#premarketprep #tradingforex #forex #WTI #BLACKGOLD #CRUDEOIL #CRUDE #CRUDEOILISSLIPPERY #daytrading #tradinglifestyle #daytraderlife

This is my premarket prep for today’s European session for WTI crude oil. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias.

Non-conjecture observations of the market

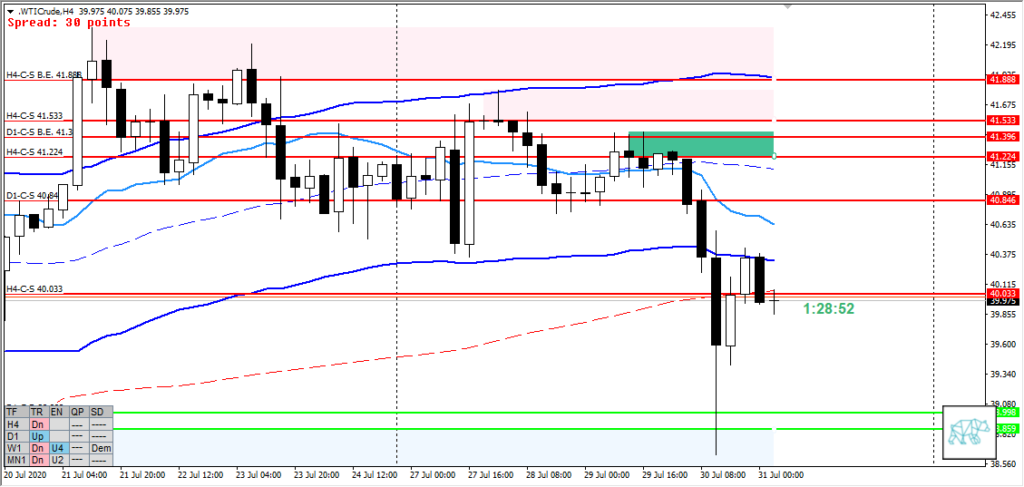

- D1 Bear Engulf forming D1-C‑S 40.846 and move down to demand D1-C‑D 39.998 currently trading below yesterday’s body

- New H4 Supply formed after some consolidation with a drop away from H4-C‑S 41.224 down to D1 and H4 demand proving reactive thus consequent move away

- New H4 Bear Engulf formed with H4-C‑S 40.033

- Market Profile

- Price below VA and range

Compared against Weekly Trading Plan

- W1 demand not taken out yet

Sentiment — Slightly Bearish

ZOIs for Possible Shorts

- D1-C‑S B.E 41.396

- H4-C‑S B.E. 41.888

- H4-C‑S 41.533

- D1-C‑S 40.846

- H4-C‑S 40.033

ZOIs for Possible Long

- D1-C‑D 39.998

- H4-C‑D 38.859

Mindful Trading

- I slept okay last night.

Focus Points for trading development

- Weekly Goal

- Have correct SL placement and position sizing

- Risk Management

- 3 allowed products

- Crude

- GBPNZD

- DAX

- 2 active opened positions — not on the same product

- 2% daily loss limit

- 3 trades allowed if ‘in the zone’

- Only trade off M30 candles or momentum plays

- After 4 losing trades in a week reduce TP to 1.5R but after 1R can consider taking profits

- 2 consecutive days of lack of sleep = NO TRADING

- 3 allowed products