17 Jul Premarket Prep WTI 07172020

#premarketprep #tradingforex #forex #WTI #BLACKGOLD #CRUDEOIL #CRUDE #CRUDEOILISSLIPPERY #daytrading #tradinglifestyle #daytraderlife

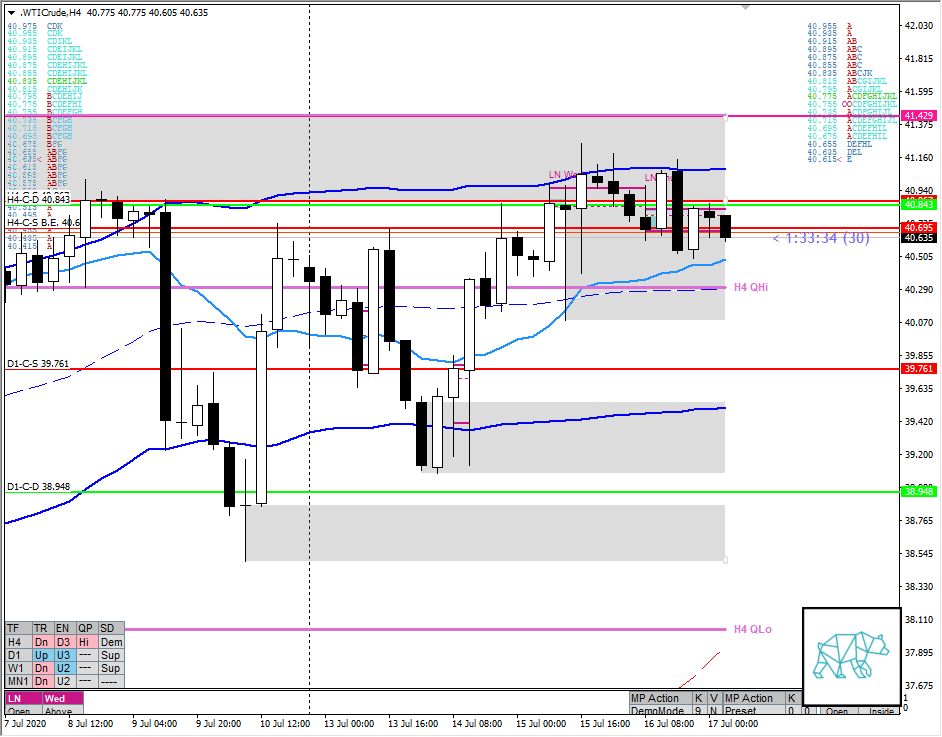

This is my premarket prep for today’s European session for WTI crude oil. Decided to make the switch back to crude since that is something I am more familiar with than Gold.

Non-conjecture observations of the market

- MN trading back inside KC

- W1 crossed over VWAP trying to re-enter KC however still consolidating within supply

- 2 weeks back a W1 bull engulf

- Daily extended tight range trading below 41.429, D1 Supply D1-C‑S 39.761 and demand D1-C‑D 38.948

- D1 Price trading above UKC and VWAP (although VWAP got touched a few times)

- Existing H4 supply H4-C‑S 40.867 with consolidation and new Bear Engulf H4-C‑S B.E. 40.695

- Currently trading within H4 demand with H4-C‑D 40.843 above VWAP

- Currently trading within H4 QHi

- Market Profile

- 2 day bracketing

- Currently trading within value

Sentiment — Neutral

ZOIs for Possible Shorts

- D1-C‑S 39.761

- H4-C‑S 40.867

- H4-C‑S B.E. 40.695

ZOIs for Possible Long

- D1-C‑D 38.948

- H4-C‑D 40.843

Mindful Trading

- Slept okay. Took a nap midday..

Focus Points for trading development

- Weekly Goal

- Correct position sizing

- Trades priority: 1) let market profile guide 2) M30 confirmation (watch out for ‘Billy No Mates’)

- Risk Management

- Only take 2 trades a day but only have 1 active trade on between the assets

- Only trade off M30 candles

- Trading Priority

- FX pair outside value

- FX pair inside > Gold

- 2+R profit during LN consider trading PNYC

- After 4 losing trades reduce TP to 1.5R but after 1R can consider taking profits

No Comments