18 Feb Premarket Prep Gold 20210218

#fintwit #orderflow #daytrading #premarketprep #XAUUSD #GOLD #Forextrader #forex #FX #Forexlifestyle #daytrade #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife

This is my premarket prep for today’s European session for GOLD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Weekly Focus Points

- Only take trades according to a hypo unless there are multiple conditions met

Compared against Weekly Trading Plan

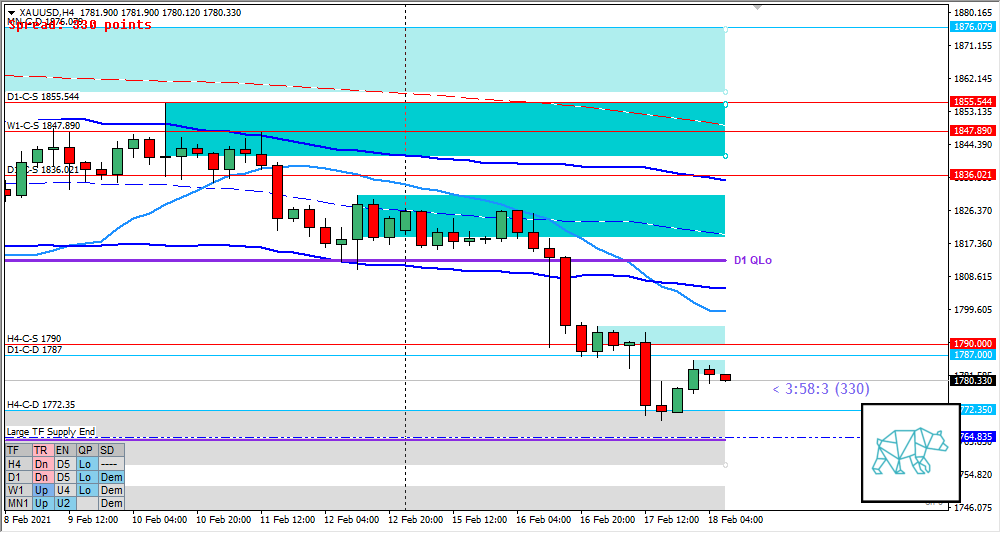

- Price is trading within W1 demand at W1 QLo / W1 50MA in UT (tested 4 times) in a squeeze with W1 VWAP

- Finally broke below W1 50MA and is trading below possibly forming a W1 DBD a the end of the week (although no close yet of course)

- Trading within W1 QLo, W1 swing still intact as well as MN demand. A take out of 1764.835 would take both out.

Non-conjecture observations of the market

- Price action

- D1 trading closing lower into D1-C‑D 1787

- Some H4 supply created at H4-C‑S 1790 through consolidation with a break down to old demand at H4-C‑D 1772.35 followed by a bull engulf at said level and some follow-through higher.

- Premarket: Price closed as a H4 Inside Bar with slightly longer buying wick.

- Trend

- Trend: H4 Down, D1 down, W1 up

- Market Profile

- 3 day bracket with yesterday fairly wide

- ADR: 25540

- ASR: 18938

- 475

- Day

- Yesterday’s High 1795.080

- Yesterday’s Low 1769.650

Sentiment

- Locations

- Sentiment

- LN open

- Below Value, Within Range

- Open distance to value

- 0.2xASR

- Narrative

- Moderate Imbalance. With some supplies at VAL and open sentiment we could see a return to value play and thus continue lower after confirming a reversal at these levels.

- LN open

- Clarity (1–5, 5 being best)

- 4

- Hypo 1 — Return to Value

- Narrative: Possible H4 Three Inside Down narrative in the making, larger timeframe bearish sentiment.

- Preferred: Bearish Price action with IB extension down (preferably on momentum) sustained auction till reaching large timeframe end of supply before possibly reversing back up. If that supply gets taken out we are looking for a longer timeframe bearish sentiment but we could see push back first before that happens.

- Hypo 2 — Value Acceptance

- Narrative: Open sentiment with close proximity we could possible see value being accepted possibly forming H4 RBR.

- Preferred: Early acceptance with quick follow-through.

Additional notes

- N.A.

ZOIs for Possible Shorts

- D1-C‑S 1855.544

- W1-C‑S 1847.890

- D1-C‑S 1836.021

- H4-C‑S 1790

ZOIs for Possible Long

- D1-C‑D 1787

Mindful Trading

- Feeling okay

Focus Points for trading development

- Monthly Goals

- Continue tracking my DRC tracking sheet

- Focus on my own progress and less on others

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym

- Trading Rules

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments