05 Mar Premarket Prep GBPNZD 20210305

#fintwit #orderflow #daytrading #premarketprep #GBPNZD #Forextrader #forex #FX #Forexlifestyle #daytrade #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Weekly Focus Points

- Only trade the main account

Compared against Weekly Trading Plan

- Price trading above last week’s body above W1 QLo with a buying wick although no close yet. Today is the last day.

Non-conjecture observations of the market

- Price action

- D1 traded higher and closed above D1 200MA deeper into overhead supply (that has been tested many times)

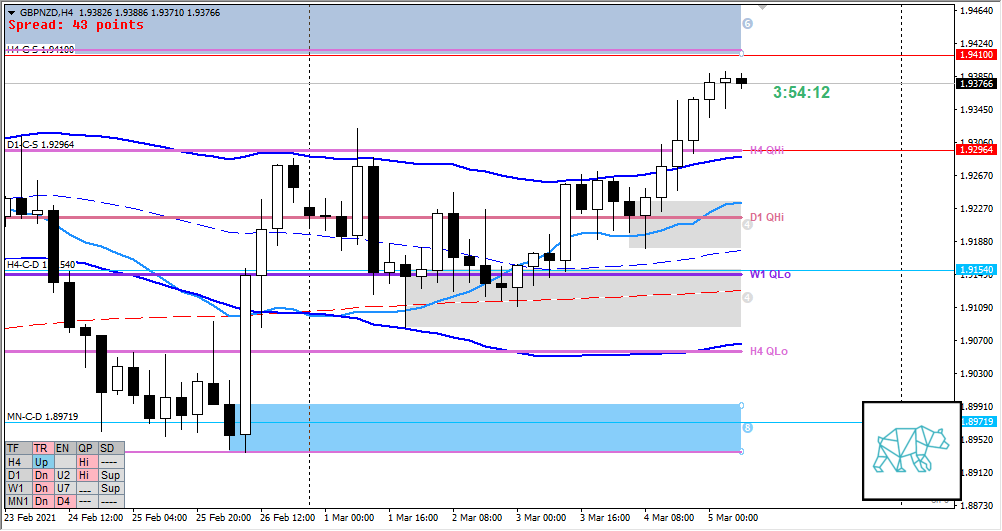

- H4 Phase 2 reaching old supply H4-C‑S 1.94100

- Premarket: H4 closed slightly higher with longer buying wick

- Trend: H4 Up, D1 Down, W1 Down

- Market Profile

- Value was created on top of the 2 day overlapping values

- ADR: 1563

- ASR: 1173

- 30

- Day

- Yesterday’s High 1.1.93597

- Yesterday’s Low 1.91792

Sentiment

- Locations

- Sentiment

- LN open

- Above Value, Outside Range

- Open distance to value

- 1.1xASR

- Narrative

- Large Imbalance. Although with D1 closing what looks like confidently above D1 200MA (thus might move on momentum) and into overhead supply we might finally have that break out in line with larger time frame sentiment. Although the open sentiment may suggest a mean reversion first.

- LN open

- Clarity (1–5, 5 being best)

- 4

- Hypo 1 — Mean Reversion

- Narrative: Open sentiment and unidirectional day yesterday with today being Friday we might see some profit-taking.

- Preferred: Bearish Price action, IB extension down with sustained auction till value edge.

- Con: No H4 demands in the way although LTF congestion might prove troublesome.

- Hypo 2 — Trend Continuation

- Narrative: Might have momentum behind the upwards move that closed into supply and above D1 200MA.

- Preferred: Strong Bullish price action with IB extension up (momentum) and sustained auction.

- Con: Due to still trading within supply we might see a low/medium initiative activity day. Non-farm later today.

Additional notes

- Non-farm later today

ZOIs for Possible Shorts

- H4-C‑S 1.94100 (old)

- D1-C‑S 1.92964

ZOIs for Possible Long

- H4-C‑D 1.91540

- MN-C‑D 1.89719

Mindful Trading

- Feeling okay

Focus Points for trading development

- Monthly Goals

- Continue tracking my DRC tracking sheet

- Focus on my own progress and less on others

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym

- Trading Rules

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments