#fintwit #orderflow #daytrading #premarketprep #GBPNZD #Forextrader #forex #FX #Forexlifestyle #daytrade #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Weekly Focus Points

- Only trade the main account

- Focus on time-based exits

- Don’t look at M5 chart unless within the last hour of trading window

Compared against Weekly Trading Plan

- Price trading within last week’s body

Non-conjecture observations of the market

- Price action

- D1 Supply still intact with a D1 consolidation within with a few selling wicks

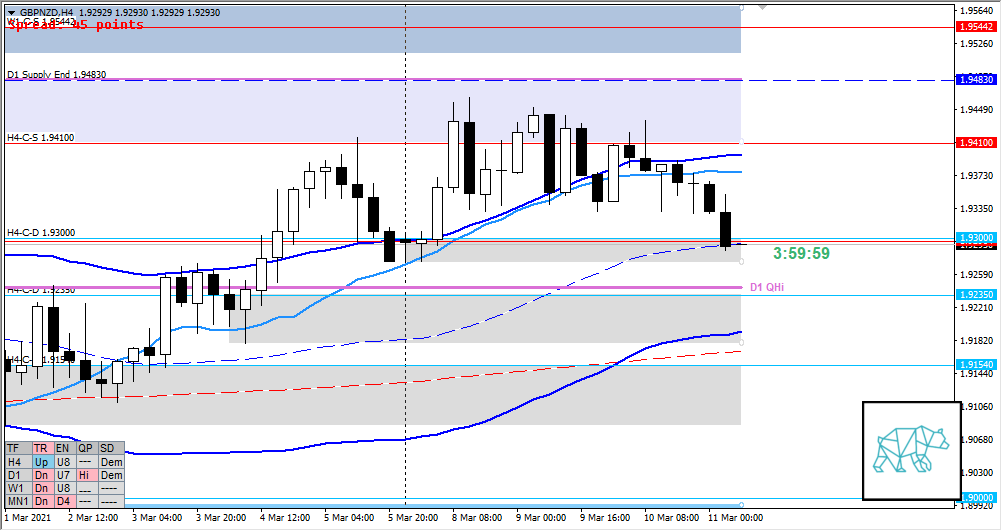

- H4 demand taken out through a possible H4 Phase 3, H4 DBD although still some buyers around as indicated by the long buying wicks. Price broke below H4 VWAP in UT nearing H4 50MA and H4 demand (H4-C‑D 1.93000) although older.

- Price trading within H4/D1 QHi although W1 QLo was rejected earlier.

- Premarket: H4 closed down at H4-C‑D 1.93000 and H4 50MA

- Trend: H4 UP, D1 DOWN, W1 DOWN

- Market Profile

- 2 wide overlapping values created.

- ADR: 1343

- ASR: 1196

- 30

- Day

- Yesterday’s High 1.94370

- Yesterday’s Low 1.93296

Sentiment

- Locations

- H4-C‑D 1.93000 within M30 QLo

- H4-C‑S 1.94100 (old) at M30 QHi

- Sentiment

- LN open

- Below Value, Outside Range

- Open distance to value

- 0.7xASR

- Narrative

- Moderate to large imbalance. LN opened at H4-C‑D 1.93000 but closed down within H4 demand price might continue. Especially when considering a possible H4 Phase to 4 transition and D1 consolidation with long selling wicks potentially closing down on the day breaking down from consolidation.

- LN open

- Clarity (1–5, 5 being best)

- 4

- Hypo 1 — Return to Value / Trend Continuation

- Narrative: Potential D1 DBD narrative, Possible H4 phase 4

- Preferred: Strong bearish close in IB with extension down taking out H4 demand. Possible IB extension up reacting off M30 VWAP in DT followed by a failed auction

- Con: H4 demand, larger timeframe bullish sentiment

- Hypo 2 — Mean Reversion

- Narrative: Open sentiment not entirely fulfilling a mean reversion although if price could traverse lower during IB and form bullish price action we could see a mean reversion. Price trading within M30 QLo. Perhaps an IB extension to failed auction.

- Preferred: Price traversing lower during IB with Bullish price action closing above M30 QLo followed by IB extension up and sustained auction,

- Con: Medium timeframe bearish sentiment.

Additional notes

- N.A.

ZOIs for Possible Shorts

- H4-C‑S 1.94100 (old)

- D1-C‑S 1.92964

ZOIs for Possible Long

- H4-C‑D 1.93000

- H4-C‑D 1.92350

Mindful Trading

- Feeling okay

Focus Points for trading development

- Monthly Goals

- Continue tracking my DRC tracking sheet

- Focus on my own progress and less on others

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym

- Trading Rules

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING