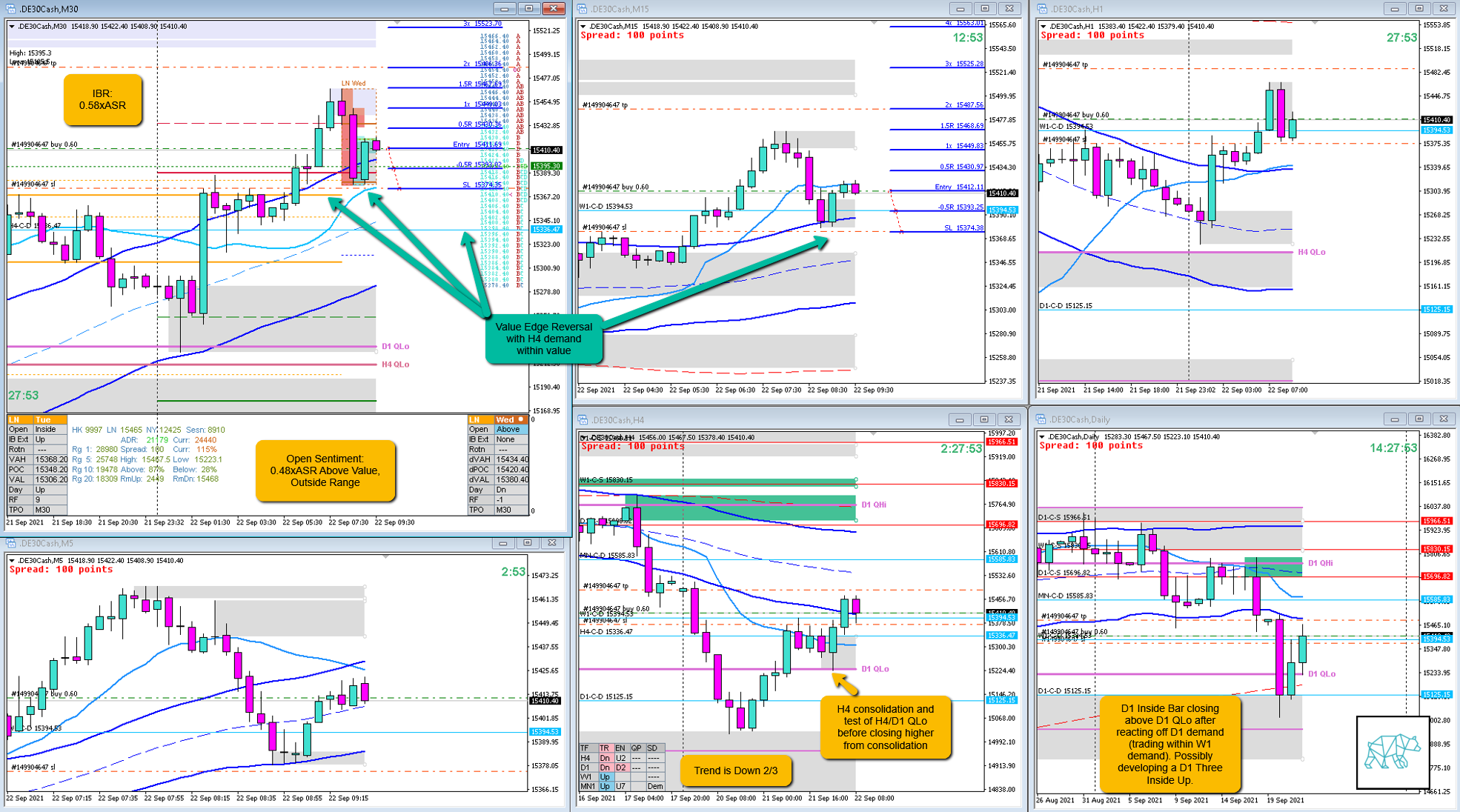

DAX

- IB traversed down 0.58xASR. C formed a Bullish Inside Bar. Waited for a slight pullback to newly formed M15 Bull Engulf to go long so that my standard size SL could be placed below IB

- Long 15412.11, SL 15374.38, TP 15487.56 (2R)

- Price has failed to extend IB

- Price hit the 2R target

Summary of the Trading Day

- Result

- 2R

- Product

- DAX

- Open Sentiment

- 0.48xASR Above Value, Outside Range

- IBR

- 0.58xASR

- Hypo

- 1

- Attempted Setup

- Value Edge Reversal

- Entry Technique

- M30 Bullish Inside Bar / M15 Bull Engulf combination. Waited for a slight pullback to M15 c‑dem before entering long.

- TPO period for Entry

- D TPO

- Trade Duration

- 4:34:47

- Long/Short

- Long

- Trade Comments

- D1 Inside Bar closing above D1 QLo after reacting off D1 demand (trading within W1 demand). Possibly developing a D1 Three Inside Up. H4 consolidation and test of H4/D1 QLo before closing higher from consolidation. Upward bias in equities. Open above sentiment with a reversal near value edge.

Actual Development

Expectation of a M30 Bullish Inside Bar is to form a Three Inside Up which it did although failing to extend above IB. The remainder of the session traded within IBR and there was no extension during the ‘normal’ trading window but price consolidated at the top half of the IBR. Price finally extended during L TPO and hit target during M TPO in line with a possible H4 RBR.

Good points

- Summarizing the potential narrative going against the Downtrend 2/3

- Summarizing the possibility for the development of a H4 base before a potential continuation up as price had not extended within the first 2 hours (ie lack of momentum behind the move)

- Slight pullback entry to newly formed M15 Bull Engulf to get a better entry as well as SL placement

- Going against H1 price action and letting M15/M30 guide the narrative

Bad Points

- Price didn’t actually reach VAH but instead used yesterday’s session high as a turning point. I will monitor this under my forward-testing category.

Next Day Review

- Time-based stop

- 0.6R

- Overlap Noise stop

- 0.9R

- End of Day Stop (end of NY session)

- 2.4R

- Highest R target

- 3.8R

For my trade plan(s) on this particular day, go here:

No Comments