#fintwit #orderflow #daytrading #premarketprep #GBPNZD #Forextrader #forex #FX #Forexlifestyle #daytrade #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife

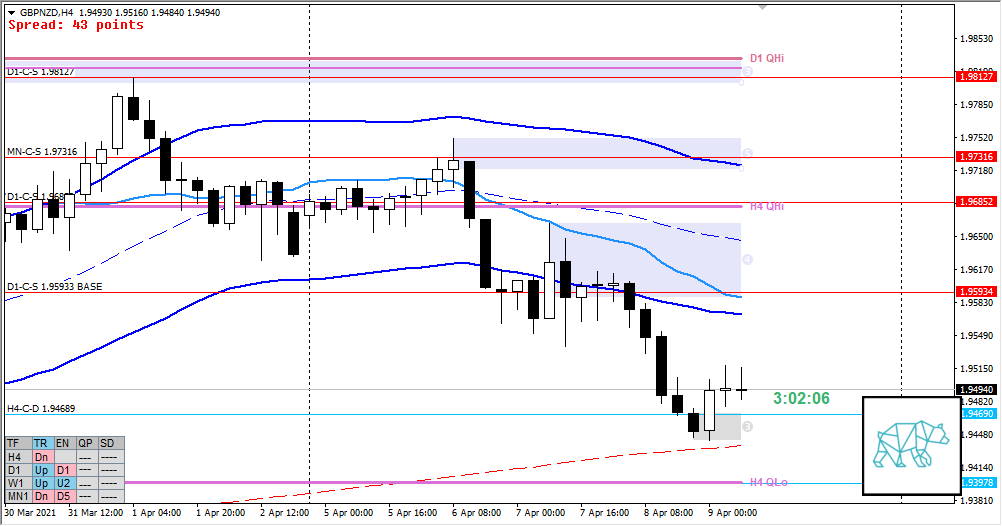

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Weekly Focus Points

- Min. 3 times hitting the gym + mandatory cardio

- Went yesterday but no cardio

- Only trade the main account

- Be mindful of DTTZs

- Only price-action based exit rules (or if hit time stop comes earlier)

- M15/M30 entries and exits at 1st DTTZ, M5 entries and exits at 2nd DTTZ

Compared against Weekly Trading Plan

- Possible W1 Three Outside Down (after reacting off MN-C‑S 1.97316) in the making returning to W1-C‑D 1.93978

- Still have today’s close

Non-conjecture observations of the market

- Price action

- D1 DBD giving D1-C‑S 1.95933 BASE at D1 VWAP in UT with price currently trading below

- Mid D1 Swing, H4 swing activated

- Price nearing H4 QLo and W1-C‑D 1.93978, some reaction already coinciding with H4 200MA in UT forming a Bull Engulf giving H4-C‑D 1.94689

- Trend: H4 down, D1 up, W1 up

- Prevailing trend: Trend is up although having reacted off larger timeframe supply already the trend might be turning

- Market Profile

- Value in DT

- Daily Range

- ADR: 1203

- ASR: 811

- 21

- Day

- Yesterday’s High 1.96130

- Yesterday’s Low 1.94453

Sentiment

- Locations

- D1-C‑S 1.95933 BASE above VAH and range

- Sentiment

- LN open

- Below Value, Outside Range

- Open distance to value

- 0.5xASR

- Premarket

- H4 Spinning Top with longer selling wick, possible Base as price already tested (2nd chance entry style) of new H4 c‑dem.

- Narrative

- Due to getting closer to W1 demand a H4 bull engulf was formed. Although due to the moderate large imbalance at the open and H4 spinning top formed premarket it could go either way. Possible H4 Evening Star as price hasn’t touched H4 QLo or W1 demand. Or a H4 RBR as possibly new demand is being formed around these levels and price could go test D1 VWAP in UT for a CAR

- LN open

- Clarity (1–5, 5 being best)

- 4

- Hypo 1 — Return to Value

- Narrative: Possible D1 phase 4 (bearish marubozu), H4 Evening Star, price not tested QLo

- Preferred: Strong Bearish Price action, IB extension down with sustained auction taking out LTF demand closing within H4 demand.

- Con: Newly formed H4 demand

- Hypo 2 — Value Acceptance

- Narrative: H4 RBR, D1 VWAP in UT BD to CAR

- Preferred: Strong Bullish Price action taking out LTF supply and closing confidently within value

- Con: D1 bearish sentiment (bearish marubozu), lots of LTF supplies, value tight

- Hypo 3 — Responsive Activity / Friday Profit-taking

- Narrative: perhaps some profit taking going on where price kinda moves in a direction but not too confidently as not to scare off buyers/sellers

Additional notes

- Capital Preservation Rule in effect

ZOIs for Possible Shorts

- D1-C‑S 1.96852

- D1-C‑S 1.95933 BASE

ZOIs for Possible Long

- H4-C‑D 1.94689

- W1-C‑D 1.96978

Mindful Trading

- Feeling okay

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym + mandatory cardio

- Only trade the main account

- Be mindful of DTTZs

- Only price-action based exit rules (or hit time stop)

- M15/M30 combination at 1st DTTZ, M5 entries and exits at 2nd DTTZ

- Trading Rules

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING