#premarketprep #tradingforex #forex #XAUUSD #GOLD #daytrading #tradinglifestyle #daytraderlife

This is my premarket prep for today’s European session for Gold XAUUSD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias.

Non-conjecture observations of the market

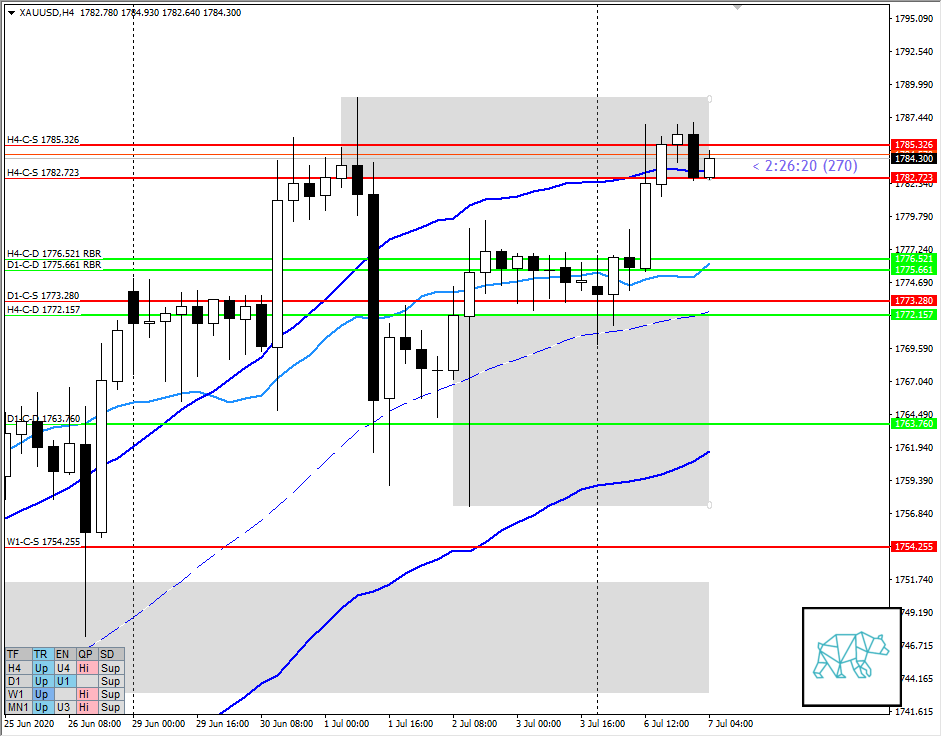

- D1-C‑D 1775.661 RBR formed however still trading within Demand

- Traded above H4-C‑S 1782.723 but then formed a H4 Bear Engulf (outside RTH with H4-C‑S 1785.326) testing the conterminous. However no rejection (yet) and might be consolidating

- Market Profile

- Market has been balancing for a little while now

- Would have to reassess at open if the market opened far enough away from previous value. For now, we are extended away however still within overall bracketing range.

- Price currently above value + previous day range

Compared against Weekly Trading Plan

- D1 still above UKC and VWAP

- Within last week’s range

Sentiment — Slightly Bullish

ZOIs for Possible Shorts

- H4-C‑S 1785.326

- H4-C‑S 1782.723

ZOIs for Possible Long

- H4-C‑D 1776.521 RBR

- D1-C‑D 1775.661 RBR

- H4-C‑D 1772.157

Focus Points for trading development

- Weekly Goal

- Correct position sizing

- Trades priority: 1) let market profile guide 2) M30 confirmation (watch out for ‘Billy No Mates’)

- Risk Management

- Only take 2 trades a day but only have 1 active trade on between the assets

- Only trade off M30 candles

- Trading Priority

- FX pair outside value

- FX pair inside > Gold

- 2+R profit during LN consider trading PNYC

- After 4 losing trades reduce TP to 1.5R but after 1R can consider taking profits