27 Mar Trade Review GBPNZD 20210319

#fintwit #orderflow #daytrading #tradingreview #GBPNZD #GOLD

I have already reviewed these trades but I like to go back and review them again. Hence this new format I am introducing into my process.

How was the Entry, SL placement and sizing?

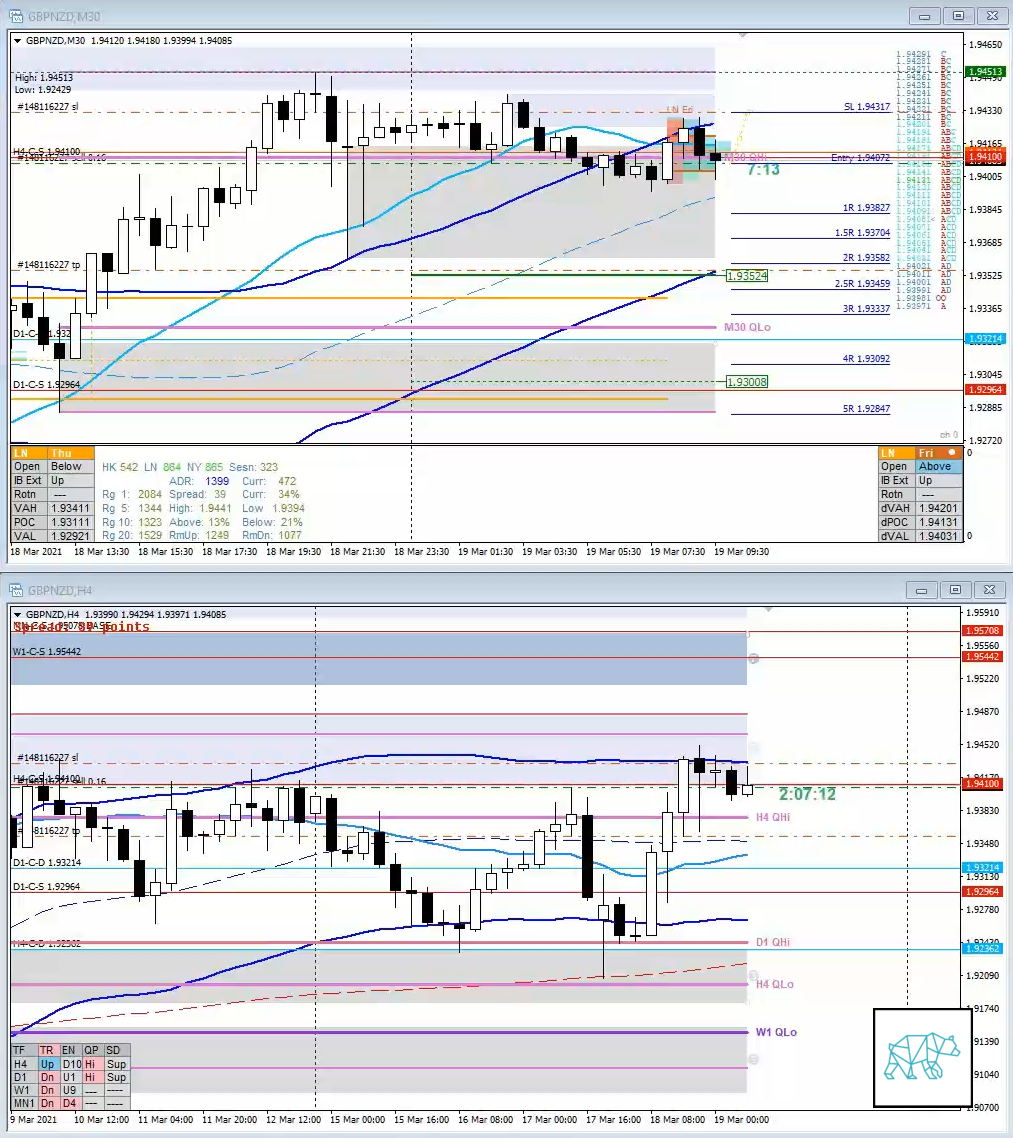

There was a moderate to large imbalance at the open but then price moved higher and met mean reversion criteria. Consequently extended above IB 1 TPO before closing as Bear Engulf in C TPO (although not closing beneath M30 QHi) failing auction. H4 DBD at H4 supply I decided for it to warrant a short.

SL placement was good as it was above the formation. Sizing was good too.

Odds enhancer: M30 VWAP flat after an uptrend

How was the profit target?

2.5R to value edge. With no H4 demand in the way although lots of LTF demand although due to no H4 demand we could have been looking at a low/medium initiative activity day.

How was the Exit?

I decided to not give into my inner grasshopper even though a M15 Bull Engulf was formed (on the hour). Then during E price moved higher and took out my SL for ‑1R loss. Good thing I stayed with the trade still as I was trying to battle my inner-grasshopper.

What would a time-based exit have done for the trade?

SL was hit.

What could I have done better?

I could have theorized that the extension above IB indicated for more upside and should have waited for more confluence in terms of a selling tail on the profile. Although with the information presented I was thinking it wasn’t the worst of opportunities. Certainly not the best either.

With the initial extension above IB, and no selling tail, I could have waited for more upside before warranting a short at the next DTTZ.

Observations

The IB range extension indicates that there are buyers present and thus we need more confluence before taking the other side. This can come through a potential TPO structure created or a selling tail.

Premarket prep on the day

Daily Report Card on the day

No Comments