This is my premarket prep for today’s European session for Gold XAUUSD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias.

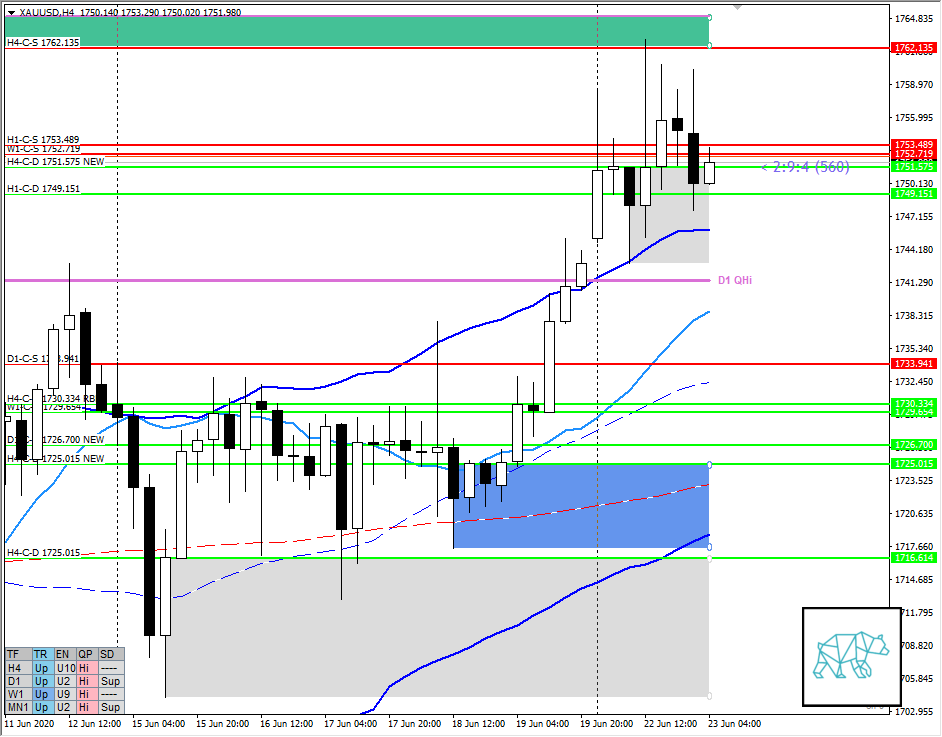

Non-conjecture observations of the market

- The day traded slightly up and is still below D1 UKC within Supply ZOI

- H4 bull engulf yesterday (forming new H4 demand H4-C‑D 1751.575 NEW) with a very long selling wick rejecting H4-C‑S 1762.135 and consequently traded slightly higher remaining above UKC

- M30 Q points established after NY took it up and retraced

- Newly formed H1 supply and demand with H1-C‑S 1753.489 and H1-C‑D 1749.151

- Market Profile

- Value is in uptrend and currently price is trading above value edge but will need to reassess at open

Compared against Weekly Trading Plan

- Still trading around W1-C‑S 1752

- Still within D1 QHi

Sentiment — Slightly Bullish

ZOIs for Possible Shorts

- W1-C‑S 1752

- H1-C‑S 1753.489

ZOIs for Possible Long

- H4-C‑D 1751.575 NEW

- H1-C‑D 1749.151

Focus Points for trading development

- Risk Management

- Only take 2 trades a day but only have 1 active trade on between the assets

- After 4 losing trades reduce TP to 1.5R but after 1R can consider taking profits