#fintwit #orderflow #daytrading #premarketprep #XAUUSD #GOLD #Forextrader #forex #FX #Forexlifestyle #daytrade #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife

This is my premarket prep for today’s European session for GOLD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Weekly Focus Points

- Don’t take trades where SL placement is suboptimal. Instead, reassess for a better entry if possible. Unless there is a momentum play.

Compared against Weekly Trading Plan

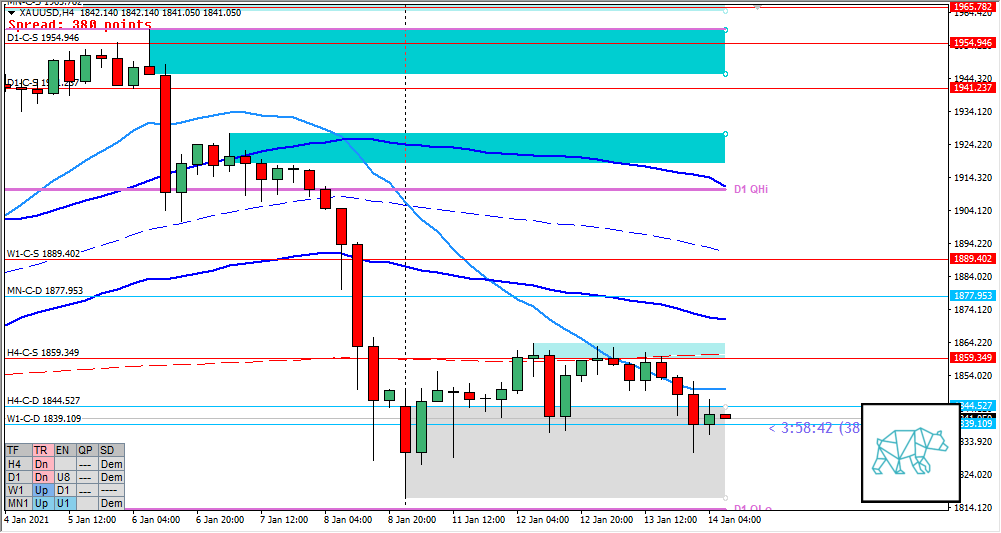

- Reacting off W1 demand after Bear Engulf was formed

Non-conjecture observations of the market

- Price action

- D1 retraced the third bar of THree Outside Up back to underlying demand

- H4 Inside bar with slightly longer selling wick premarket

- Market Profile

- Value formed above Monday’s value

- ADR: 34435

- ASR: 19003

- 475

- Day

- Yesterday’s High 1862.960

- Yesterday’s Low 1841.790

Sentiment

- Locations

- H4-C‑S 1859.349 above VAH

- Sentiment

- LN open

- Below Value, Outside Range

- Open distance to value

- 0.6xASR

- Sentiment

- Moderate to large imbalance. Price trading at H4 VWAP in DT and trading within D1 demand at 200MA. H1 Pinbar created reacting of W1 C‑dem.

- LN open

- Clarity (1–5, 5 being best)

- 4

- Hypo 1 — Swing Reversal

- Preferred: Price trades slightly lower to mean reversion level then creating bullish price action and IB extension up with sustained auction.

- Hypo 2 — Trend Continuation

- Preferred: Price closed within underlying demand. IB extension down with sustained auction (probably low/medium activity day).

Additional notes

- N.A.

ZOIs for Possible Shorts

- W1-C‑S 1889.402

- H4-C‑S 1859.349

ZOIs for Possible Long

- MN-C‑D 1877.953 coinciding with D1 demand

- H4-C‑D 1844.527 & W1-C‑D 1839.109

Mindful Trading

- Feeling okay

Focus Points for trading development

- Monthly Goals

- Continue tracking my DRC tracking sheet

- Focus on my own progress and less on others

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym

- Trading Rules

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING