01 Feb Premarket Prep Gold 02012021

GBPNZD in a too tight range thus focusing on Gold today.

#fintwit #orderflow #daytrading #premarketprep #XAUUSD #GOLD #Forextrader #forex #FX #Forexlifestyle #daytrade #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife

This is my premarket prep for today’s European session for GOLD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Weekly Focus Points

- Only take trades according to a hypo unless there are multiple conditions met

Compared against Weekly Trading Plan

- Trading above last week’s spinning top

Non-conjecture observations of the market

- Price action

- 2 consecutive days of a move higher but with very long selling wick taking out previous demand

- H4 spinning top with slightly longer selling wick

- Market Profile

- Price created a wide value area slightly below the 3‑day bracket

- ADR: 26967

- ASR: 19610

- 490

- Day

- Yesterday’s High 1875.580

- Yesterday’s Low 1839.52

Sentiment

- Locations

- W1/D1 C‑dems at VAL

- Sentiment

- LN open

- Within Value

- Open distance to value

- N.A.

- Sentiment

- Balancing. LN open just below VAH after a M30 Three Inside Down was formed below ADR 0.5 high.

- LN open

- Clarity (1–5, 5 being best)

- 3

- Hypo 1 — Balancing Market / Value Rejection Failure

- Narrative: LN open within value. Play off nearby LTF and ADR levels.

- Hypo 2 — Value Rejection Up

- Narrative: W1 Base into Rally narrative (although it’s just the first day of the week so) backed by a possible H4 RBR.

- Preferred: Take out LTF supply exhausting ADR, IB extension up with sustained auction.

Additional notes

- N.A.

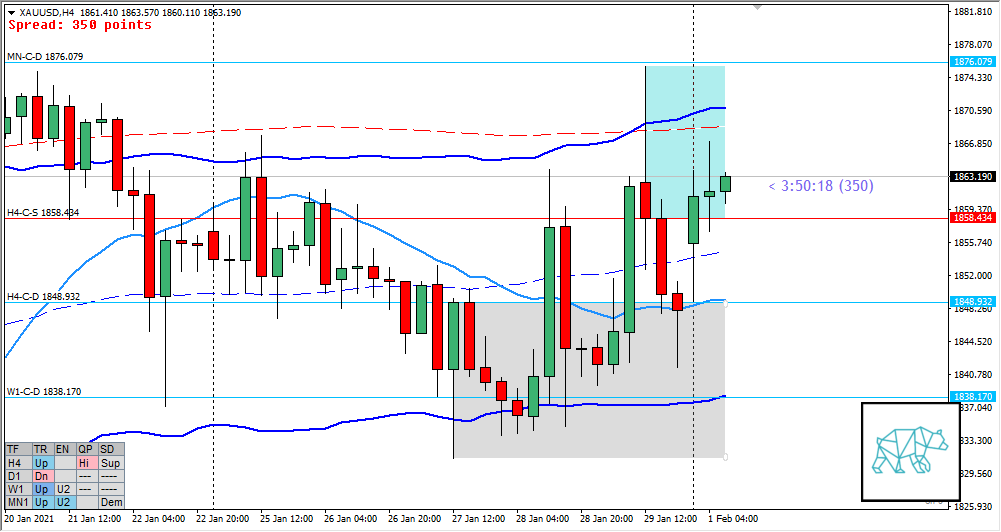

ZOIs for Possible Shorts

- W1-C‑S 1889.101

- H4-C‑S 1858.434

ZOIs for Possible Long

- H4-C‑D 1848.932

- W1-C‑D 1838.170

Mindful Trading

- Feeling slightly less sharp. Perhaps the weekend trip took more out of me then I thought. Extra caution today.

Focus Points for trading development

- Monthly Goals

- Continue tracking my DRC tracking sheet

- Focus on my own progress and less on others

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym

- Trading Rules

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments