16 Feb Premarket Prep GBPNZD 20210216

#fintwit #orderflow #daytrading #premarketprep #GBPNZD #Forextrader #forex #FX #Forexlifestyle #daytrade #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife

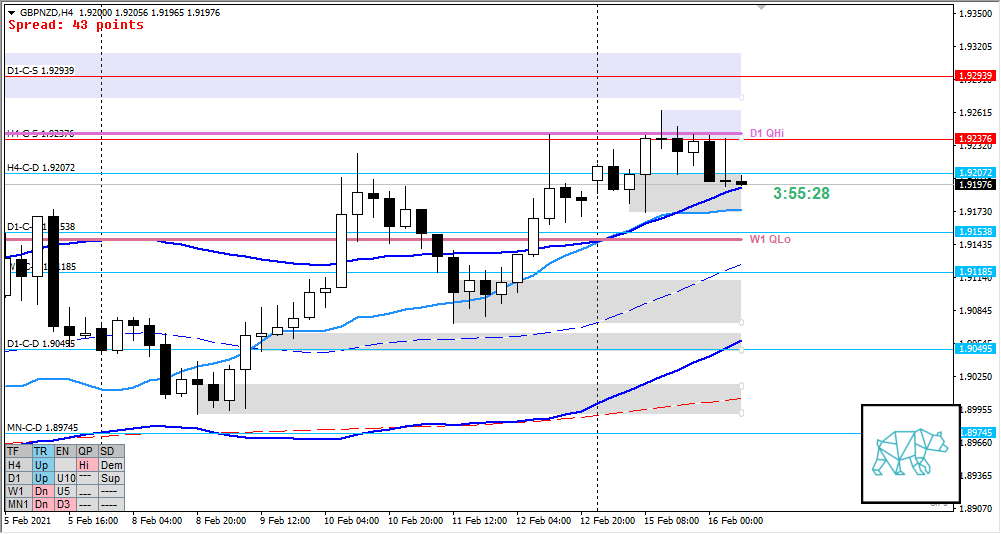

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Weekly Focus Points

- Only take trades according to a hypo unless there are multiple conditions met

Compared against Weekly Trading Plan

- W1 Bull Engulf closing above W1 QLo negating any lower time frame QHi

Non-conjecture observations of the market

- Price action

- D1 price made HHs not taking out overhead supply (yet)

- Price took out old H4 supply and created a new one through a H4 Evening star and DBD giving H4-C‑S 1.92376 at D1 QHi

- Premarket: H4 closed reacting off newly formed H4-C‑S 1.92376 and D1 QHi forming a Gravestone Doji (with long selling wick) at H4-C‑D 1.92072

- Trend: H4 up, D1 up, W1 down

- Market Profile

- Wide value area created on top of bracketing range

- ADR: 1098

- ASR: 899

- 23

- Day

- Yesterday’s High 1.92638

- Yesterday’s Low 1.91723

Sentiment

- Locations

- ADR 0.5 Low at LTF demand below value within range

- LTF supplies near VAH

- Sentiment

- LN open

- Within Value

- Open distance to value

- Right at VAL

- Narrative

- Balancing market. Will look to play off nearby ADR and LTF SD levels.

- LN open

- Clarity (1–5, 5 being best)

- 4

- Hypo 1 — Balancing Market

- Preferred: Play off nearby ADR and LTF SD levels, preferably levels below due to larger time frame bullish sentiment

- Hypo 2 — Value Rejection Down

- Narrative: H4 consolidation and break down, M30 DBD (2n drop Bear Engulf)

- Preferred: Early close below VAL, IB extension down

- Con: Larger time frame bullish sentiment

- Variation: D1 c‑dem at W1 QLo

- Preferred: IB extension down followed by reversal pattern and failed auction

Additional notes

- N.A.

ZOIs for Possible Shorts

- D1-C‑S 1.92939

- H4-C‑S 1.92376

ZOIs for Possible Long

- H4-C‑D 1.92072

- D1-C‑D 1.91538

- W1-C‑D 1.91185

- MN-C‑D 1.89745

Mindful Trading

- Feeling okay

Focus Points for trading development

- Monthly Goals

- Continue tracking my DRC tracking sheet

- Focus on my own progress and less on others

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym

- Trading Rules

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments