#fintwit #orderflow #daytrading #tradingreview #GBPNZD #GOLD

I have already reviewed these trades but I like to go back and review them again. Hence this new format I am introducing into my process.

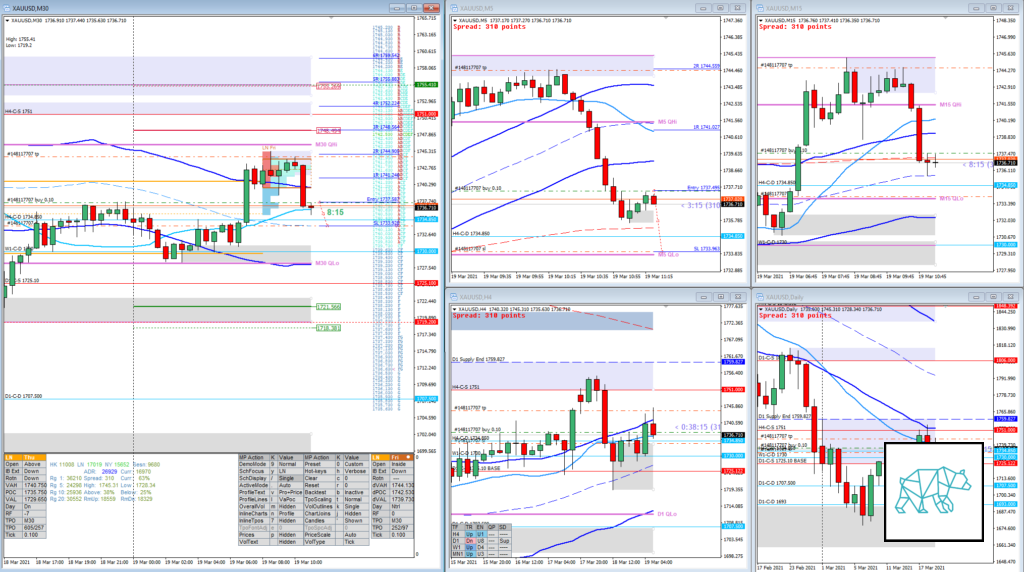

How was the Entry, SL placement and sizing?

The open was within balance then proceeded to consolidate and tried rejecting value but there was no IB extension. There was a nearby M30 QHi and ADR 0.5 high that could have been the first opportunity for a value rejection failure / balancing market play. I had placed a sell limit order which didn’t get triggered as price moved away. Could have gone in on the close.

Later on at the next DTTZ there was a M5 reversal that transitioned into a M15 hammer. Although a weak pattern I went long. SL placement was correct as it was determined on the standard SL distance.

Price then closed as a M15 Bull Engulf but then proceeded to take out LTF demand at which point I got out at a ‑0.5R loss.

Odds enhancer: potential buying tail in the making

How was the profit target?

Profit target was okay. There were no supplies to 2R although it would mean the auction to fail and retrace all the way back to IB high.

How was the Exit?

Based of time of day and LTF entry I decided what I did not want to see and if I did I would act. Which I did. After seeing a M15 bull engulf I did not want to see the demand get taken out. I believe I did well.

What would a time-based exit have done for the trade?

Time-based this trade would have netted a ‑0.2R loss. Overlap noise close a mere 0.3R profit.

What could I have done better?

I believe it was premature to have taken this trade. I should have waited for a stronger buy signal before entering. In hindsight this strong buy signal did not really come to be honest. Although a consolidation on M15 at H4 demand with the right time of day could have warranted an entry. This time the move happened outside of my trading window but it was good to have observed.

Observations

Consolidations at a good trading location at the right time of day can warrant an entry based on that premise. There is no need to wait for a good price action close in the trading direction.

Premarket prep on the day

Daily Report Card on the day