24 Dec Premarket Prep GBPNZD 12242020

#fintwit #orderflow #daytrading #premarketprep #Forextrader #forex #FX #Forexlifestyle #daytrade #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #GBPNZD

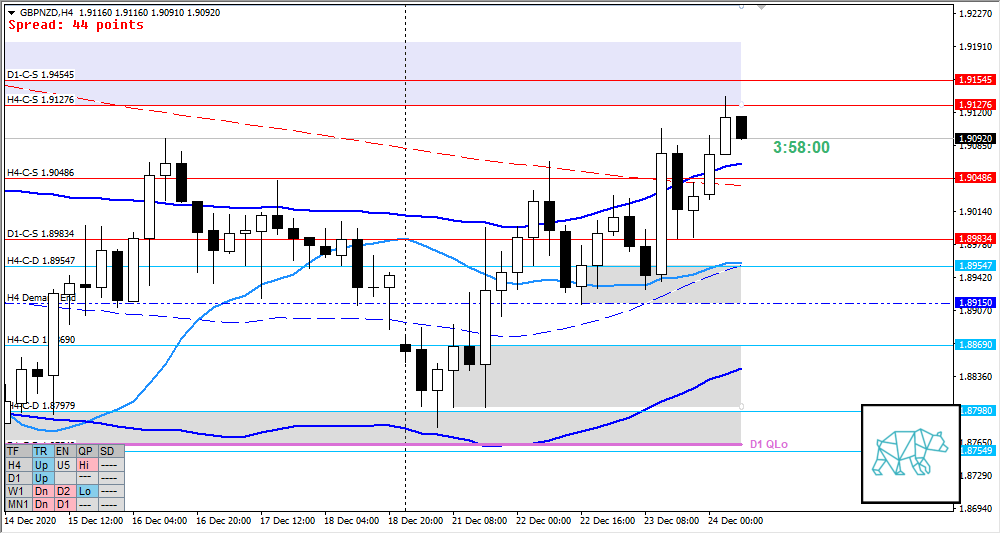

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Weekly Focus Points

- Don’t take trades where SL placement is suboptimal. Instead, reassess for a better entry if possible. Unless there is a momentum play.

Compared against Weekly Trading Plan

- Returned to W1 sup base level and trading higher

Non-conjecture observations of the market

- Price action

- D1 traded higher above D1 VWAP in DT after BO

- D1 Phase 2 although messy and running into D1 50MA

- Big H4 Bull Engulf at H4-C‑D 1.89547 followed by a big retracement (although under 50%) with no follow-through. Instead a H4 Three Inside Up.

- Took out D1/H4 supply premarket testing H4-C‑S 1.91276

- Market Profile

- 2‑day bracket

- ADR: 1446

- ASR: 1249

- 31

- Day

- Yesterday’s High 1.91030

- Yesterday’s Low 1.89294

Sentiment

- Locations

- H4 c‑sup at ADR 0.5 high, exhaustion above

- Sentiment

- LN open

- Above Value, Outside Range

- Open distance to value

- 1.1xASR

- Sentiment

- Large Imbalance. Although H4/D1 supplies got taken out we could still see bullish sentiment in the market as well as a mean reversion.

- LN open

- Clarity (1–5, 5 being best)

- 4

- Hypo 1 — Mean Reversion

- Open 1.1xASR above value, outside range at H4 C‑sup

- Preferred: Strong Bearish price action with IB extension down, sustained auction.

- Con: Medium large time frame bullish sentiment.

- Hypo 2 — Trend Continuation

- H4/D1 supply taken out premarket

- Preferred: Bullish price action with IB extension up and sustained auction.

Additional notes

- Brexit talks are still on

ZOIs for Possible Shorts

- D1-C‑S 1.91545

- H4-C‑S 1.91276

ZOIs for Possible Long

- H4-C‑D 1.89547

Mindful Trading

- Feeling okay

Focus Points for trading development

- Monthly Goals

- Continue tracking my DRC tracking sheet

- Focus on my own progress and less on others

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym

- Trading Rules

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments