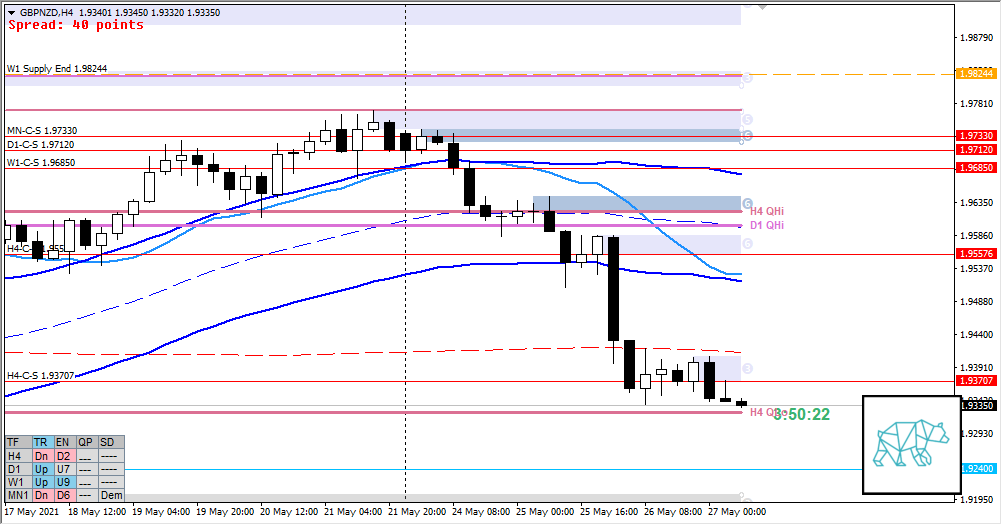

27 May Premarket Prep GBPNZD 20210527

#fintwit #orderflow #daytrading #premarketprep #GBPNZD #Forextrader #forex #FX #Forexlifestyle #daytrade #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Weekly Focus Points

- Min. 3 times hitting the gym + mandatory cardio

- In lockdown currently

- Trading rules

- 1 trade per day minimum (unless I missed the 1st DTTZ and the 2nd DTTZ is a continuation to the first)

- 1R targets allowed if conditions are less than optimal (buffer trades allow for 0.5–0.8R profit-taking)

- M15/M30 entries and exits at 1st DTTZ, M5 entries and exits at 2nd DTTZ

- Only price-action based exit rules (or if hit time stop comes earlier)

- Otherwise a Bart Simpson exercise

- 1 trade per day minimum (unless I missed the 1st DTTZ and the 2nd DTTZ is a continuation to the first)

Compared against Weekly Trading Plan

- Price trading below last week’s body and range at the bottom of the Monthly body

Non-conjecture observations of the market

- Price action

- D1 closed down in a Phase 4 not having reached D1-C‑D 1.92400

- Price left a little buying wick and is currently trading within its range

- H4 created some demand above H4 QLo through a possible Phase 1 or 3

- Trend: H4 Down, D1 Up, W1 Up

- Prevailing trend: Trend is up

- Market Profile

- Values in DT

- Daily Range

- ADR: 1213

- ASR: 941

- 24

- Day

- Yesterday’s High 1.95867

- Yesterday’s Low 1.93364

Sentiment

- Locations

- H4-C‑S 1.93707 at VAL

- W1-C‑D 1.92794 at ADR exhaustion Low

- Sentiment

- LN open

- Below Value, Within Range

- Open distance to value

- 0.24xASR

- Premarket

- H4 closed as an inverted hammer almost taking out H4 demand thena t the open this got taken out.

- Narrative

- Moderate Imbalance. Open within range after taking out a H4 demand could mean a continuation to the move. Although trading at H4 QLo there could be a push higher. If there is an acceptance of value it would mean a shift in sentiment from bearish to bullish.

- LN open

- Clarity (1–5, 5 being best)

- 4

- Hypo 1 — Trend Continuation / Return to Value

- Narrative: possible H4 phase 3, Open sentiment, H4 Bear Engulf and test of new Supply giving H4-C‑S 1.93707 and close down. LN open taking out H4 demand.

- Preferred: Strong Bearish PA, Possible re-test of value edge, IB extension down, Sustained auction to W1 demand (0.6xASR below), D1 demand (1xASR below).

- Con: trading at H4 QLo

- Hypo 2 — Value Acceptance

- Narrative: open sentiment trading at H4 QLo, possible H4 phase 1

- Preferred: early acceptance of value with quick follow-through

- Con: LTF supplies within value as well as newly formed H4-C‑S 1.93707

- Hypo 3 — Swing Reversal at W1D1

- Narrative: Variation to Hypo 1

- Preferred: Strong Bullish PA at D1 demand with TPO structure or fading the auction, Single Print Fade.

- Con: ADR exhaustion in the way

Additional notes

- Capital Preservation Rule in effect

ZOIs for Possible Shorts

- H4-C‑S 1.93707

ZOIs for Possible Long

- W1-C‑D 1.92794

- D1-C‑D 1.92400

Mindful Trading (lack of sleep?)

- Feeling okay

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym + mandatory cardio

- Trading rules

- M15/M30 entries and exits at 1st DTTZ, M5 entries and exits at 2nd DTTZ

- Only price-action based exit rules (or if hit time stop comes earlier)

- Otherwise a Bart Simpson exercise

- Risk Management

- Without forcing a trade: aim to take 1 trade a day, if possible 2.

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments