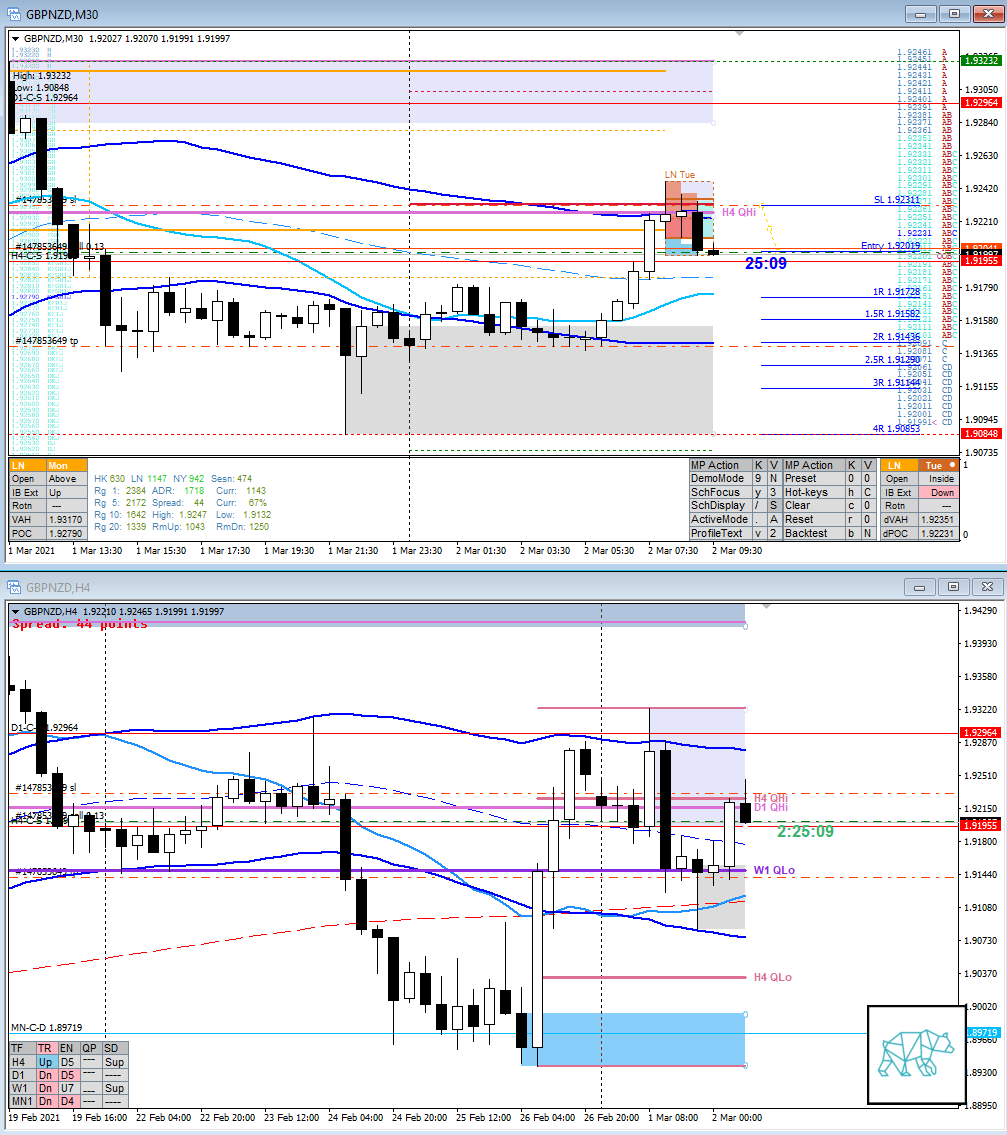

20 Mar Reviewing Day GBPNZD 20210302

#fintwit #orderflow #daytrading #tradingreview

Exit

How was the Entry, SL placement and sizing?

There was an open within value where IB traded from within at VAL at H4 QHi. C then proceeded to close below VAL through Bear Engulf coinciding with an IB extension down. Entry was good as it was taken after the confirmation of value rejection through aforementioned points. SL placement due to the momentum nature of the trade was good as well even though it cut through the formation.

Odds enhancer: Price was trading at M30 UKC in R with VWAP flat

How was the Exit?

I took profits prematurely and pocketed 0.6R. At the time I justified it by it being early in the month and wanting to have a little buffer.

During G price started faltering at H4 c‑dem on M15 and M30 closed as a Bull Engulf. An exit here would have netted 2R. Although my usual take profit is 2R so that would have taken me out anyway.

What would a time-based exit have done for the trade?

A time-based stop would have netted slightly over 1R.

What could I have done better?

Obviously here if I had chosen to wait for a price action exit rule I would have netted more.

Observations

A reversal came during G TPO in the form of a bull engulf. At the time there was some structure of 3 TPOs and single prints in D left behind (which did not get taken out even later in the session).

Premarket prep on the day

Daily Report Card on the day

No Comments