#fintwit #orderflow #daytrading #premarketprep #Forextrader #forex #FX #Forexlifestyle #daytrade #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #XAUUSD #GOLD

This is my premarket prep for today’s European session for GOLD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Weekly Focus Points

- Don’t take trades where SL placement is suboptimal. Instead, reassess for a better entry if possible. Unless there is a momentum play.

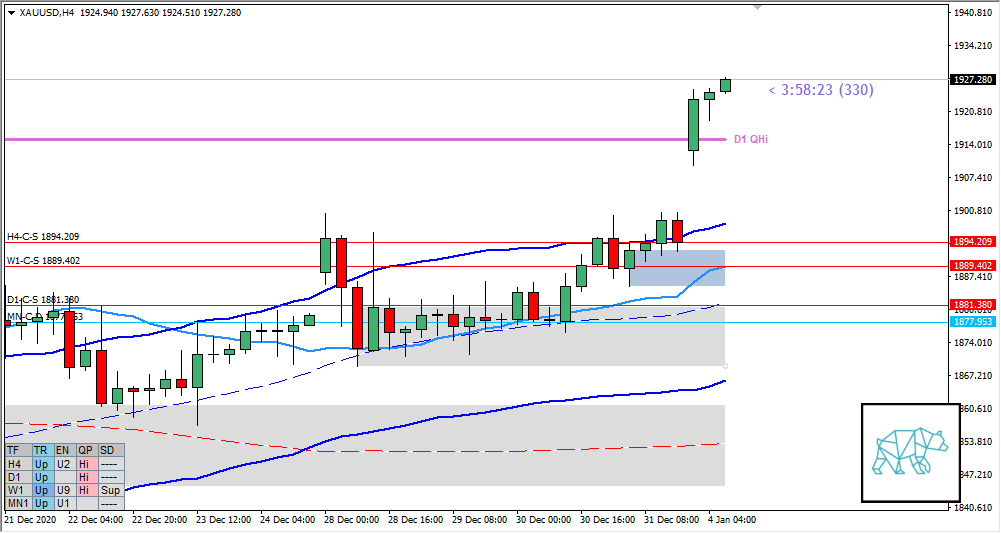

Compared against Weekly Trading Plan

- Moving deeper into W1-C‑S 1888.402 and trading above last week’s body

Non-conjecture observations of the market

- Price action

- Gap up and price took out H4/D1 supply

- Market Profile

- Value created below the bracketing range with price currently trading above it. ADR exhausted to the upside.

- ADR: 23770

- ASR: 16310

- 408

- Day

- Yesterday’s High 1900.230

- Yesterday’s Low 1885.290

Sentiment

- Locations

- N.A.

- Sentiment

- LN open

- Above Value, Outside Range

- Open distance to value

- 1.9xASR

- Sentiment

- Exceptionally large imbalance and ADR got exhausted after H4/D1 supply got taken out. Either some mean reversion is coming up or we are in for a unidirectional session.

- LN open

- Clarity (1–5, 5 being best)

- 4

- Hypo 1 — Trend Continuation

- Preferred: Bullish Price action with IB extension up and sustained auction

- Hypo 2 — Mean Reversion

- Preferred: Price action reversal, IB extending over followed with failed auction and quick follow-through.

Additional notes

- N.A.

ZOIs for Possible Shorts

- W1-C‑S 1888.402

ZOIs for Possible Long

- MN-C‑D 1877.953

Mindful Trading

- Not going to trade today

Focus Points for trading development

- Monthly Goals

- Continue tracking my DRC tracking sheet

- Focus on my own progress and less on others

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym

- Trading Rules

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING