#premarketprep #tradingforex #forex #WTI #BLACKGOLD #CRUDEOIL #CRUDE #CRUDEOILISSLIPPERY #daytrading #tradinglifestyle #daytraderlife

This is my premarket prep for today’s European session for WTI crude oil. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias.

Non-conjecture observations of the market

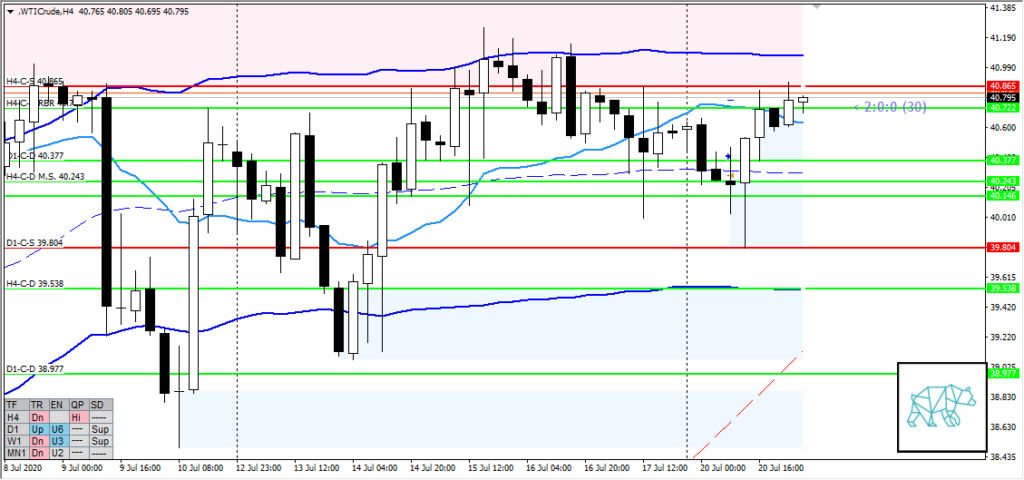

- Big rejection of underlying demand followed by a move up giving H4-C‑D M.S. 40.243 surpassing D1-C‑D 40.377 and making a H4-C‑D RBR 40.722 (thus new demand) testing overhead longtime supply of H4-C‑S 40.865

- Market Profile

- Price trading currently 30–50 ticks above VAH but still hasn’t reached ADR 0.5 (which would coincide with H4 UKC in a range)

Compared against Weekly Trading Plan

- D1 and W1 consolidation continue

Sentiment — Slightly Bullish

ZOIs for Possible Shorts

- H4-C‑S 40.865 (weaker)

- H4-C‑S B.E. 40.692

ZOIs for Possible Long

- H4-C‑D RBR 40.722

- D1-C‑D 40.377

- H4-C‑D M.S. 40.243

Mindful Trading

- Slept good. No nap.

Focus Points for trading development

- Weekly Goal

- Correct position sizing

- Have correct SL placement

- Due to summer time I will focus on trading off newly formed SD ZOIs for intraday plays. Keeping in mind that due to lack of liquidity 2nd chance entries can give better R/R using the M30/M15 rule.

- Risk Management

- Only take 2 trades a day but only have 1 active trade on between the assets

- Only trade off M30 candles

- Trading Priority

- FX pair outside value

- FX pair inside > Gold

- 2+R profit during LN consider trading PNYC

- After 4 losing trades reduce TP to 1.5R but after 1R can consider taking profits

- 2 consecutive days of lack of sleep = NO TRADING