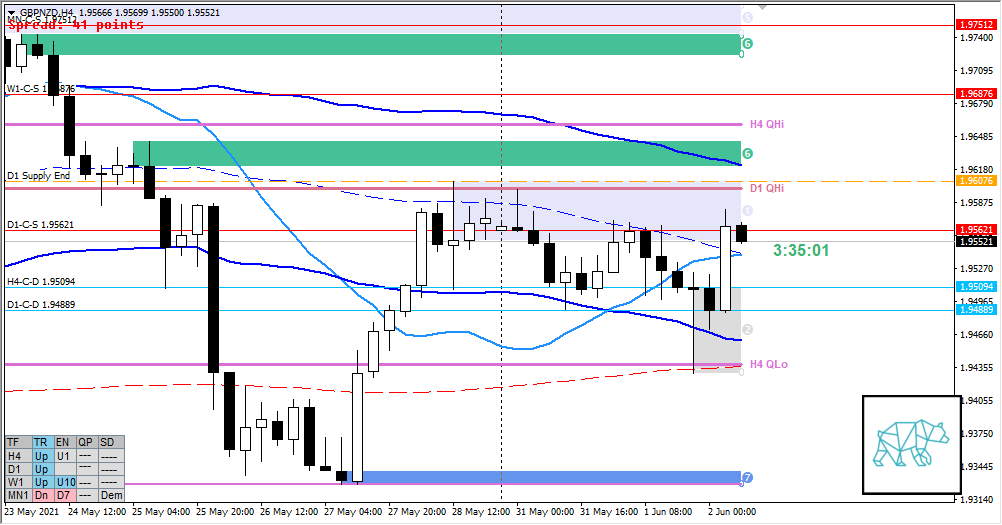

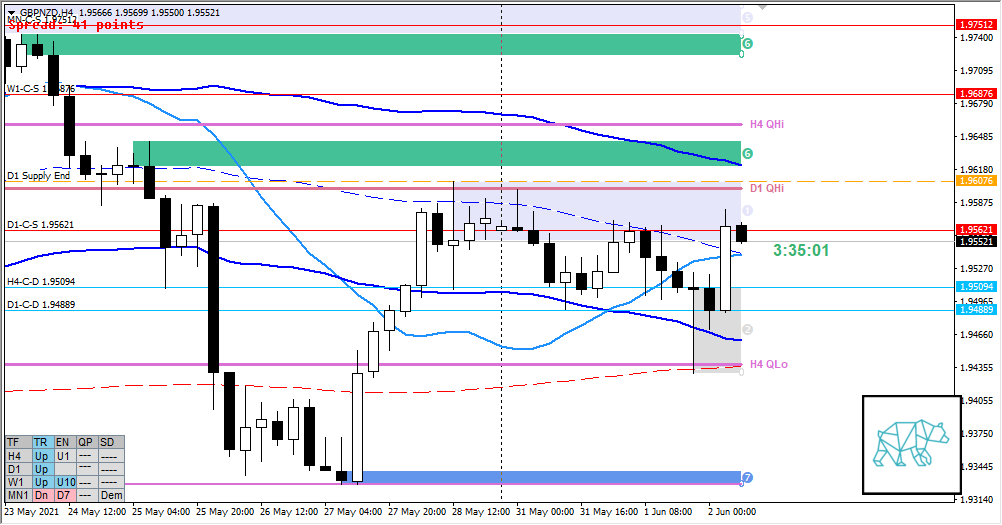

02 Jun Premarket Prep GBPNZD 20210602

#fintwit #orderflow #daytrading #premarketprep #GBPNZD #Forextrader #forex #FX #Forexlifestyle #daytrade #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Weekly Focus Points

- Min. 3 times working out at home + mandatory cardio

- Trading rules

- Focus on taking ONE trade a day. If I missed the first DTTZ then a trade needs to be taken on the 2nd DTTZ unless there is a high/medium initiative activity day.

- Only price-action based exit rules (or if hit time stop comes earlier)

- M15/M30 entries and exits at 1st DTTZ, M5 entries and exits at 2nd DTTZ

- Buffer trades (profit target >1R) are allowed and encouraged

- 13 trades by the end of the month

- No social media / messenger apps / phone calls allowed during the trading window

Compared against Weekly Trading Plan

- Price trading below last week’s body and within range of buying wick

Non-conjecture observations of the market

- Price action

- D1 traded down with slightly longer buying wick reacting off D1-C‑D 1.94889 and tested D1-C‑S 1.95621

- H4 reacting off H4 QLo before forming a DBD

- Trend: H4 Up, D1 Up, W1 Up

- Prevailing trend: Trend is UP

- Market Profile

- 2‑day overlapping values

- Daily Range

- ADR: 1206

- ASR: 846

- 22

- Day

- Yesterday’s High 1.95715

- Yesterday’s Low 1.94306

Sentiment

- Locations

- H4-C‑D 1.95094 inside value at VAL

- D1-C‑D 1.94889 below value outside range

- Sentiment

- LN open

- Above Value, Outside Range

- Open distance to value

- 0.4xASR

- Premarket

- H4 Bull Engulf formed on top of D1 demand giving H4-C‑D 1.95094 closing slightly within D1 Supply

- Narrative

- Moderate to Large Imbalance due to slight opening above range at ADR 0.5 high. Due to potentially having started the summertime chop season price could have the tendency to continue balancing in line with the 2‑day overlapping values. Making a big move from recently formed D1 demand in premarket combined with an open above value the sentiment favors longs a bit for a potential Return to Value play.

- LN open

- Clarity (1–5, 5 being best)

- 3

- Hypo 1 — Swing Reversal

- Narrative: D1 Supply, overlapping values, price trading at the top of the range,

- Preferred: Strong Bearish PA, IB extension down, sustained to value edge, monitor for VAA

- Con: Big H4 move premarket

- Hypo 2 — Trend Continuation / Return to Value

- Narrative: Big H4 move premarket, open sentiment

- Preferred: strong Bullish PA with IB extension up and sustained auction taking out overhead supply otherwise a potential pullback to value edge to PA reversal to failed auction,

- Con: possible balancing overall market

Additional notes

- Capital Preservation Rule in effect

ZOIs for Possible Shorts

- D1-C‑S 1.95621

ZOIs for Possible Long

- H4-C‑D 1.95094

- D1-C‑D 1.94889

Mindful Trading (lack of sleep?)

- Feeling a bit anxious so will be a bit careful. Also, with being the first day of the month I do not need to go wild on the first day.

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- Total of 13 trades by the end of the month

- Weekly Goal

- Min. 3 times working out at home + mandatory cardio

- Risk Management

- Without forcing a trade: aim to take 1 trade a day, if possible 2.

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments