#fintwit #orderflow #daytrading #premarketprep #XAUUSD #GOLD #Forextrader #forex #FX #Forexlifestyle #daytrade #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife

This is my premarket prep for today’s European session for GOLD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Weekly Focus Points

- Min. 3 times hitting the gym + mandatory cardio

- Only trade the main account

- Be mindful of DTTZs

- Only price-action based exit rules (or if hit time stop comes earlier)

- M15/M30 entries and exits at 1st DTTZ, M5 entries and exits at 2nd DTTZ

Compared against Weekly Trading Plan

- Trading above last week’s Dragonfly Doji and W1 demand

Non-conjecture observations of the market

- Price action

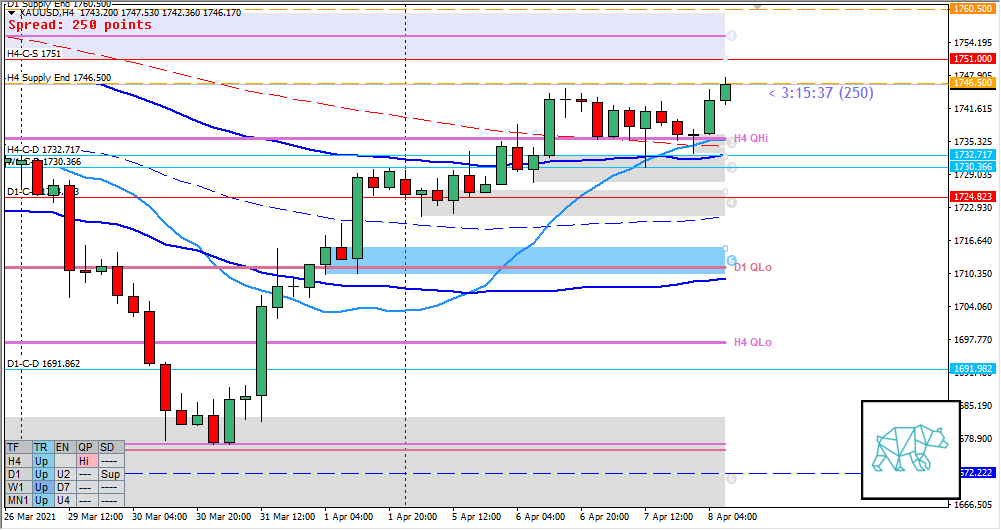

- D1 RBR after rejecting D1 QLo with yesterday forming an Inside Bar with a buying wick — still trading within D1 supply (about 1xADR to go to take out said supply)

- Possible H4 Phase 1 or 3 testing off H4 VWAP in UT trading within H4 QHi (possibly less valuable as D1 QLo has been rejected). Consistent H4 demands in UT being made

- H4 Supply End 1746.500 (round number) still intact

- Trend: H4 up, D1 down, W1 up

- Prevailing trend: Mixed Trend

- Market Profile

- Values still in UT although strength has died off a bit as yesterday’s value is right on top of the previous one.

- Daily Range

- ADR: 21681

- ASR: 11993

- 300

- Day

- Yesterday’s High 1743.780

- Yesterday’s Low 1730.530

Sentiment

- Locations

- H4-C‑S 1742.491 above VAH within M30 QHi

- H4-C‑D 1732.717 below VAL right above M30 QLo

- Sentiment

- LN open

- Above Value, Outside Range

- Open distance to value

- 0.3xASR

- Premarket

- H4 Morning Star with IB taking out H4 supply. In line with possible D1 RBR.

- Trend just turned all to UP

- Narrative

- Moderate Imbalance even though slightly above range. Possible D1 RBR and H4 supply taken out after forming a Morning Star.

- LN open

- Clarity (1–5, 5 being best)

- 4

- Hypo 1 — Trend Continuation

- Narrative: Possible D1 RBR, H4 supply taken out

- Preferred: Strong Bullish Price Action, IB extension up with sustained auction

- Con: H4-C‑S 1751 right above

- Hypo 2 — H4 Swing Reversal

- Narrative: H4 supply overhead, Trading within D1 supply, possible D1 consolidation

- Preferred: IB extension up with price action reversal at H4 supply, perhaps a failed auction or TPO structure build and or single print fade

- Con: Possible D1 RBR

- Hypo 3 — Value Acceptance

- Narrative: D1 supply

- Preferred: No IB extension up, early acceptance and follow-through

- Con: IB not the widest, LTF demand at VAL, H4 C‑dem at VAL

Additional notes

- Capital preservation rule in effect

ZOIs for Possible Shorts

- H4-C‑S 1751

ZOIs for Possible Long

- H4-C‑D 1732.717

Mindful Trading

- Feeling okay

Focus Points for trading development

- Monthly Goals

- Continue tracking my DRC tracking sheet

- Focus on my own progress and less on others

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym

- Trading Rules

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING