28 Jan Premarket Prep Gold 01282021

GBPNZD in a too tight range thus focusing on Gold today.

#fintwit #orderflow #daytrading #premarketprep #XAUUSD #GOLD #Forextrader #forex #FX #Forexlifestyle #daytrade #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife

This is my premarket prep for today’s European session for GOLD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Weekly Focus Points

- Only take trades according to a hypo unless there are multiple conditions met

Compared against Weekly Trading Plan

- Price trading within previous week’s candle

Non-conjecture observations of the market

- Price action

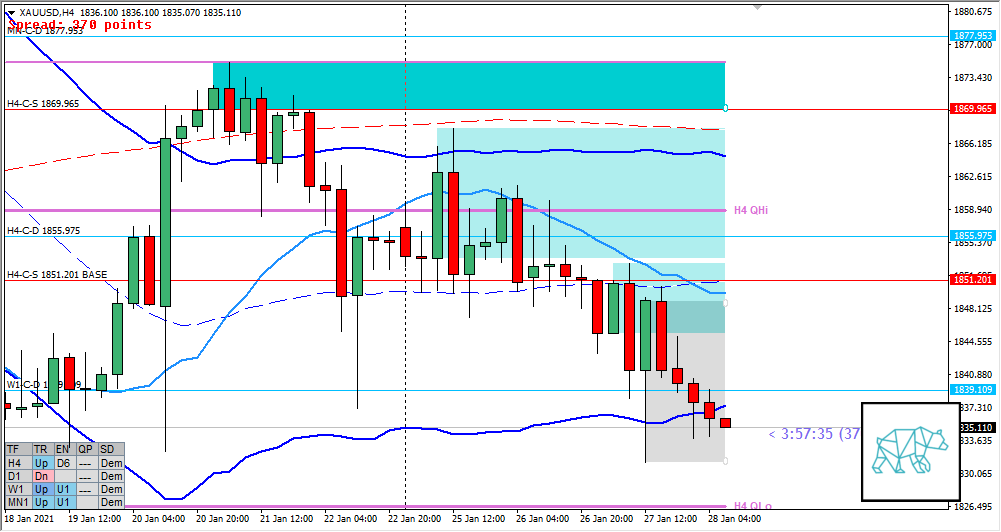

- D1 arrival at W1-C‑D 1839.109 (coinciding with D1 demand) multiple tests closing below D1 200MA in UT

- Mid D1 swing

- Some H4 consolidation with consequent move slightly lower reacting off H4 LKC in R (currently testing for the second time) trading within H4 demand.

- Trading in lower half of H4 swing no arrival at QLo (yet)

- Market Profile

- Price created a wide value area slightly below the 3‑day bracket

- ADR: 25122

- ASR: 17061

- 430

- Day

- Yesterday’s High 1853.050

- Yesterday’s Low 1831.320

Sentiment

- Locations

- W1/D1 C‑dems at VAL

- Sentiment

- LN open

- Below Value, Outside Range

- Open distance to value

- 0.2xASR

- Sentiment

- Moderate Imbalance. With near proximity and nearby D1/W1 C‑dems we could see a move up although H4 has consistently traded lower.

- LN open

- Clarity (1–5, 5 being best)

- 4

- Hypo 1 — Return to Value

- Narrative: continuation to the D1 decline

- Preferred: Bearish price action confirming a rejection of VAL with consequent IB extension down and sustained auction.

- Hypo 2 — Value Acceptance

- Narrative: Due to arrival at W1/D1 demand we could see a swing reversal up or at least a push higher (pullback perhaps)

- Preferred: Early acceptance with quick follow-through. Monitor for H4-C‑S 1851.201 BASE to be hit and price action backing up a possible continuation.

- Hypo 3 — Responsive Activity

Additional notes

- End of the month in an already weird month so extra caution is advised.

ZOIs for Possible Shorts

- W1-C‑S 1889.402

- H4-C‑S 1869.965

- H4-C‑S 1851.201 BASE

ZOIs for Possible Long

- MN-C‑D 1877.953 coinciding with D1 demand

- H4-C‑D 1855.975

- D1-C‑D 1847.306

Mindful Trading

- Feeling okay, but slightly distracted with other stuff IRL. Extra caution.

Focus Points for trading development

- Monthly Goals

- Continue tracking my DRC tracking sheet

- Focus on my own progress and less on others

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym

- Trading Rules

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments