04 Mar Premarket Prep GBPNZD 20210304

#fintwit #orderflow #daytrading #premarketprep #GBPNZD #Forextrader #forex #FX #Forexlifestyle #daytrade #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Weekly Focus Points

- Only trade the main account

Compared against Weekly Trading Plan

- Price trading below last week’s body above W1 QLo

Non-conjecture observations of the market

- Price action

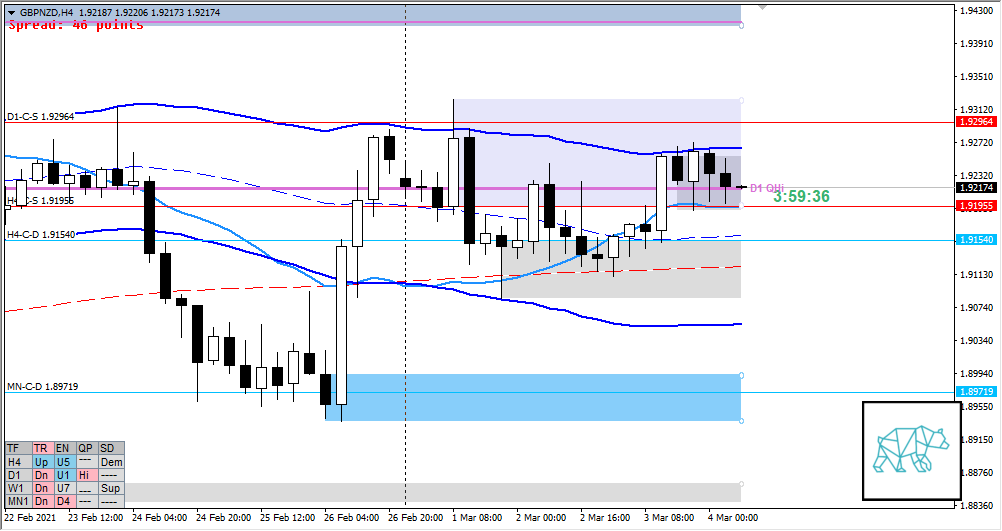

- D1 Bull Engulf closing near D1-C‑S 1.92964 and D1 200MA

- H4 RBR at H4-C‑D 1.91540 closing well within overhead supply H4-C‑S 1.91955 followed by consolidation

- Premarket: H4 traded lower from consolidation

- Trend: H4 Up, D1 Down, W1 Down

- Market Profile

- 2‑day overlapping values

- ADR: 1611

- ASR: 1186

- 30

- Day

- Yesterday’s High 1.92720

- Yesterday’s Low 1.91108

Sentiment

- Locations

- N,A.

- Sentiment

- LN open

- Above Value, Within Range

- Open distance to value

- 0.3xASR

- Narrative

- Moderate Balance. With continued testing of overhead supply and D1 200MA combined with larger timeframe sentiment still being bullish price could potentially break higher.

- LN open

- Clarity (1–5, 5 being best)

- 4

- Hypo 1 — Return to Value

- Narrative: Open sentiment and larger timeframe bullish sentiment together with D1 narrative.

- Preferred: Strong bullish price action near VAH, IB extension up with sustained auction taking out LTF supplies and then clearing the H4 supply. Possible test of value without accepting and then reversing possibly through a failed auction if not within IB.

- Con: Trading right into supply could mean low/medium initiative activity.

- Hypo 2 — Value Acceptance

- Narrative: Top of the D1 Phase 1 / 3 range as well as H4 closer lower, and close proximity to value edge

- Preferred: early acceptance with quick follow-through

- Con: H4 demand at VAL

Additional notes

- N.A.

ZOIs for Possible Shorts

- D1-C‑S 1.92964

- H4-C‑S 1.91955

ZOIs for Possible Long

- H4-C‑D 1.91540

- MN-C‑D 1.89719

Mindful Trading

- Feeling okay

Focus Points for trading development

- Monthly Goals

- Continue tracking my DRC tracking sheet

- Focus on my own progress and less on others

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym

- Trading Rules

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments