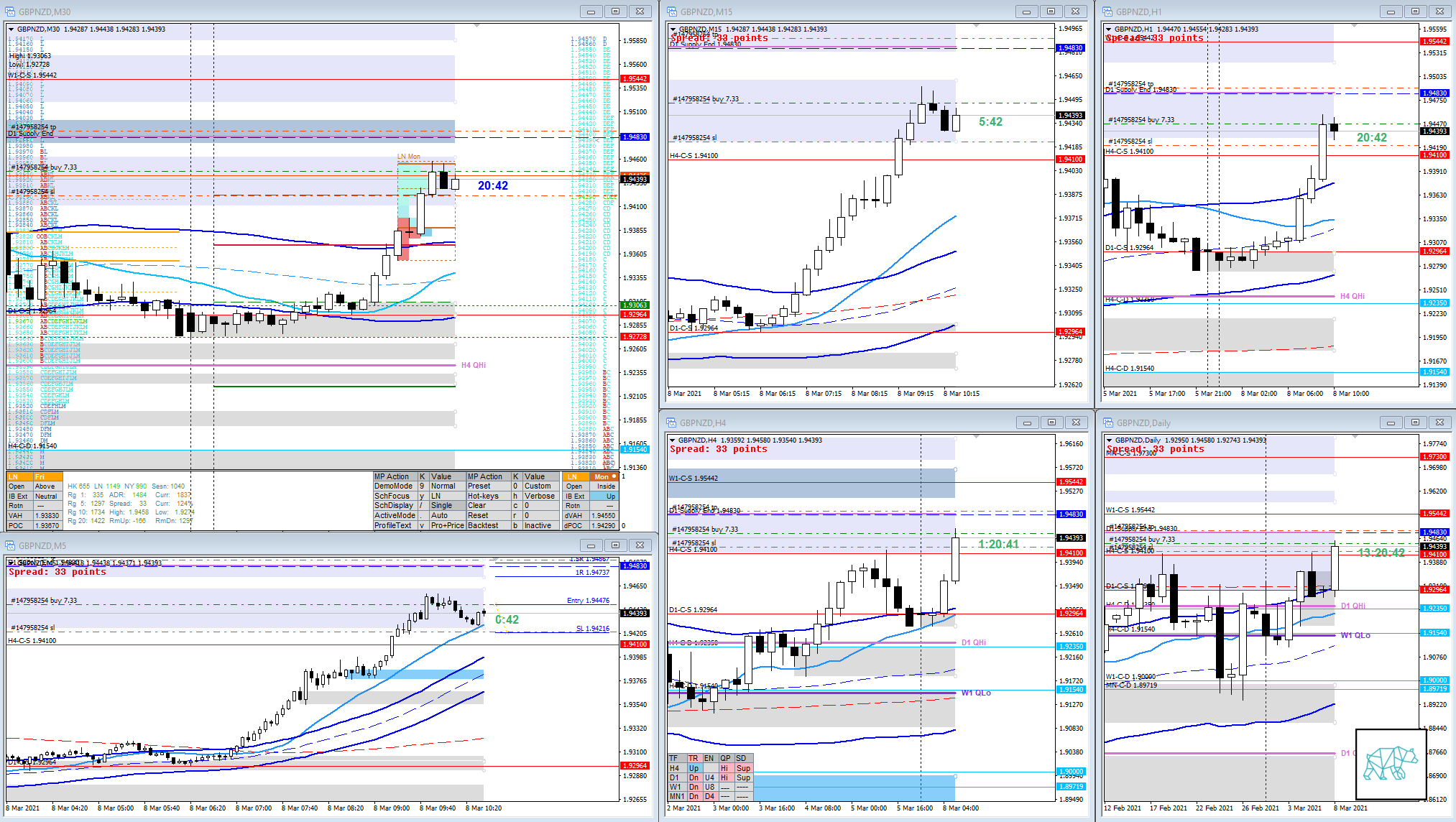

20 Mar Trade Review GBPNZD 20210308

#fintwit #orderflow #daytrading #tradingreview #GBPNZD

How was the Entry, SL placement and sizing?

On the day price opened within value with a larger timeframe bullish sentiment. Price extended above VAH but closed as a Gravestone Doji (which in my experience is neutral like hammers the often see a continuation then a reversal. C TPO proceeded to extend above IB rejecting value in a sustained move. My entry was based on a (experiemental) late-sustained entry setup that I had observed before based on a M5 Bull Engulf at VWAP in UT. Difference this time was that it did not coincide with a test of IB edge. Regardless I went long to test my thesis and got stopped out. SL placement was based off entry and a hold below would have negated my thesis anyway so I believe SL placement was good. Another bad point was that M30 had printed a bearish inside bar, as well as M15 Three Inside Down. Both not good signs of a continuation at this level. Sizing was good.

Quite quickly after the first trade price started consolidating and had left a weak selling tail in D plus a weak bear engulf during G TPO. G had started taking out some single prints and I went short. SL placement was not good as it was cutting through the formation although I was expecting a quick move to IB edge. Price reversed and moved higher taking out SL.

Odds enhancer: ADR exhaustion indicating a possible continuation to the move due to trading during the London session.

How was the Exit?

SL got hit on both trades.

Single Print Fade Exit

What would a time-based exit have done for the trade?

Both trades that I was in were not good. The trade I “should have” been in was the extension in C coinciding with a momentum move as well as a value rejection. This would have netted about 1.5R time-based. Although a 2R target could have been hit prior to that otherwise LTF price action could have warranted an exit. This trade would have been risky due to ADR 0.5 high at VAH and the tendency for a balancing market due to open within value (at the time I was looking for a potential value rejection failure and was looking for a potential short. Having said all this I am getting better at recognizing the market conditions for a value rejection.

What could I have done better?

I should not have taken the late-sustained auction entry as there was less confluence + M30/M15 already printing a reversal (even though this got taken out again later in the session but hindsight is 20/20. We trade what we see in the moment and I ‘missed’ or did not give enough weight to this price action). Same for the single print fade as ADR had been exhausted and M30 consolidation had a weak bear engulf attempt of a break down. As well as structure that was created was very wide in value.

Don’t take experimental setups until after having statistically proven its edge.

Observations

With neutral price action from within value, price can still reject value through an IB extension. Especially when coinciding with a momentum move.

Premarket prep on the day

Daily Report Card on the day

No Comments